For decades, expert options traders have been relying on a variation of the ever popular butterfly trade to enhance their monthly income and allow them to safely include a directional bias to their trading.

The Broken Wing Butterfly (BWB) is a more advanced trade, not because it is difficult to understand – but because there are more nuances that require expertise in order to execute the trade effectively.

Let’s say hypothetically you believed LNKD (LinkedIn) would be trading near support within the next 30 days. Before understanding options strategies, a trader may think the only way to profit if this idea is correct would be to short the stock.

With a very basic understanding of options, you realize there are additional strategies available to you. You can sell calls, buy puts, or use vertical spreads to define your risk.

Let’s look at the pros and cons of these strategies.

Shorting the stock:

Pro: You can win big if you’re right

Con: You MUST be right to win

Selling Call Verticals:

Pro: You can win even if you’re a little wrong

Con: You can lose more than you can make

Buying Put Verticals:

Pro: You can make more than you can lose

Con: You must right on the direction, how far, AND when

What if there was an options trade that can let you win if you’re a little wrong and also gives you a favorable risk vs. reward?

Enter the Broken Wing Butterfly…

In our example we can see that if we’re wrong the maximum loss to the upside is $309.50. It doesn’t matter how far the stock runs up… that’s the extent of the risk if we are wrong on direction.

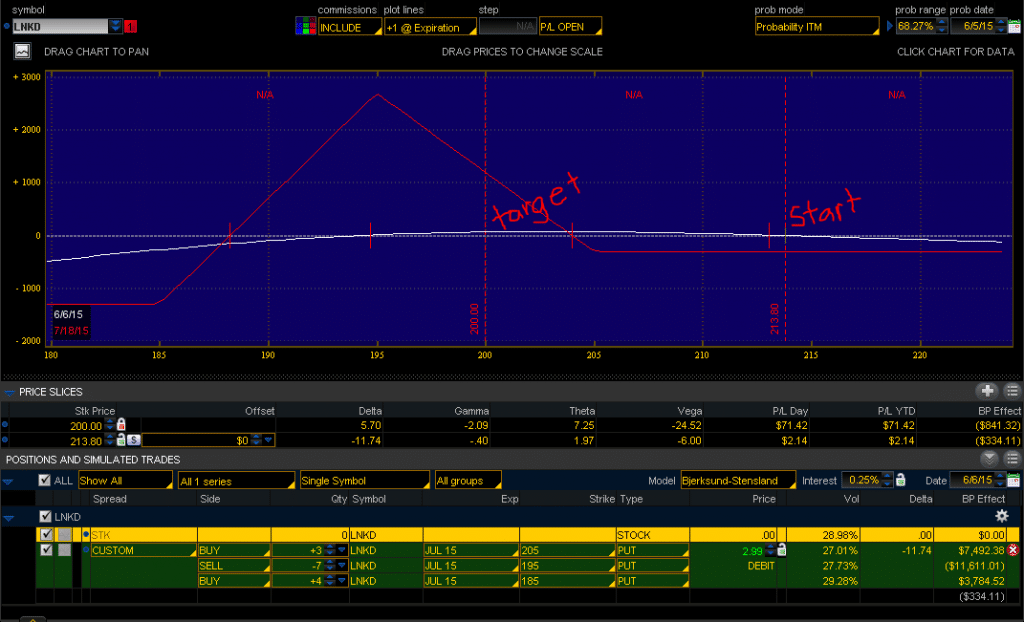

This trade centers a butterfly at 195 which is below my target of 200, however it uses a ratio of contracts to reduce my upside risk. Here’s the trade profile at initiation.

The only way to have a risk greater than the target reward is to actually be too right about the direction. The probabilities of a favorable risk vs. reward are in your favor with this trade, but you will need to have conditional orders, alerts, or watch the trade to make sure you are out before it moves too far in your favor.

Most traders don’t find they have a problem with being too right. More often than not, they are wrong about direction or wrong about timing. The BWB options trade allows you to control risk in those two circumstances.

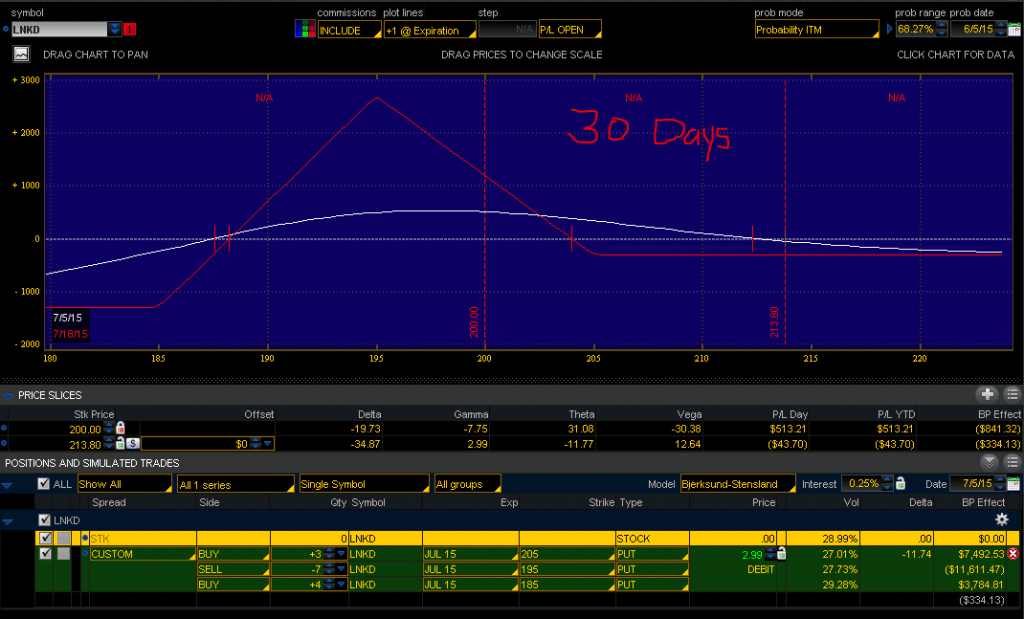

Then, analyzing the trade 30 days from now, our target of 200 on LNKD shows a profit of $502. At expiration (43 days from entry) it’s even better, with a potential profit target of $1,193.

Ultimately the BWB gives you the three following edges

- You have a small defined risk if you are very wrong

- You have a small gain if you are a little wrong

- You have a big win if you are right

The trade-off is that you have more risk if you are too right. However, even that risk is defined in case of a black-swan event.

Seems like a no-brainer to start trading BWB’s, right?

Well let’s look at some of the nuances that require some guidance and experience.

Nuance Examples:

- Underlying stock price and/or implied volatility may prove difficult to find a good risk/reward, especially after commissions. It could be that the underlying stock price is too low, or that the implied volatility is too low… or both. On occasion, you will find a low underlying value that has enough IV in the options to find a good risk/reward.

- Strike width and ratio of debits/credits is not ‘one-size-fits-all’. You’ll need to analyze several expiration cycles and several strike widths to find the trade that gives you enough edge while serving your directional bias.

- One of the best aspects of the BWB is that you can take a directional opinion, apply a good options strategy, and win even when you’re wrong. However, extremely volatile stocks or stocks with pending news may turn your winning idea into a losing trade. You will need to make sure there is no pending news or that your stock doesn’t have an extremely high Implied Volatility.

You can see that the BWB has a lot of variability and it isn’t something that works on every stock, ETF, or index – or on every time frame.

Andrew Falde

SMBU

No Relevant Positions. Options Risk Disclaimer.