The new trader is usually in a rush. They want to be handed a system that will make them profitable practically overnight. A professional and consistent trader is one who is usually informed in a way that goes against the conventional.

Getting to that level of knowledge requires building enough experience with conventional information so that you can make it your own.

It takes a great deal of time and effort to gain the ability of original thinking. Think about a musician starting out with an instrument. They first learn the basics and then spend years perfecting their own unique style. Eventually that instrument becomes an extension of themselves.

Refining your trading skills requires a similar form of commitment and discipline. One thing I tell new traders is if you want to become an expert in this game, you must have a strong interest in every aspect of the game. You should be enthusiastic about learning techniques or philosophies that will offer no immediate value to your trading. You are learning because you enjoy learning about anything related to trading.

This is what eventually leads to the refined thinking skills required to navigate the markets on the short term.

There are many topics that I am very familiar with that don’t have any immediate use in my trading. One such topic is Market Profile.

Market Profile is a technical perspective that was developed by J. Peter Steidlmeyer, a trader at the Chicago Board of Trade. He created this way of looking at prices to better evaluate market value as it developed throughout the trading day. His charts resemble a bell shape that looks similar to a normal statistical distribution. He introduced the Market profile graphic in 1985.

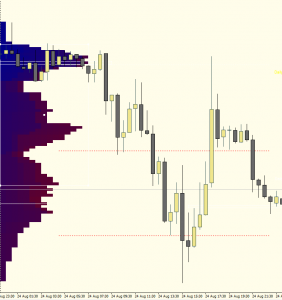

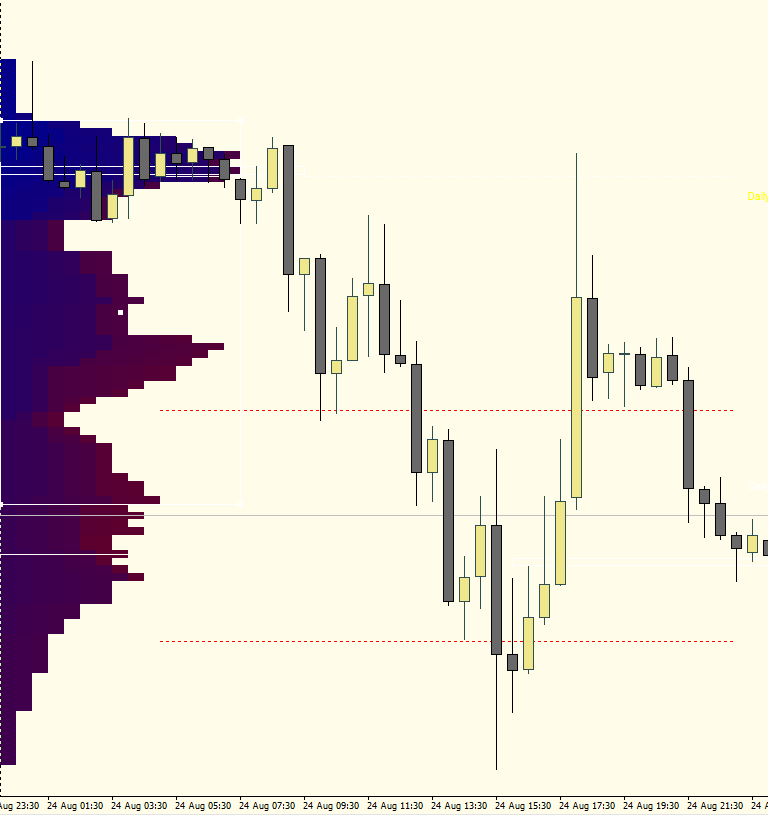

This is a graphic based on The Market Profile. The original profile uses letters to track time in 30 minute intervals.

I read a few books on this perspective. I experimented with charting packages that were able to produce a similar profile graphic. I tried to develop trading strategies around this perspective. I have not been able to use this tool in a way that offers me any immediate benefit.

Have I wasted my time? Was all that effort for nothing? Actually the opposite is true. I may not be able to use the profile graphic in my trading, but I have gained an enormous understanding of price behavior. It is this understanding that helps me interpret price action as it unfolds, and allows me to adjust my expectations appropriately. Now that is extremely helpful.

One concept that Market Profile emphasized for me is the difference between a balanced market, and one that is imbalanced. Balance simply means an equal amount of buyers and sellers around a particular price area. That also means what? A range-bound market. I also learned that the more time price spends at a particular level, the more significant that level is. Usually you will find the “point of control” or price level where the most time was spent. This implies volume. When price moves away from this area, and happens to revisit it, this area becomes a very important potential turning point. So I can adjust my expectations appropriately and better anticipate the market.

