May and June Bearish Butterfly Strategies – 06.19.12 from SMB on Vimeo. SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world … Read More

One day on the street with a professional trader

In the article Book Takes a Look Inside Professional Day Traders, national columnist Joel Stein is spotted $100,000 to try his hand at professional intraday trading for one day. Matt Nadell, @tradecrushers, a guest blogger at SMBU Blog, in Chicago gives Joel a taste of the nerve-wrecking excitement that trading can offer while teaching him basics along the way. Highlights: … Read More

Introducing a new blogger: Greg Loehr

SMB is proud to announce the addition of an experienced options trader and educator to our blog, Greg Loehr, of Optionsbuzz.com. Greg has served both as a market maker on the floor of the CBOE as well as a proprietary trader for various firms prior to his founding Optionsbuzz.com. Greg has also been a repeat guest on SMB’s Options … Read More

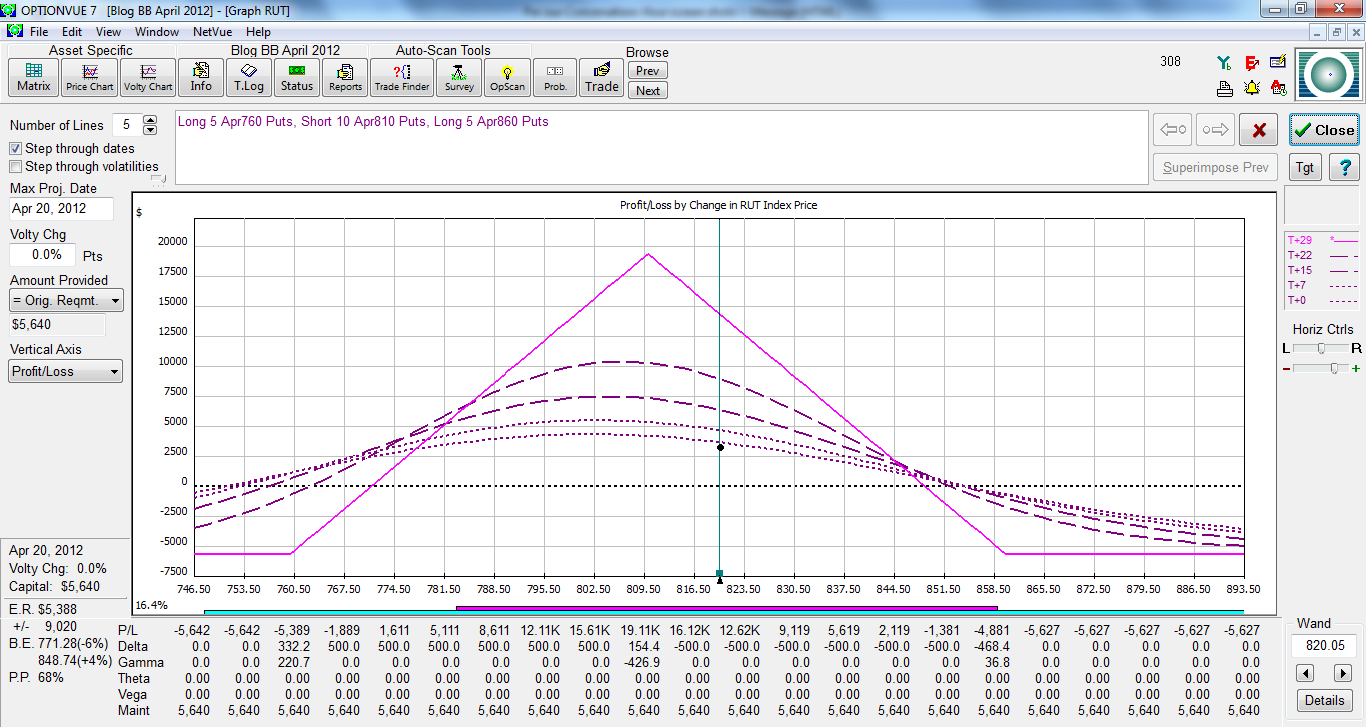

The April Bearish Butterfly Trade

This post is the first in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the April, 2012 expiration of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. On Friday, February 24, we initiated the April bearish butterfly trade … Read More

The March Bearish Butterfly Trade Update–A Strong Finish

This is the fouth and final post in a series that we published over the previous weeks, tracking the hypothetical performance of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. As of our last writing, the $RUT index closed at 823 and the trade was down 4.5% … Read More

