Good morning traders. SPYs took an early morning dip as the tech leaders saw some rest and pulled back/ consolidated. Its impressive to see how resilient the market is. Lower prices bring in aggressive buyers, something that is very important to the health of the rally. In terms of the SPYs chart the longer we spend above 113.20 the higher … Read More

AAPL Flash Crash?

I received a couple of twitter messages about whether I was trading AAPL on the Open today. JoeP had mentioned in his morning thoughts blog that we were watching the 291 level closely for a possible break of the recent uptrend. As it turned out I was short RIMM on the Open and watching CRM as well for a break … Read More

Traders Ask: What R U Thinking While Trading?

Mike, A few nights ago I watched Alex Rodriguez pound two homers against Boston. As I watched, Alex was calm, collected, and observing what was being thrown at him. I wonder whats going on in his head during those moments, when he’s just waiting for the pitcher to release the ball? “Absolutely nothing” I said. “Alex is just intently … Read More

SMB Morning Rundown – September 28, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open

Morning Thoughts on September 28, 2010

Good morning traders. Futures up slightly overnight have us opening near the 114.40 level in the SPY. I am starting to see signs of some exhaustion among some of the leading stocks, particularly AAPL which gave back its gains and closed right above is 60 min trendline at 291. My major tell in the market is going to be how … Read More

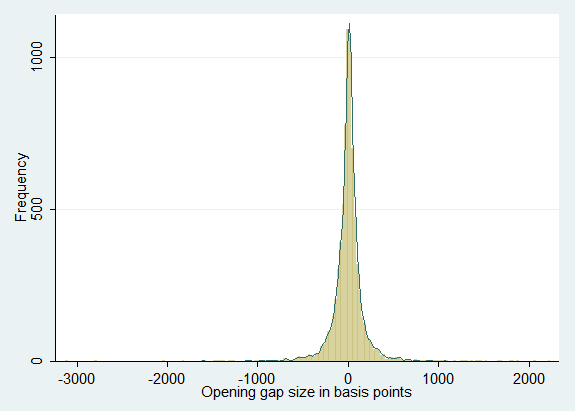

Gap Study (2/3)

Part 2/3 of a series of posts showing one way to apply quantitative thinking to market problems.

Traders Ask- Where Do You Find All Those Levels?

I was away part of the week so as I kept half an eye on the football game this afternoon I used the other half to catch up on my archiving of the SMB blog. Turned out that being behind was a good thing because I was able to instantly walk forward and see how the analysis played out. … Read More

SMB Morning Rundown – September 27, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open