Bella,

A couple quick questions on EDU based on what you were discussing in the meeting after the close:

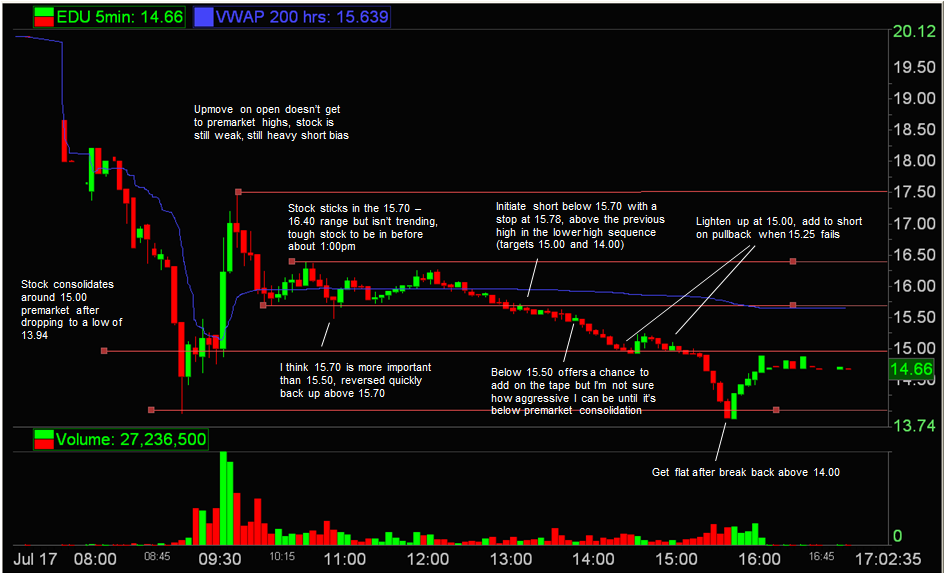

I was watching EDU and felt that the 15.70 level was more important intraday support than 15.50. The push down to 15.50 happened simultaneously with the market exhausting its downtrend before pulling back, and at the time it looked like EDU did the same. Then after 15.70 held and the couple hours of price action in the range, EDU headed steadily down into 15.70, broke through and spent time below and at that point it seemed to me the stock was different and heading lower. (see my Trade Management below)

Is that a reasonable evaluation of those levels or is that a bit of overthinking?

Even if that analysis is right should I wait to get short below 15.50 regardless because the probability / R:R from 15.70 could be lessened even if 15.00 and then 14.00 are the targets on the short?

BELLA RESPONDS

This is a great question. When can you tell a stock is continuing its trend? What price is more important 15.70 or 15.50 with this EDU trade?

As I trader it is most important to be asking the right questions and then for you to make sense of your decision. You did ask the right question and you do have the right areas of decision. So let’s not undervalue the excellent work there by you.

Second you will develop a personality as a trader. If you are an aggressive trader you will gravitate towards the short below 15.70. If you are a more active trader the same. If you are a conservative trader you might decide between these levels depending on some variables.

You could have decided: I will add to my EDU short if I see EDU holding below 15.70 because it has not held below there. If you do so you should also still consider whether to add below the 15.50 level.

The first move down to the 15.50s was a quick move so you could conclude that because of a lack of time down there at those prices that that was not as significant as the 15.70 level. A lack of time, a lack of volume at prices can be a factor to conclude another level is more significant.

One thing not to miss with EDU is that it acted cleanly around the 15.50 with its second pass. It held 15.50 but then the offer stuck 15.62. EDU dropped below the level AND then stuck the offer at 15.55, lower than 15.62. It is optimal for us to see a hold below 15.50 on the offer to confirm a downtrend continuation pattern. We didn’t get that but we did see the holds and meek upmoves to 15.62 and 15.55, a sign of weakness.

Good review of your trading!

Bella

no relevant positions