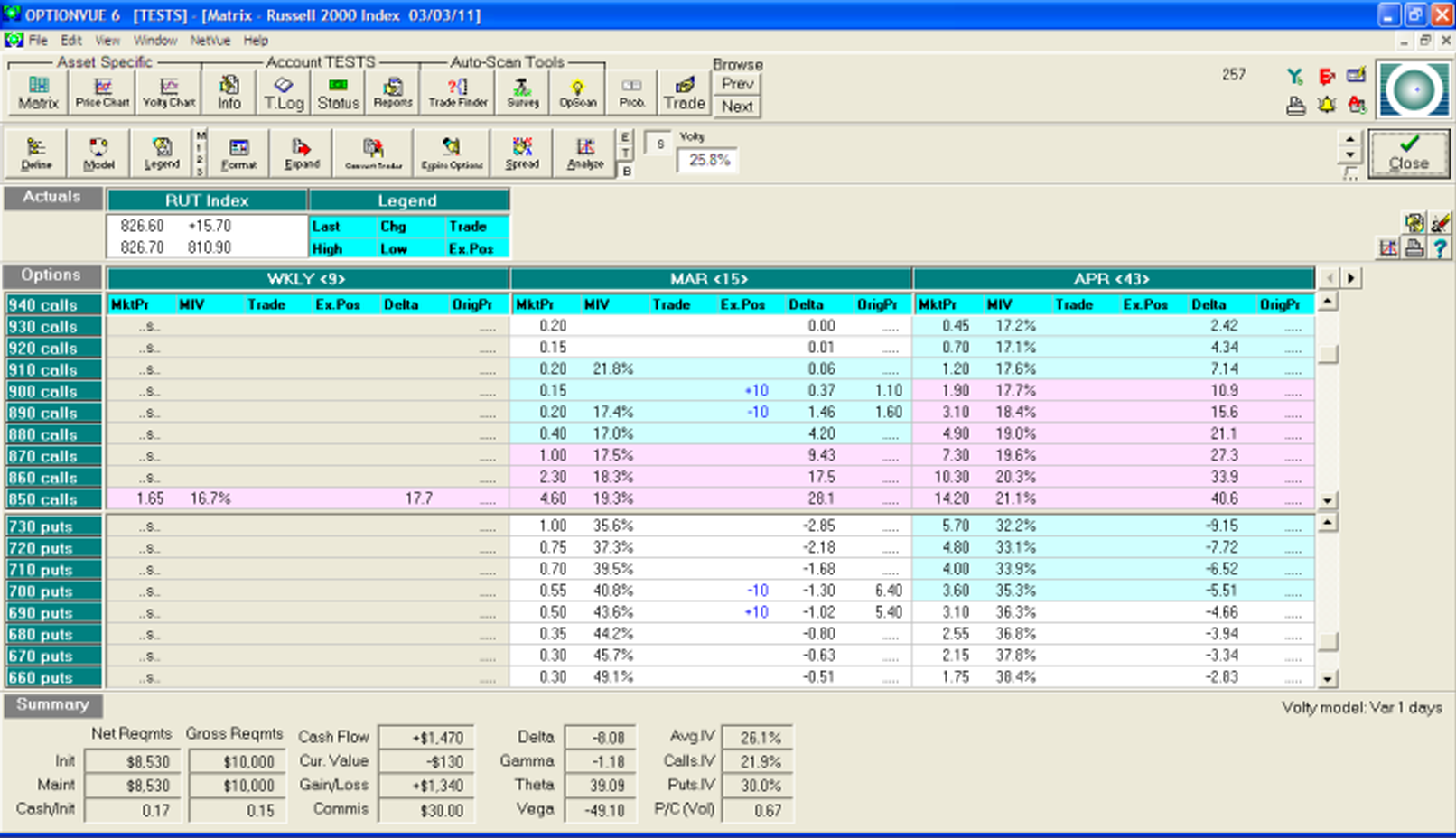

One of the most popular income options strategy is known as the high probability iron condor, which consists of a call side credit spread and a put side credit spread “facing each other” very far out of the money. For example, on January 19, 2011, at about 10:30 in the morning, the RUT Index was trading at 798. An options trader … Read More

What do all successful traders have in common?

In the summer of 2010, I traveled to Manhattan from my home in Philadelphia to meet with Roy Davis of SMB Capital for the purpose of checking out SMB’s intraday equities training program. While I am an income options spread trader myself, my premise was that intraday equities trading and options income trading were not at all mutually exclusive … Read More

Bias Shmias!

One of the most frequent confessions I hear from developing traders is that they couldn’t change their bias when the price action warranted such a change. They develop a bias as to which direction a stock will trade and hold on to their viewpoint despite overwhelming evidence to the contrary. I have even heard there are many experienced traders who deal … Read More

The Back Nine- You First

On the couch, wife out of town, a full container of perfectly ripe cantaloupe, what is a young man to do? I found a killer documentary, not via NFLX, The Back Nine that has left me with a day full of thoughts on trader performance. First should we teach traders to work through their psychological hurdles before we talk set ups? … Read More

Sometimes Nothing’s A Real Cool Hand

For those of you who are movie buffs like me, you’ll know that one of the truly greatest films of all time is Cool Hand Luke, the titlecharacter having been played by Paul Newman in one of his finest roles. If you haven’t seen it, see it. What a great flick. The Paul Newman character is a prisoner on a … Read More

Exploring Trading Education: Why Aren’t Universities Teaching Trading?

I just returned from Penn State for a talk with some future traders (perhaps). Some serious college traders inside of an investment club reached out for my visit. My charge? Discuss what it’s really like to be a profes-sional trader so that some might better understand what we do. In a recent New York Times article the rise of trading labs … Read More

The Right Way to Adopt a New Options Strategy for Your Playbook

In our last blog post we discussed the reasons that options traders should take it slowly when adopting a new income strategy. Here are some simple steps you can take to assure that your adoption of a new options strategy is sound: Communicate with the developer of the strategy and see if he or she is still actively trading the … Read More