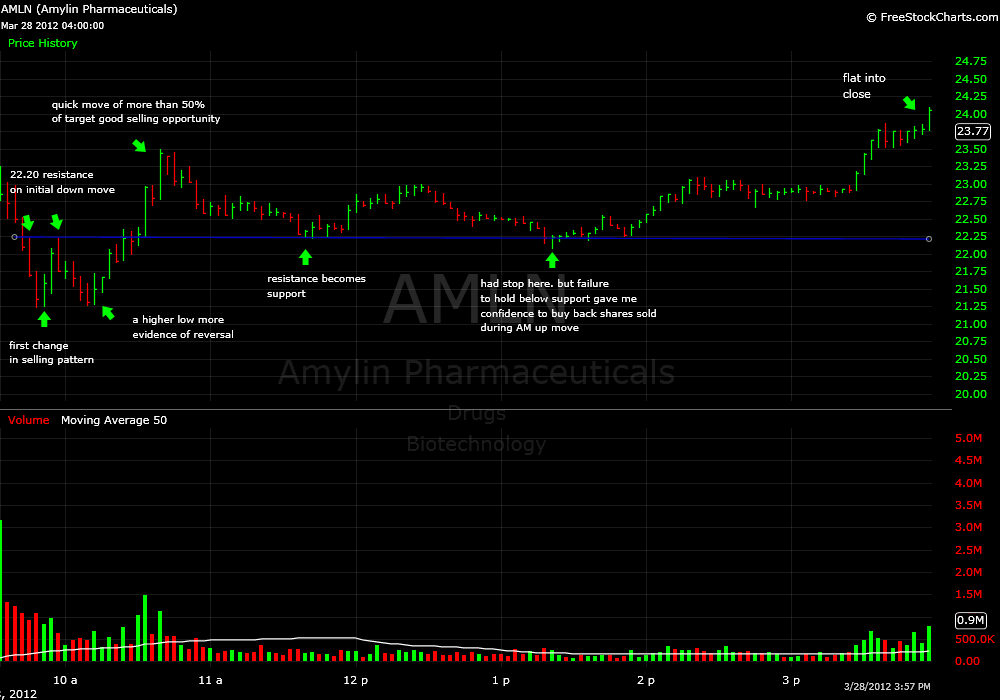

We received a few requests for a trade review of the AMLN trade I was tweeting during today’s Open. I’ve illustrated my key thoughts via the annotation of the chart below. Let me outline some of the “bigger picture” considerations that are not covered by the chart annotations:

- It was reported that AMLN received a $3.5 billion takeover bid which they had rejected. A rejection of a takeover bid will put a company “In Play” and often brings other potential bidders to the table willing to up the ante above the original takeover price.

- The reported bid works out to about $23.75 per share. The fact that AMLN was trading up to that level in the pre-market on heavy volume indicates that many large traders believe the bid was legitimate and other offers significantly higher will be forthcoming.

- Once a stock becomes “In Play” related to potential takeover offers I immediately calculate prices where large traders may step in and start buying after initial profit taking occurs on the Open. 10% below the takeover offer is a price where a hedge fund analyst would recommend to their trader to start buying. In the case of AMLN that is around $21.39 per share (why this is the case is an entire other post and isn’t particularly interesting).

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].

No relevant positions

*live trades discussed in this post took place in T3 Trading Group, LLC a CBSX broker dealer