Before the Open I asked SMB Trader CST, “What are you looking at?”

“I am thinking of trading DNDN Bella. I am looking for an opening drive.”

I checked briefing.com:

Dendreon: Provenge launch is on track

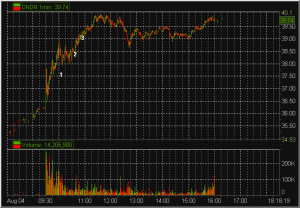

The market reacted positively to this news as DNDN was gapping up. On our long term charts 37.50 and 40 were the next important technical resistance levels. And then came the classic gap and go pattern.

Before the open @alphatrends tweeted:

i laugh to myself when i see tweets about the market which are written with tone of fact “XYZ is going to be 20% higher by nxt week” etc

about 10 hours ago via StockTwits Desktop

Retweeted by you and 2 others

In mid trade with our DNDN position I tweeted jokingly:

@alphatrends I predict $DNDN may (or may not) get to 40 today 🙂

about 9 hours ago via web

After the close I asked CST to replay this DNDN set up with our desk. While he caught most of the move he wished he had done so with more size. So I placed him in front of the class to explain where he would have added more size while controlling his risk with this very set up. Specifically I asked for the desk and CST to consider and then discuss where we could have added more size, while controlling our risk with this gap and go pattern. CST and myself caught this move but we definitely left money on the table. This was an exercise for a better result the next gap and go opportunity.

We found a consensus for three spots to be more aggressive. They are marked in the chart below as 1,2 and 3.

1. Above 37.50, an important technical resistance level.

2. Above 38.50 with a strong green candle indicating DNDN was going up again.

3. And a hold above 39, an intraday resistance level.

Where to be aggressive is not more important than replaying where being more aggressive made the most sense to you. Next time we will be in a better position to capture this trade with more size, while controlling our risk and with the confidence of a set up well studied.

Mike Bellafiore

Author, One Good Trade: Inside the Highly Competitive World of Proprietary Trading (Wiley Trading)

5 Comments on “DNDN- A Replay”

where to take profits? resistance at $40? (don’t be a wuss) OR failure to hold $39?

aren’t profit targets are just as important as adding? i feel that’ s a key piece of info to complete this blog.

Eric,

The real level was 40. IMO it was a hold of your core position until then. You can lighten up at other points of resistance on the tape intraday. But you want to be in your core for the real move. Yes do not be a wuss!

Bella

Thx Bella, So rare to have moves like yesterday, need to be mentally prepared when the next one comes.

Eric,

Are these moves rare with a stock with such fresh news?

Bella

the pattern I’ve noticed is that stocks will gap up, give you a nice move early then fall apart. this is what i meant by moves (DNDN holding up) as a rare move. that is also the reason I am more inclined to take some quick profits lately than search for multiple point moves.