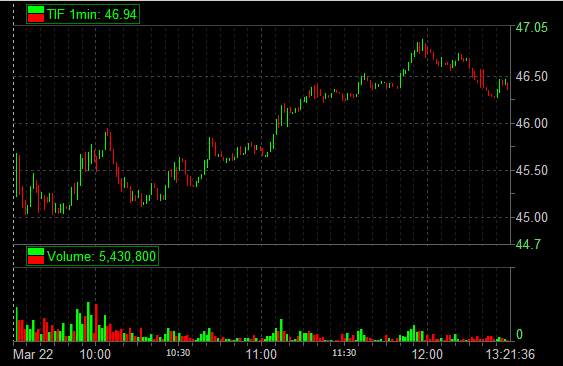

TIF, Tiffany & Company, offered opportunity on the Open. 45.35 was the most important level. Trades off of these points of inflection offer ridiculous risk/reward opportunities.

45.35 was the most important level. After an initial upmove on the Open 45.05 held the bid. And then TIF found 45.35 but could not hold a bid at this price. Repeating white prints (hidden sellers in this case) at 45.35 scrolled across our prints, like a hive of bees swarming honey. The intraday volume spiked. No bid could hold 45.35. And so TIF traded lower.

Finally TIF held above 45.35 and 65 cents of a clean upmove followed.

TIF reversed after a huge battle at 45.89. Battle to the sellers. TIF leaked all the way back down to where this all started around 45.11. I was a bit confused whether this was a support play again from near 45 or we were headed for lower ground. But I did not have to guess. TIF above 45.35 signaled strength.

And you can see from the chart TIF had a nice upmove to 45.60, pulled back to guess where? Yep 45.35. I wonder why that was? 45.35 was the most important intraday level which we learned from watching the prints on the Open, with volume matching.

A Buy into a pullback to 45.35 as a Trade2Hold would leave you long and $1.30 in the money. All by using points of inflection.