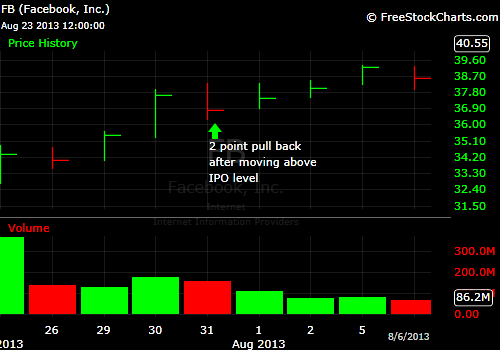

Before I start to break down each StockTweet I want to share some background information for this trade. FB reported a huge fundamental shift in their most recent earnings report on July 24th. FB’s mobile revenue as a percentage of its total revenue doubled. This was a game changing piece of information as the largest impediment to FB’s stock performance … Read More

Perception or Reality?

I have been long VMW since I bought it yesterday at the Open around 79.50. It closed near its high so I held it as a swing position. This morning I bid for more stock about $1 below where it closed yesterday, which had been the prior day’s morning resistance (see chart below). My bid got hit before the market … Read More

NFLX is the New AMZN?

Netflix is the new Amazon. What does this mean? It means for the foreseeable future hedge funds will step in and buy this name on every large dip and it will continue to have huge breakouts after periods of consolidation. Why is this the case? In the case of AMZN it got enough large players in the market to buy … Read More

Webinar: Create a System to Trade Breakouts with Steve Spencer

Join SMB partner Steven Spencer on Thursday, July 18 at 4:30pm ET for a discussion on short-term breakout trading. He will cover recent trades in NFLX and DDD and help you to gain a better understanding of which setups are more likely to work. If you would like to know more about the breakout setups Steve will be covering in … Read More

Mastering Breakouts: Do You Have a System to Identify and Trade Breakouts?

I read a statistic several years ago that the majority of what traders call “breakouts” fail. For this very reason there are algorithmic trading programs that fade breakouts. And there are some manual traders who love to fade all breakouts as well. There are many others who like to load up in the direction of the breakout 100% of the … Read More

The Box vs. The Big Picture

I was at the office Sunday doing some admin stuff and working on some trading prep for this week. One of our senior traders was at the office reviewing some trading videos as well. He had a question for me about how he could trade the large reversals we have been seeing in the market more effectively. He is a … Read More