So do I use Market Profile? No, but I utilize concepts that I would not have known about if I didn’t spend time reading the books and experimenting with it in real time.

So the lesson here is this: Trading is a continuous learning experience. You will never know everything there is to know. This constant pursuit of knowledge is what being “passionate about the markets” is all about. So the next time you come across a magazine article, book or blog post related to trading, read it and add that one new piece of information to your foundation. Eventually all these pieces of information come together to help you form a much more accurate perspective of the market.

Marc Principato, CMT

9 Comments on “Unleashing Trading Potential: Leveraging Market Profile Strategies”

I have always been interested in learning more about market profile? Have you had failures when you tried to trade it? Just wondering because it seems like it would be icing on the cake for any horizontal line support and resistance type of analysis….Which I do a lot of, I think it is the most overlooked gem in trading.

Hi Jeff,

I have experimented with it, but haven’t been able to incorporate it into my methodology to produce any meaningful results. I still have a lot more to learn from this perspective. Learning the basics though as really helped my understanding of price action, and market psychology. Great topic to study just for better understanding of market behavior, especially for newer traders.

I use volume profiling extensively in my trading. It’s worth reading Steidlmayer’s original books on market profiling, as well as Dalton’s updated one, but I’ve gained more practical knowledge from the traders using volume profiling in their intraday trading, such as FuturesTrader71.

It’s important to distinguish between market profiling, which is Time at Price, vs volume profiling, which is Volume at Price. Steidlmayer developed market profile at a time where is was impossible given the current computational power to use volume at price. Now he’s beginning to make the shift.

A suggestion for new users. When viewing high volume and low volume nodes as support and resistance, don’t give them equal weighting or assume that price will behave the same around them. FuturesTrader71 gives a great analogy. High volume nodes are like tall grass in golf. Price will enter, but it will rotate around these nodes more slowly since there is perceived value there. These are good place to place exits. Low volume nodes are better for support/resistance, and they should behave like golf balls against concrete with price hitting them and being rejected quickly. If price stays there, then consider their resistance suspect (like any other S/R line).

With more use, especially the use of composites, volume profiling can also teach about rotations around price and provides targets for retraces and extensions. Feel free to fire me an email if you have questions.

Thanks for the comment Jeff. Great info about the difference between Market Profile and Volume Profile. I’m familiar with Futurestrader71, his posts on twitter are great. And great book suggestions. What instrument do you trade mostly?

Marc,

You’re welcome. Of those books, I’d say James Dalton’s “Market in Profile” is the best overview.

I primarily trade E-mini and 6E futures, though my 6E trading is more mechanical than discretionary. The rotational aspect of ES is more applicable for VP.

IMHO, one of the dangers for new traders using VP solely, with no other momentum or trend indicators, comes when trades are made at areas of possible S/R with no sense of context. Roughly 20% of the days, the ES is going to be trending and pushing through initial S/R points, and it’s only points of exhaustion when those levels become effective. I see traders stabbing, stabbing, stabbing at reversals, then when the trade actually works, mentally needing to bail quickly to keep their profit and ego. This is me speaking from costly experience. 😉

Good discussion!

I like the music analogy. To stretch it further, as a trader you play “live” usually many times before you develop the skills needed to play well. Paying audiences, just like Mother Market, are indifferent to the best of your intentions and efforts. You are as good as your last gig and when that was bad … Imagine going on stage night after night to booing, hissing and torrents of abuse. How do you find the resources to carry on?

You need to develop a thick skin that still feels pain, and that is no mean feat. And yes it undoubtedly it helps if you have a deep interest in every aspect of the game.

Hi Andrew,

Great post and great points. Thanks for sharing. How long have you been trading for and what do you trade? Do you use Profile in your analysis?

Hello Marc

I discovered the value of charts about 3 years ago; it is somewhat embarrassing to consider how long I spent previously trying to find a consistent edge by reading news and listening to “experts”. My tendency since has been towards simplification and now use mainly different time frames, and inflection points based on trend lines, consolidations and spikes. In the same vein I now trade mainly UK100 cfd’s, and only the morning session. Though I came across MP some time ago it seemed too complex for my approach so I didn’t properly explore the concept. What I do now works, when I do it; the biggest trading discovery of all being of course just how much of an enemy I am to myself.