This is the fouth and final post in a series that we published over the previous weeks, tracking the hypothetical performance of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series.

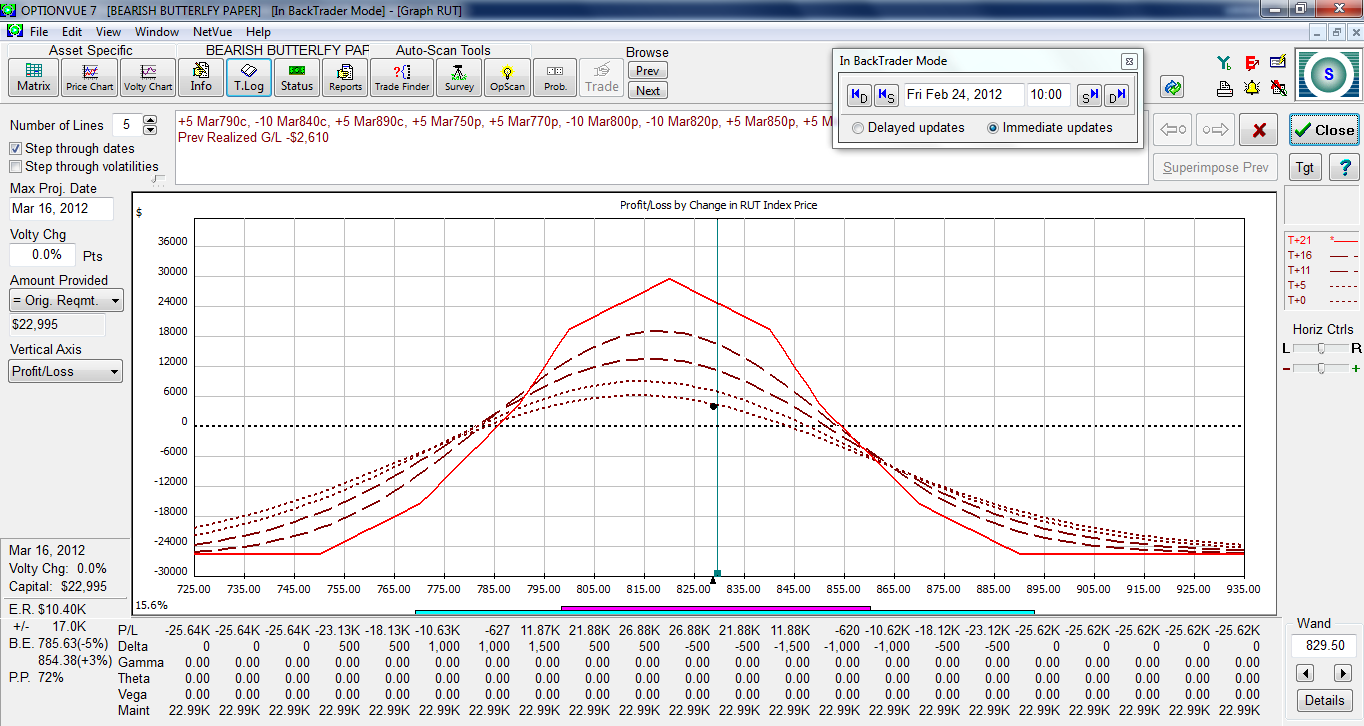

As of our last writing, the $RUT index closed at 823 and the trade was down 4.5% on planned capital with 29 days before expiration. The $RUT continued to be rangebound since our last writing, trading in the range of 815 and 830. No adjustments were necessary. The passage of time would have turned the hypothetical trade profitable and would have helped the position immensely. The $RUT had been losing its upward momentum which was very helpful at this stage. According to our guidelines, this hypothetical trade would be closed on Friday, February 24th, as we reached our target profit at that point. The $RUT was trading at 827 and the hypothetical position was up 17% on planned capital. The risk graph before the exit looked like this:

Although this type of trade works best in sell-offs, this type of trade would have worked out well in an unfavorable uptrending market. As we said in the past the Bearish Butterfly Strategy can win in most market scenarios if executed with discipline.

John Locke

Locke In Your Success, LLC

Please note: Hypothetical computer simulated performance results are believed to be accurately presented. However, they are not guaranteed as to accuracy or completeness and are subject to change without any notice. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Since, also, the trades have not actually been executed; the results may have been under or over compensated for the impact, if any, of certain market factors such as liquidity, slippage and commissions. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any portfolio will, or is likely to achieve profits or losses similar to those shown. All investments and trades carry risks.

No Relevant Positions.