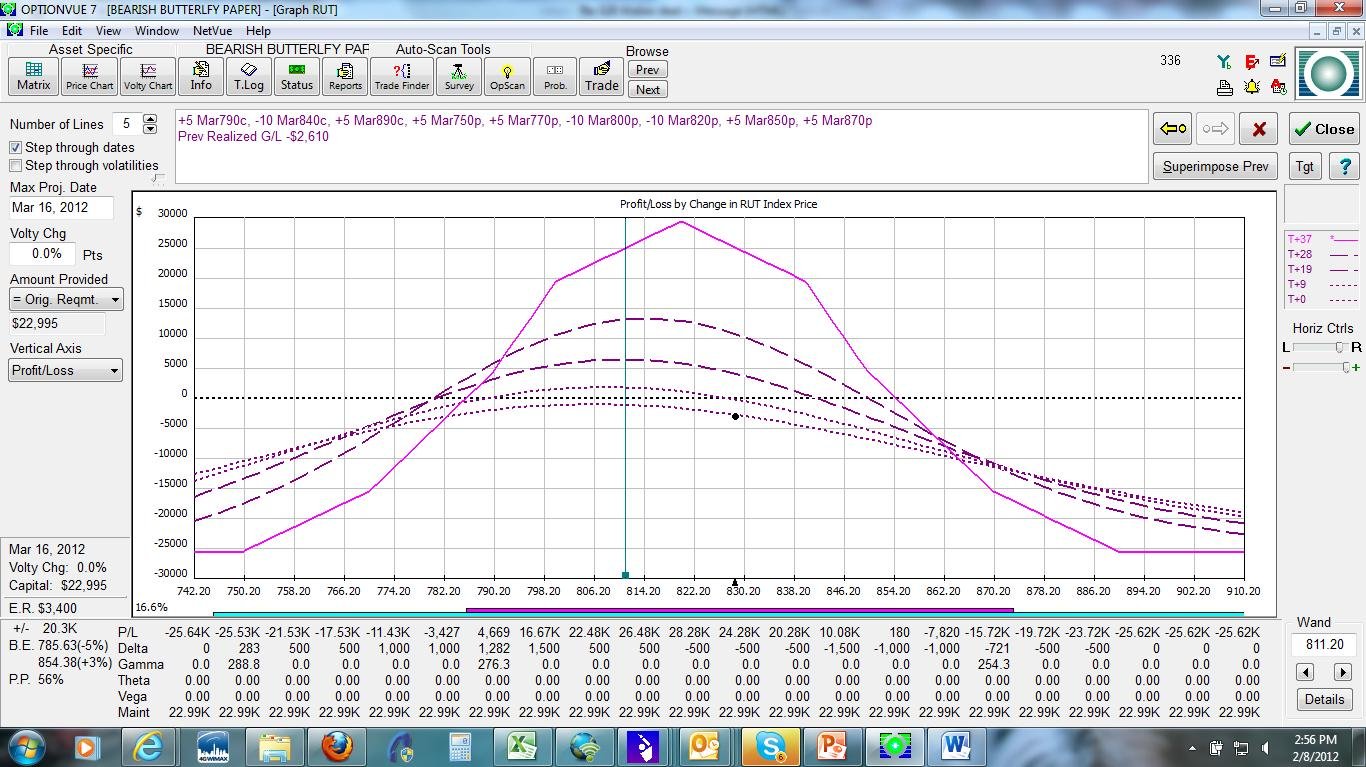

The March Bearish Butterfly Trade Update–Time is our friend as the $RUT stalls out

This post is the third in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. As of our last writing , the $RUT index closed at 828 and the trade was … Read More

