@DynamicHedge wrote a must-read piece recently that went viral, “Letters to a Young Trader”, in which along with buckets of awesome advice he also asserted prop trading shops are dying. This is true. But this is not the same as prop trading is dead and/or ALL prop shops are dying. That would not be correct. The author never stated this but … Read More

SMB Forex Daily Review – July 26th, 2012

Marc Principato Director of SMB Forex [email protected] * No Relevant Positions

How To Tell If A Trading Book Is Useful

As part of your desire to learn more and improve as a trader, you have probably checked out some books on the subject. Some of them, like Market Wizards, are truly inspiring and excellent reads. Maybe some of them have been helpful but most likely a lot of them were bad. Similarly, if you go to a bookstore or browse … Read More

Spencer Trade Review: $VVUS

Trade review for VVUS for Friday July 20th plus thoughts on possible trades for Monday. Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected]. No relevant positions

How to tell a stock is breaking down (EDU)

Bella, A couple quick questions on EDU based on what you were discussing in the meeting after the close: I was watching EDU and felt that the 15.70 level was more important intraday support than 15.50. The push down to 15.50 happened simultaneously with the market exhausting its downtrend before pulling back, and at the time it looked like EDU … Read More

Should you quit trading?

Hey Mike, How are you? Everything at SMB going well? Life outside of work is good? If you have the time, I could use some advice. I have now been trading about 10 months at (firm deleted) and learning from one of the best traders. For our style of trading, the firm as a whole finds this to be one … Read More

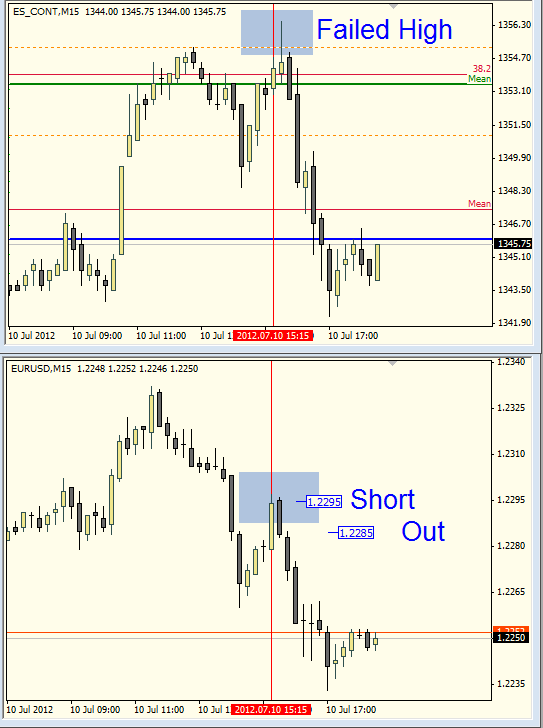

S&P/FX Trade Example

I talk a lot about the intermarket relationship between the S&P 500 Index futures, and the EUR/USD forex pair. The relationship is typically, S&P goes higher, EUR goes higher. There are fundamental reasons for this that I am not going to go into here. What I want to do here is highlight a particular condition that appeared in the S&P … Read More