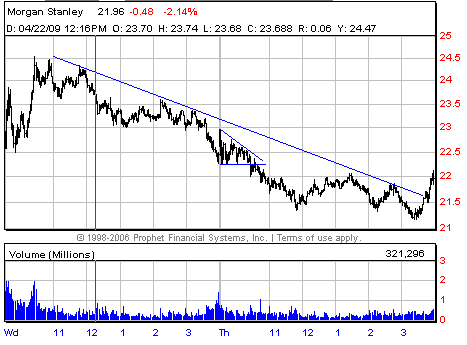

The theme of the day is the “Second Day Play”. Jtoma talked about it on Fast Money and now I will review the best Second Day Play from today. Yesterday, MS released earnings and traded in a 2 point range for the day between 22.50 and 24.50. MS was behaving relatively weaker than the market yesterday afternoon. When the market rallied it had trouble getting above 23.50. After trading down to 23 it had trouble trading above 23.30. These signals pointed to a weak close and a possible short for the following day.

I decided if it closed below 23 that I would hold a small short position overnight and trade it with a short bias today. My trading plan was simple. If MS failed to trade above 23 on the Open I would look to add to my small short position as soon as I identified large selling on the Box. When the market opened MS couldn’t trade above 23 and quickly traded down to 22.40. There was an identifiable seller at 22.65 so I added to my short position.

MS began to trade in a forty five cent range between 22.25 and 22.70. Each time it sold off I would cover some of my short position. Each time it traded towards 22.70 I would short more stock. Then I noticed the up moves were becoming shallower. MS couldn’t trade above 22.60 and then 22.50. I became more confident that the 22.25 level would soon break and there would be a move down to the longer term support of 22.

When MS broke through 22.25 on its fifth attempt I had my largest position of the morning for a quick move down to 22. I believed based on yesterday’s price action that MS would probably pop back up to 22.25 before finally failing so I covered most of my position into to the down move. This allowed me to be in a position of strength when MS traded back up to 22.30. This is an important point. Too often less experienced traders will get caught with their largest position at the end of a move. This leads to unnecessary losses even when they have the correct bias. Take profits into sharp down moves and make sure you reload once the stock has retraced to a more favorable price.

The final piece of this trade is the break of 22. 22 is an important support level in MS on the longer term chart. So once it traded below this level I was expecting a minimum of another point of downside. My plan for this part of the trade was to cover half of my position if MS broke below 22 but failed to hold an offer at 22 or lower. I then would reshort some stock at 22.14 because I had previously identified a seller at 22.15.

MS broke below 22 but popped back above so I covered half of my position. I was able to reshort some stock at 22.14 before MS broke 22 for the second time. It stayed in a downtrend for the next hour so I just held my position. Then it was on to SMB administrative BS so I missed most of the up and down action later in the day.

Overall, MS provided a ton of great risk/reward trades so it was a great Second Day Play!

Don’t forget to follow us on twitter.