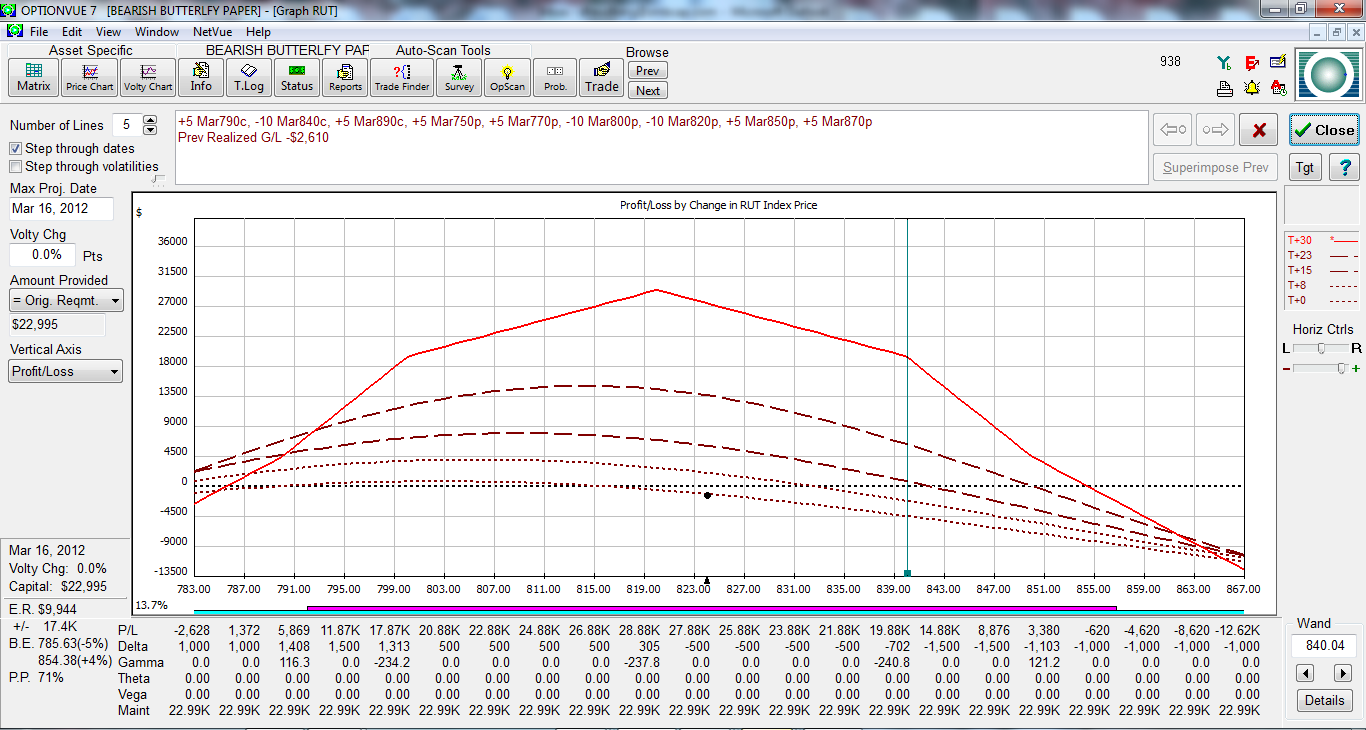

The March Bearish Butterfly–the wheels of the $RUT grinds slowly upwards

This post is the second in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. In the law there is an expression, “the wheels of justice grind slowly”. To bearish butterfly … Read More

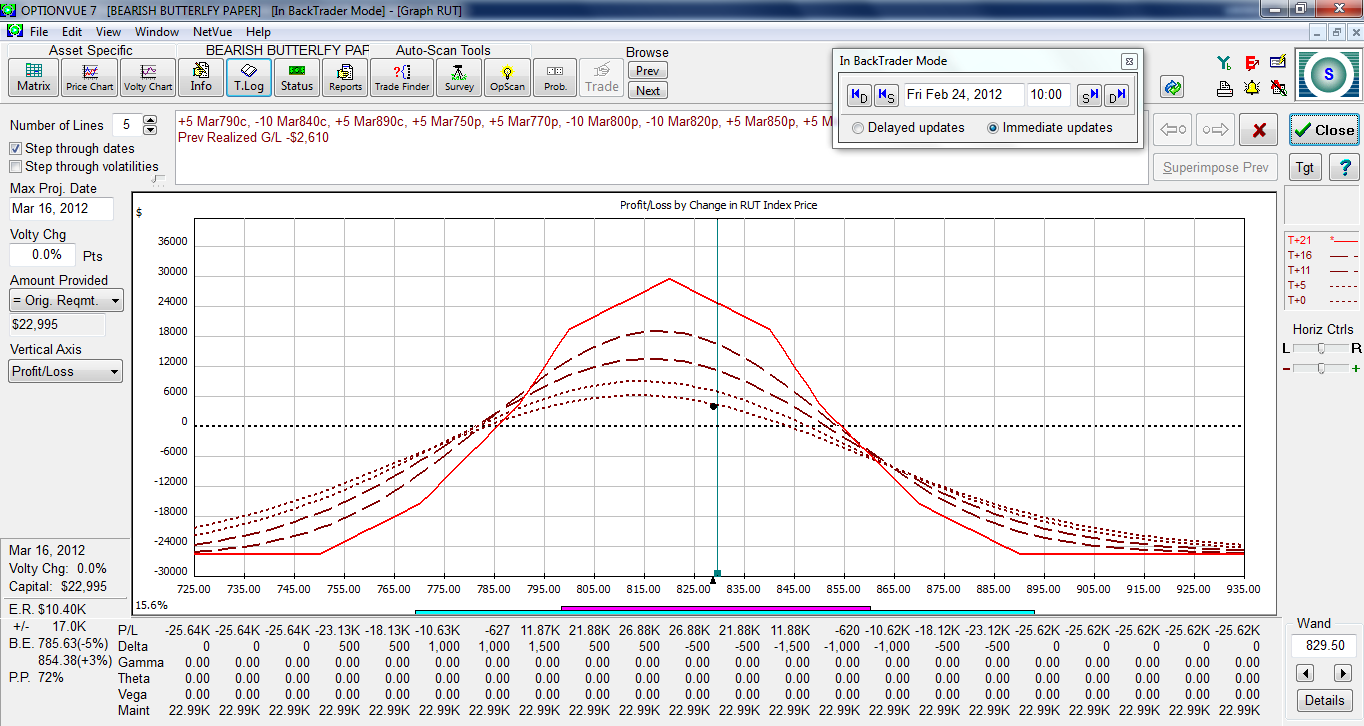

The March Bearish Butterfly Trade

This post is the first in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. On Friday, we initiated the March bearish butterfly trade in the $RUT. If this was an … Read More