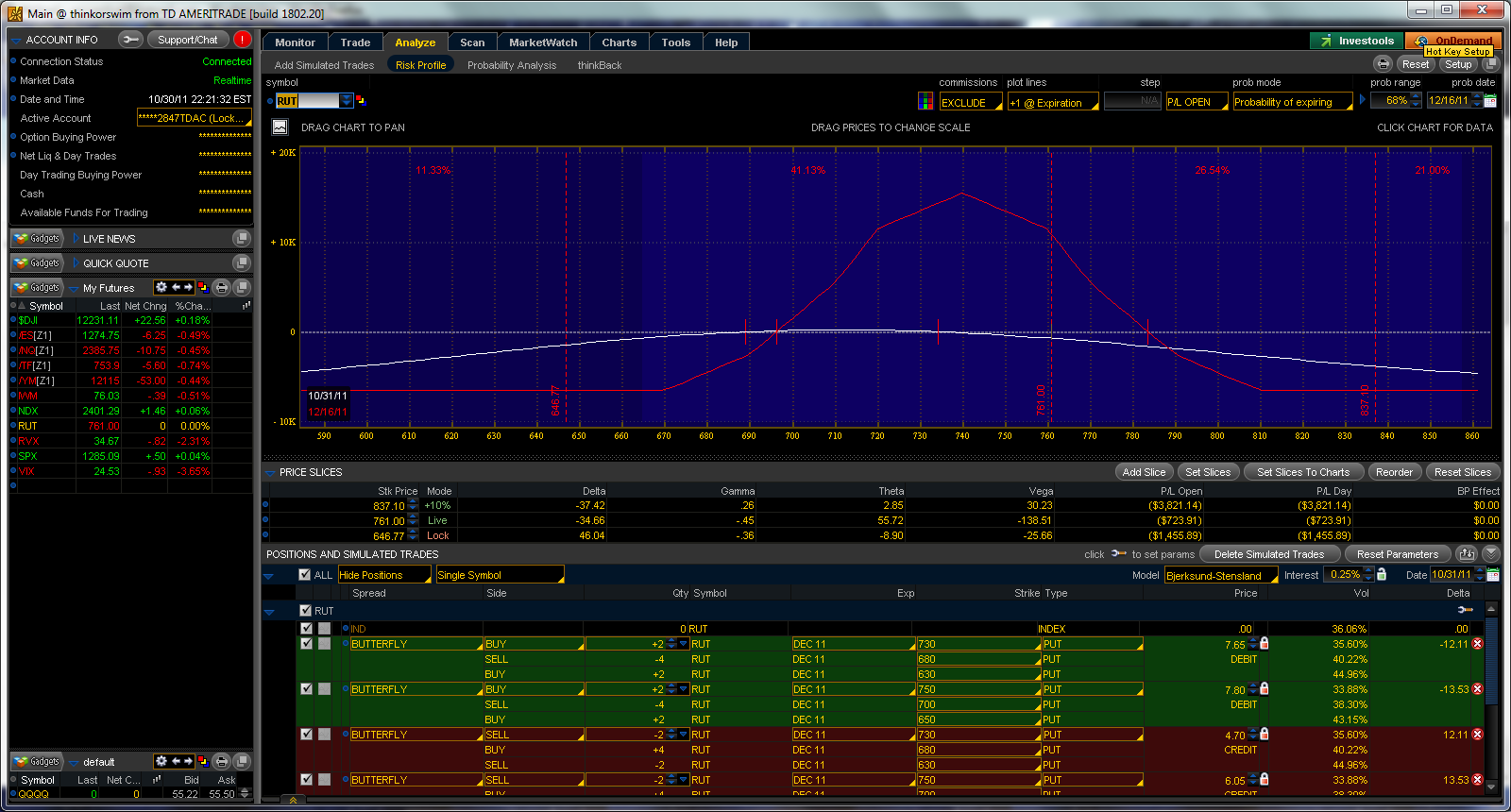

Last Thursday’s rally, probably a dim memory at the moment, was so strong that our trade methodology called for us to add a third butterfly and roll the original two butterflies up 60 points each such that the new position is comprised of three 50 point wide butterflies centered at 720,740 and 760. As of last Thursday, the position was … Read More

Free Options Webinar Today at 5PM EDT. The Options Tribe: Iron Condors using SPX Index Options

September 6, 2011 at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options … Read More

Trader’s Ask: Why did I hit my stop much earlier than I thought I would yesterday?

I had an interesting meeting yesterday evening with SMB’s options trainees reviewing yesterday’s meltdown and the affect it had on their options positions. We spent the whole meeting dissecting trades that the options trainees had made during the day. breaking down what went right and wrong with each one and why. It was a great meeting–real traders faced with the … Read More

Smart Thinking About Capital Levels and Simulation

One of the great things about our growing Options Tribe community is the number of experienced spread traders that are actively participating and communicating their thinking to us. This free exchange of ideas is what the Tribe is all about: the more that people share their perspectives and approaches, the stronger we all become as traders. Recently, I received an email … Read More

Maximizing Profits: Legging Out of a Winning Options Spread

Nothing is more frustrating to an options spread trader than working a trade for 30-60 days, using all of your skills and knowledge to initiate, adjust and improvise to position the trade for a nice win and then, on the day you have decided to exit and pocket that profit, you run into execution problems. There is nothing quite like … Read More

Expiration Week Pinning Trades

Here’s an e-mail I received from a good friend of mine and former mentoring student Options Tribe Member Craig. Craig is a fine option s trader and specializes in “expiration week trades”. These are highly specialized trades that Craig makes almost every month during options expiration week. Each expiration week , I ask Craig what he’s up to this month. … Read More

Traders Ask: Is it better to neutralize a double butterfly or simply close it?

Martin asks: I have a question about one of your first webinars involving the February butterfly. At the end of the trade it appears that instead of closing the trade completely you just neutralized it. What was the reason that you handled it that way ? What is the advantage of neutralizing the trade instead of closing it?: Martin is … Read More

Decoding Market Volatility: Navigating the Heck Out of Options Trading with Dan Harvey

When I first started trading options a number of years ago, I became very friendly with a great options trader, and an even greater human being by the name of Dan Harvey. Dan, a retired medical doctor, is one of the finest options traders I have ever met. He is very analytical, very calm and a very flexible thinker. … Read More

- Page 1 of 2

- 1

- 2