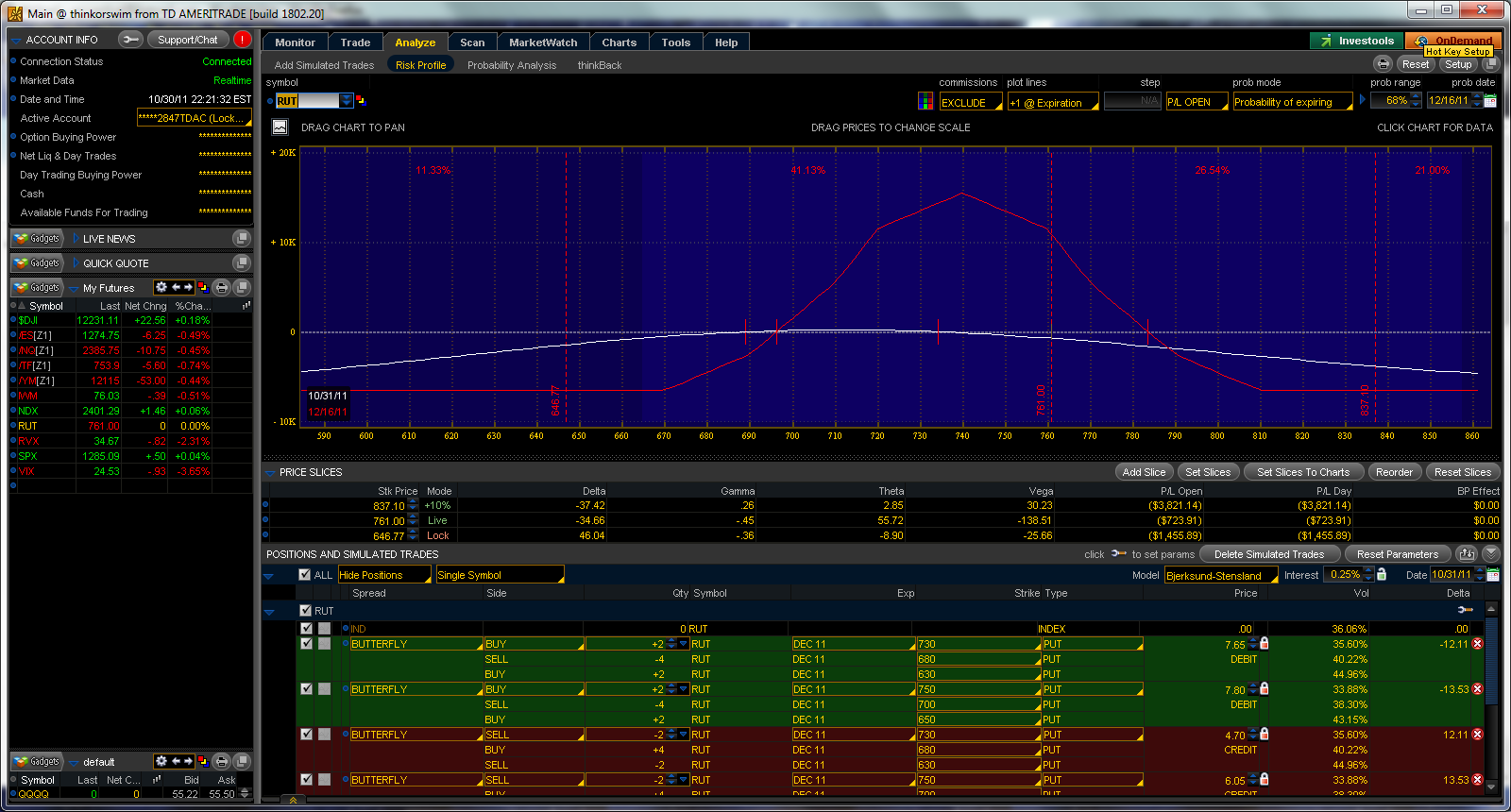

Last Thursday’s rally, probably a dim memory at the moment, was so strong that our trade methodology called for us to add a third butterfly and roll the original two butterflies up 60 points each such that the new position is comprised of three 50 point wide butterflies centered at 720,740 and 760. As of last Thursday, the position was as follows:

The sell off which has taken place over the last few days has improved the P and L of the trade significantly, but it is still very early days in the larger story of this trade.

John Locke

Locke In Your Success, LLC

One Comment on “The Continuing Saga of December’s $RUT Bearish Butterfly Trade: Insights and Analysis”

What is your understanding of how Vega and Delta can be interpreted as hedging each other. Logically it makes sense that negative Delta and negative Vega would be a hedge…. but have you seen any rules of thumb? Thanks.