All great options strategies will have losing months. There is no getting around this simple fact, and it is critical to your mindset as a successful options trader that you accept these months as part of the game. While non-directional options spread strategies are also known as “income options trades” (giving some traders the mistaken idea that the strategies will produce … Read More

Monthly Options Spread Trading is a Twelve-Inning Game

Imagine a major league baseball game, where your favorite team gave up no runs for the first eight innings and then twelve runs in the ninth. Are you happy if the opposing team gave up one run in each inning of that same game? Of course not. The opposing team won 12-9. Yet the opposing team “lost” each of the … Read More

The Anthony Corporation Board of Directors

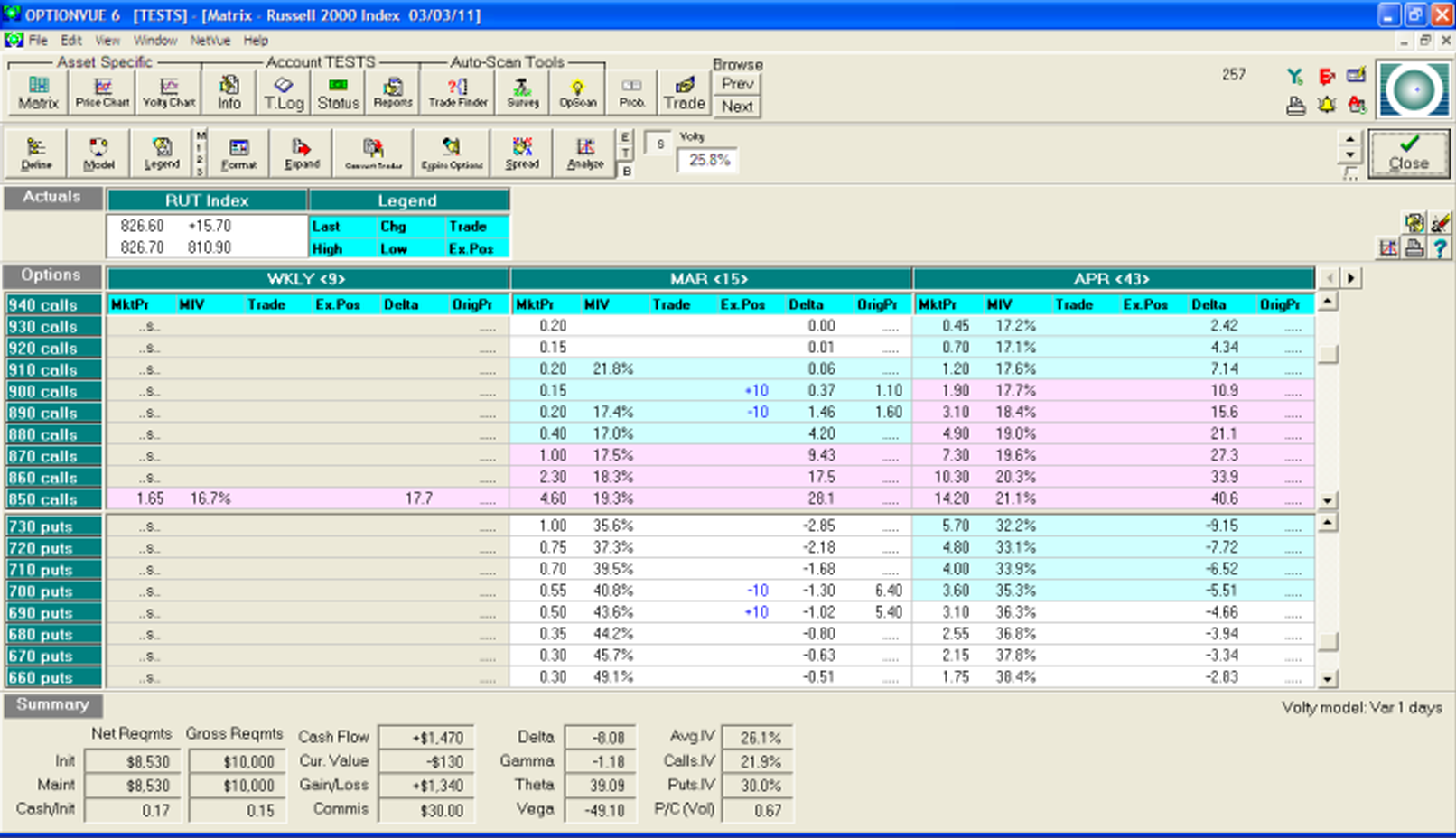

One of the most popular income options strategy is known as the high probability iron condor, which consists of a call side credit spread and a put side credit spread “facing each other” very far out of the money. For example, on January 19, 2011, at about 10:30 in the morning, the RUT Index was trading at 798. An options trader … Read More

- Page 2 of 2

- 1

- 2