Let’s say I told you I wanted to improve my golf game. Specifically I wanted to get better at driving the ball. Currently I can drive the ball about 250 yards because I am no good 🙂 And I continued that yesterday I worked very hard on game. I went to my local driving range, parked the Lexus (the car … Read More

Morning Thoughts on October 1, 2010

Good morning traders. Yesterday I wrote that “I will be watching XLF and OIH as market tells; we need to get some more sectors involved if the rally is really going to have some legs in it.” Indeed financials worked as a very good tell. Its very important whenever the market is a major inflection points that you understand what … Read More

Quick Market Take

The past week or so I have begun to feel a bit uneasy about the market action. It hasn’t been as crazy as the action that we saw in late January that led to pretty vicious two week sell off but it has definitely caught my attention. The failed breakout of the 115 SPY level has me on full alert … Read More

SMB Morning Rundown – September 30, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open

Morning Thoughts on September 30, 2010

Good morning traders. Inside day yesterday is constructive for the bulls as the market is consolidating its previous run without giving gains back. I will be long the market over 115, waiting until it holds higher to really load up on the long side. I will be watching XLF and OIH as market tells; we need to get some more … Read More

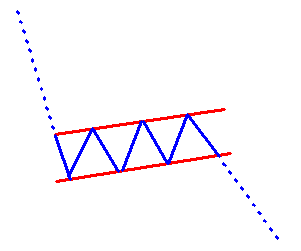

Some notes on flags

A few random thoughts continuing Bella’s earlier post on flags

Traders Ask- How Do I Trade a Bearish Flag Pattern?

Hi Mike. Yesterday in you webinar you showed us a chart on Toyota that dropped nicely on bad news. After that initial drop the stock began a sideways move. The question is: Do you continue to trade that stock during the day even though its going kind of sideways, or do you wait for it to brake the lows or … Read More

SMB Morning Rundown – September 29, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open