In a prior post, I presented the concept of retest support and resistance in a formation before a chart expands into any kind of trending space

Trading Vault Concept –

“Support and resistance structures are reliable. They provide ideal trading targets- for entry and exit. Learning to develop the patience to wait on them to develop is the real struggle for the average trader.”

I’d like to follow up with a look at these charts at how the orders may have worked out themselves

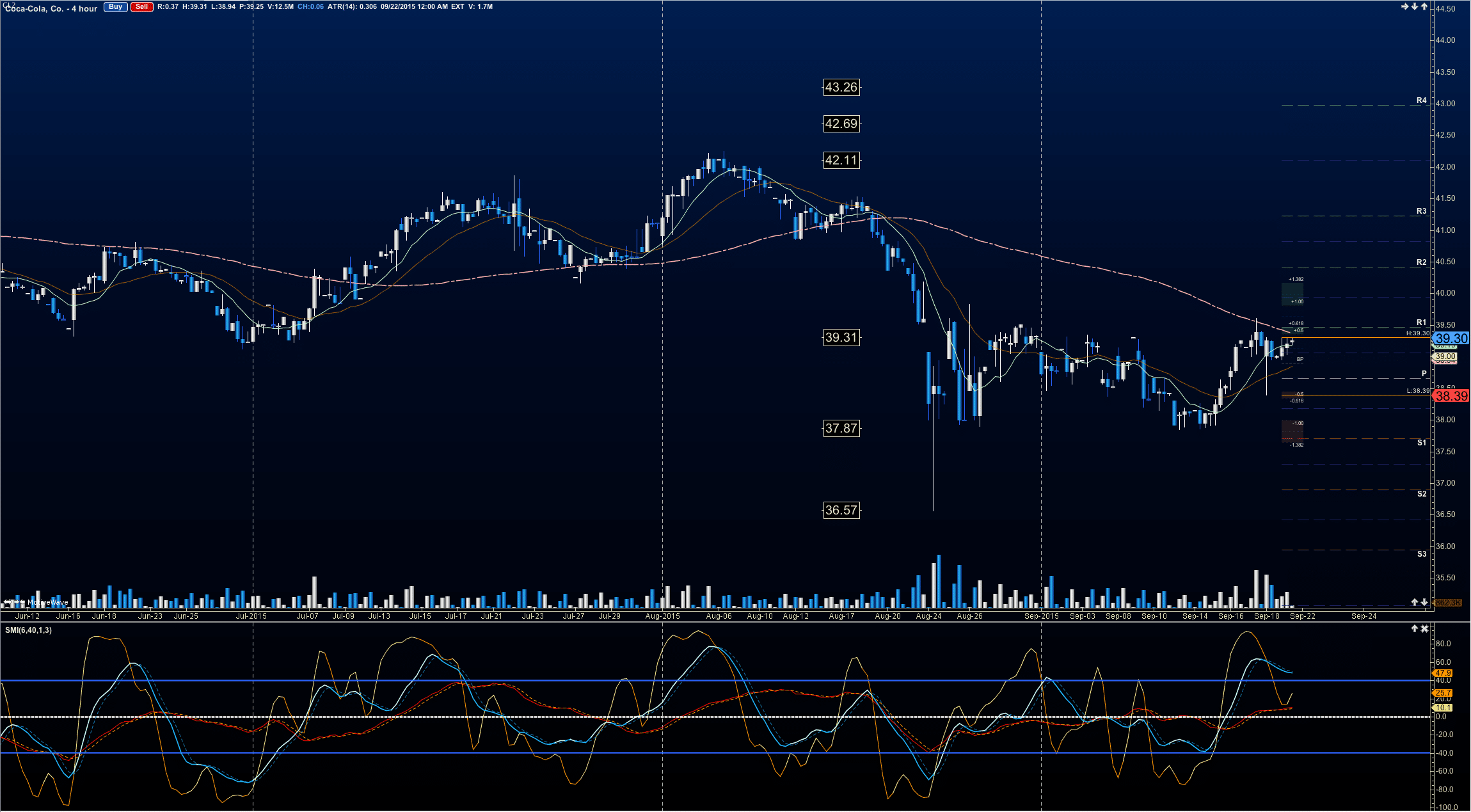

Let’s have a look at KO again –

Let’s walk through the mechanic using The Trading Vault techniques-

Here was the long scenario –

“If the KO chart bounces above 38.7, I’ll put a conditional order for THE FOLLOWING DAY in to go long at 38.33 pullback in a 1/2 sized position; my stop will be at the 37.8 region. If it retraces into 37.8 and begins to bounce holding positive momentum, I will add to the position as it rises above 38 to make it full sized. My initial targets upward will be 38.89, 39.31, 39.67 and 40.17 where I think it is very likely to reverse and lose this channel bottom again – If the chart bounces sharply, I will adjust the entries for the following day (and update this post with a new one).”

Execution event – Notice that the chart triggers this price on Sept 16 and accelerates rapidly on the 17th into areas just shy of the 3rd target before pulling back in the early hours of Sept 18 into within pennies of our entry point. Though the trigger to move was created on the 16th, our price entry behavior (we are able to adjust price based on strength of the earlier move up- a technique you can learn by evaluating momentum properly using The Trading Vault concepts) did not occur until the premarket of the 18th.

We are now back up at the 2nd target once more but with decidedly less momentum and formation strength than the last time we were up here, so as students of the strategy we would be looking at a potential double top event that would close the long and potentially open a short. (A little more advanced mechanically but the steps are straightforward in terms of what to look for) This is time to take partial profit: at the second target. At each target region, an action event must be staged – raise the stop, trim the gains, add to the position, something of consequence needs to take place.

Now, let’s consider GPRO –

Reviewing the prior post here, we see that I suspected a dip lower before the bounce – because the market structures and forms suggested as such- and indeed the chart has lost the levels it was setting on Sept 14. If you are looking for a long, we are still in the wait state, and with current momentum formations and price drift, lower levels are still on the horizon.

The probable motion was a bit mixed as the chart bounced sharply into the 37.32 region before reversing. This is much higher than I anticipated but the end result was the same – price failure, probably due in part to trapped buyers trying to pick a bottom near 37.5 and having the bottom fail.

So……, just what are we waiting for here? Well, if you want to be short, then just about any bounce in this formation should deliver the entry for you. Perhaps a stretch into 33.6, with a soft stop near 34.1, with targets back at 32.4, 31.8, 30.5 – but be careful. Buyers will likely start to become a bit antsy about getting in down here, so use bracketed orders to remove profits at targets

For those of us who are fans of this stock/product, if we see some kind of strong exhaustion move to the south near 30 or 28.6, that presents a unique toe dipping opportunity with some short out of the money puts with lots of time decay – but for the rest of us, watching this one stabilize before we enter into a swing event is the most prudent of choices.

If you want to learn how to read charts like this, and structure your trades with precision, I’ll teach you in The Trading Vault

* no relevant positions

No relevant positions