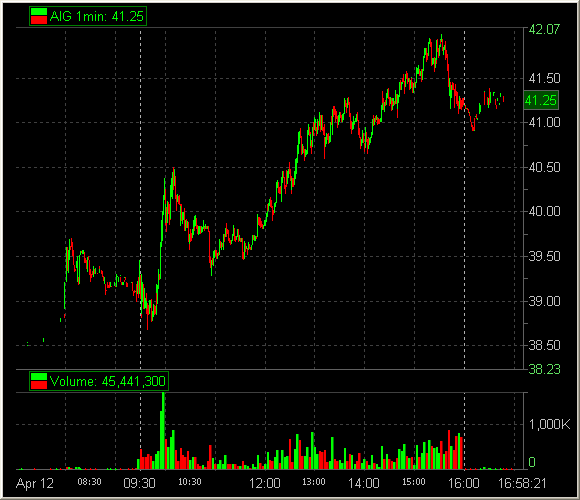

Wednesday AIG broke about an important resistance level of 36. If for some reason you have been trapped under a rock for the past two months you might have missed that most things breaking out head for higher ground. Boss Lindzon has labeled the recent market upmove as the “inconceivable rally.” One of the original trading bloggers, Rev Shark, on RealMoney.com has been urging caution lately. But all agree that momentum plays are working so we watch an AIG for follow through. 40 became our new resistance level in AIG as we have waited the last few trading days for follow through. As we opened and AIG raced above 39, many wondered: could today be that day?

With all the HFT noise in an AIG I play for a bigger move. My win rate will be lower. And essentially AIG must trend and follow through for victory. But if I catch one of these AIG all-day trending days then my downside is 25 centsish and my upside is 5 points. That is not a bad risk/reward. Today was not one of those all-day trending days. There was only one losing trade followed by one winning trade.

When AIG stuck its head above 40, the volume increased, and then it started to consolidate- I made a play. I got long 39.91, with a stop at 39.74. AIG first found 40.50 with an impressive upmove. I didn’t move a muscle at anytime to sell any shares at any price. Could this be the day? Was I going to catch the multi-point upmove? Well no. AIG failed above 40.50, leaked all the way down and found my stop. In fact AIG continued much lower, finding more stops, and disappointing more than just me.

Oh well. This is the AIG game. Remember our win rate will not be high. When we catch it that can make for an awesome day, but there are many false starts, fake breakouts, and disappointing days in our good friend- AIG.

40.80 was our next important level in AIG. As the the lunch hour was in full swing, AIG creeped higher. Can’t they just leave us alone to enjoy our lunch already? And AIG broke above 40.80. I was teaching and doing all things partner at the time so I did not buy the first break above 40.80.

But as the afternoon progressed AIG was consolidating above 40.80. I returned to my trading station, sat down, bought into a sharp downmove to 41.06, set a stop for 40.69, and teased Ram Jam, who sits next to me, about not being allowed to sell.

AIG approached 42 and Mr. Spencer proclaimed this a level. Why does he have to ruin the party? We lightened up as the pass at 42 did not look promising. I held 1/2 of my position however. The market broke to the downside for the last hour, driving AIG lower. I faded the downmoves, buying and then kicking it out 15-20c higher, while holding 1/2 a lot. This minimized what I was giving back from the 42 fig.

The day ended and I offered my remaining shares at 41.25. I had hoped for a better close. But it was not to be. I played for a bigger move and it never came.

4 Comments on “PLAYING AIG FOR A BIGGER MOVE”

AIG- Suggest you have a look at the 5/7 top, 8/5 move, 11/2-3 time frame and the important 2/4-5 time period.

42 is Psychological-somewhat technical at this stage, but 43.01-15 may prove to be more pivotal.

May be I got lucky but I believe I played it better this time- I just bought at 12:38h on the good volume break of the cup and handle pattern at the $40.50 level(which was also the high of the opening hour spike).

I figured $42 level would be a good target because the stock was definitely in play, volume was great and the $42 level would have doubled the morning spike from $39 to $41.50.

It rarely works so perfectly for me and I feel so good about it that I decided to share.

Great blog, guys.

May be I got lucky but I believe I played it better this time- I just bought at 12:38h on the good volume break of the cup and handle pattern at the $40.50 level(which was also the high of the opening hour spike).

I figured $42 level would be a good target because the stock was definitely in play, volume was great and the $42 level would have doubled the morning spike from $39 to $41.50.

It rarely works so perfectly for me and I feel so good about it that I decided to share.

Great blog, guys.

My play was like your Gman, but when it hit 41.7 on the way down, I locked what profit I had and will be taking a hard look again tomorrow, looking for a strong break above 42.