NFLX has been in play since the huge move on Thursday. I looked to trade it on the short side on Friday as it was overextended and had a powerful Opening Drive to the downside. It ended trading off about four points from its high but failed to close below 81 which had been a key support level on Thursday. … Read More

Two SPY Trades

I don’t trade the SPY on a daily basis. But I have a few “go to” trades that I will make when they trigger. Fade a pullback to a recent S/R level in the direction of the higher time frame trend (Trade2Hold) Fade a pullback to a recent S/R level against the direction of the higher time frame trend (Scalp … Read More

Beware the Hedge Fund

Steve Spencer discusses with Fox Business how funds will push momentum stocks around to try to outperform the market. Watch the latest video at video.foxbusiness.com

What Is The Best Preparation To Be A Trader?

You want to be a trader. Maybe you’re just starting out in the working world or maybe you’re considering a career shift. Nonetheless, you know one thing will all of your being—you want to make it as a trader. There could be a host of potential reasons, all of which make sense. You want to swing around huge positions and … Read More

This Is What Insider Trading Looks Like

One of the most volatile stocks last week was LNCR. On Wednesday the Financial Times reported that it was in talks to be taken over for over $40 per share. The stock immediately spiked on heavy volume from 26 to 29. The market clearly believed the story. So it was on the top of my list for trading the rest … Read More

Reversal Rehearsel Revisted

Two weeks ago I wrote this post discussing that a lot of money was being made on the desk via reversal patterns. This post will discuss a few trades from last week that continued to show this pattern remains highly relevant and where a lot of money can be made intraday. On Thursday after the Supreme Court health care decision … Read More

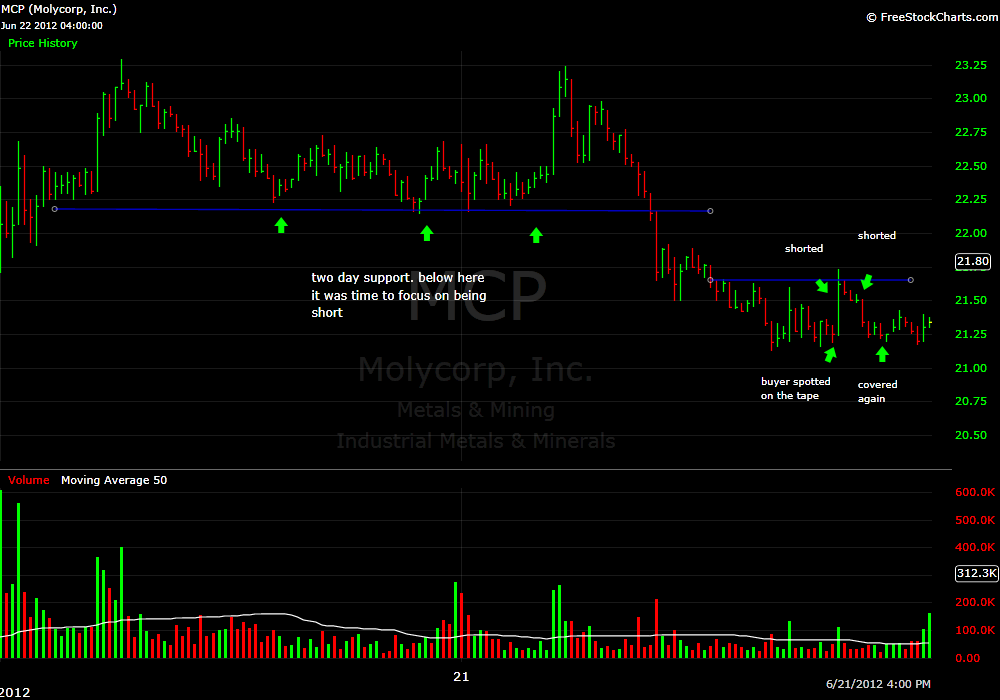

Tape Reading Was Money For This Play

On Thursday I was short MCP because it was trading below its two day support of 22.20. The market was having a trend down day and I was very comfortable holding the position until the close. But then something changed on the tape. There was a 100 share bid on ARCA at 21.20 that was being hit and continued to refresh … Read More

The Truth About Our Economy

It has been almost 4 years since the US fell into the Great Recession and we have yet to see a strong recovery. One of the after-effects of the Great Recession has been the increased attentiveness to monetary policy. Attentiveness to monetary policy existed before the Great Recession but not to the degree seen today; since the Federal Reserve took … Read More