Accuracy is simply defined as the percentage of trades that end profitably. It is the final of our seven steps to systems success. To phrase it better, accuracy is the last thing we look at in building a system. Accuracy—almost without fail—is the first question asked about a system. However, it has the least impact on the success of a system. … Read More

Duration: The Sixth Step to Systems Success

Number six in our seven steps is Duration. Duration represents the expected length of time in winning trades, losing trades, and all trades. Almost without exception we find that trend- and momentum-oriented signals have a shorter duration for losing signals and a longer duration for winning signals. The reverse is true for mean-reversion trades. Knowing your expected duration is important … Read More

The Fifth Step to Systems Success: Frequency

Our fifth of seven steps for building, testing, and following a system is to understand the frequency of the system. Higher frequency increases profit potential, but it also reduces reliability. The two primary downsides of higher frequency are 1) transaction costs and 2) execution assumptions. In back testing you can assume buying every bid and selling every offer. But this … Read More

Step Four of Systems Success: Volatility

Is volatility good or bad? Let’s look at it from the perspective of run ups—potential gains, and drawdowns—potential losses. And let’s not forget real gains and real losses. Never take your eye off the ball on what we are trying to do, which is to build a trading system that is statistically reliable so that over hundreds, or even thousands of … Read More

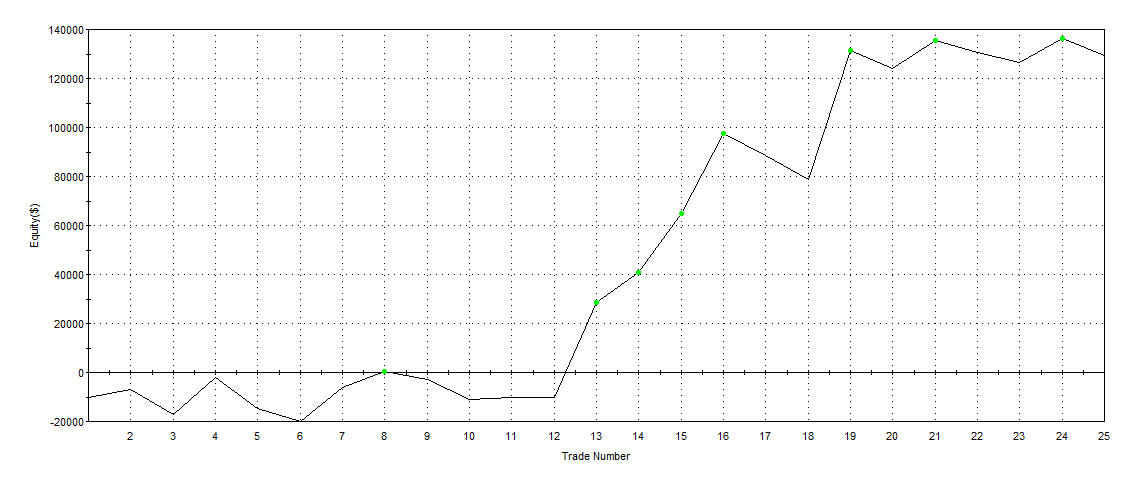

The Third Step to Systems Success

Previously, we covered Risk and Return as the first two things we look at when building a system. The third thing we want to review is called Expectancy. The idea behind expectancy is to focus on the big picture and long-term results of your system — and not just the next trade. Insurance companies and casinos base their entire enterprise around this … Read More

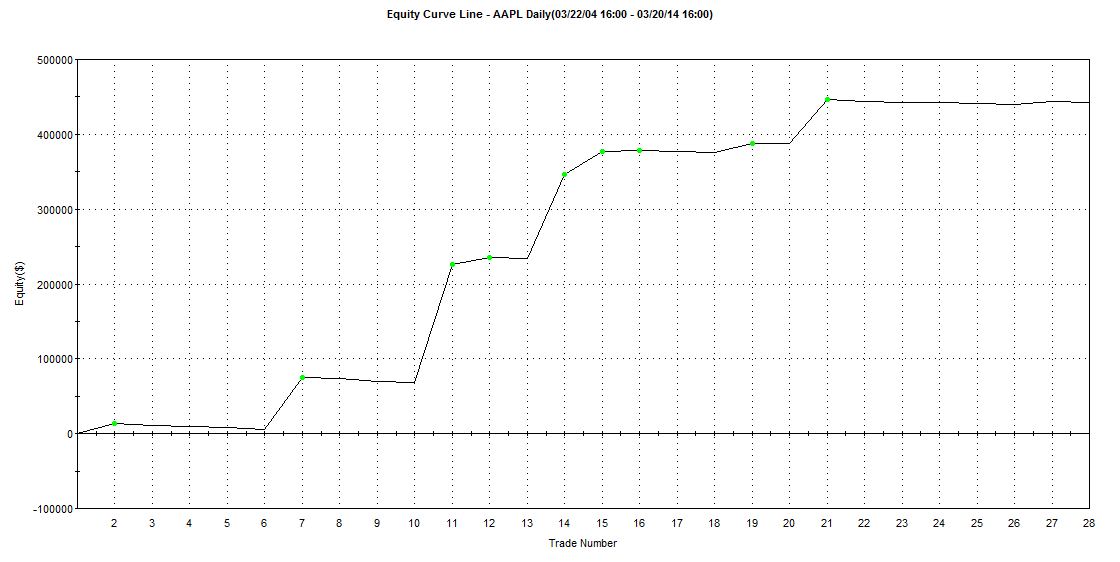

The Second Step to Systems Success

Last time we talked about Risk, which is the first and most important aspect of a trading system. We discussed how limiting risk can create higher absolute returns because of reinvestment, raising capital, and using leverage. Now we can talk about our second focus: Returns. There are three types of returns that we need to understand. First is the back tested returns. … Read More

The First Step to Systems Success

Risk. This is the first and most important metric for a systems trader to track and improve. When learning about a system or strategy, most people first ask about the returns. Imagine you had one program that generated 21% per year on average and second was doing 35%. For some, the analysis is over because they just want higher returns. … Read More

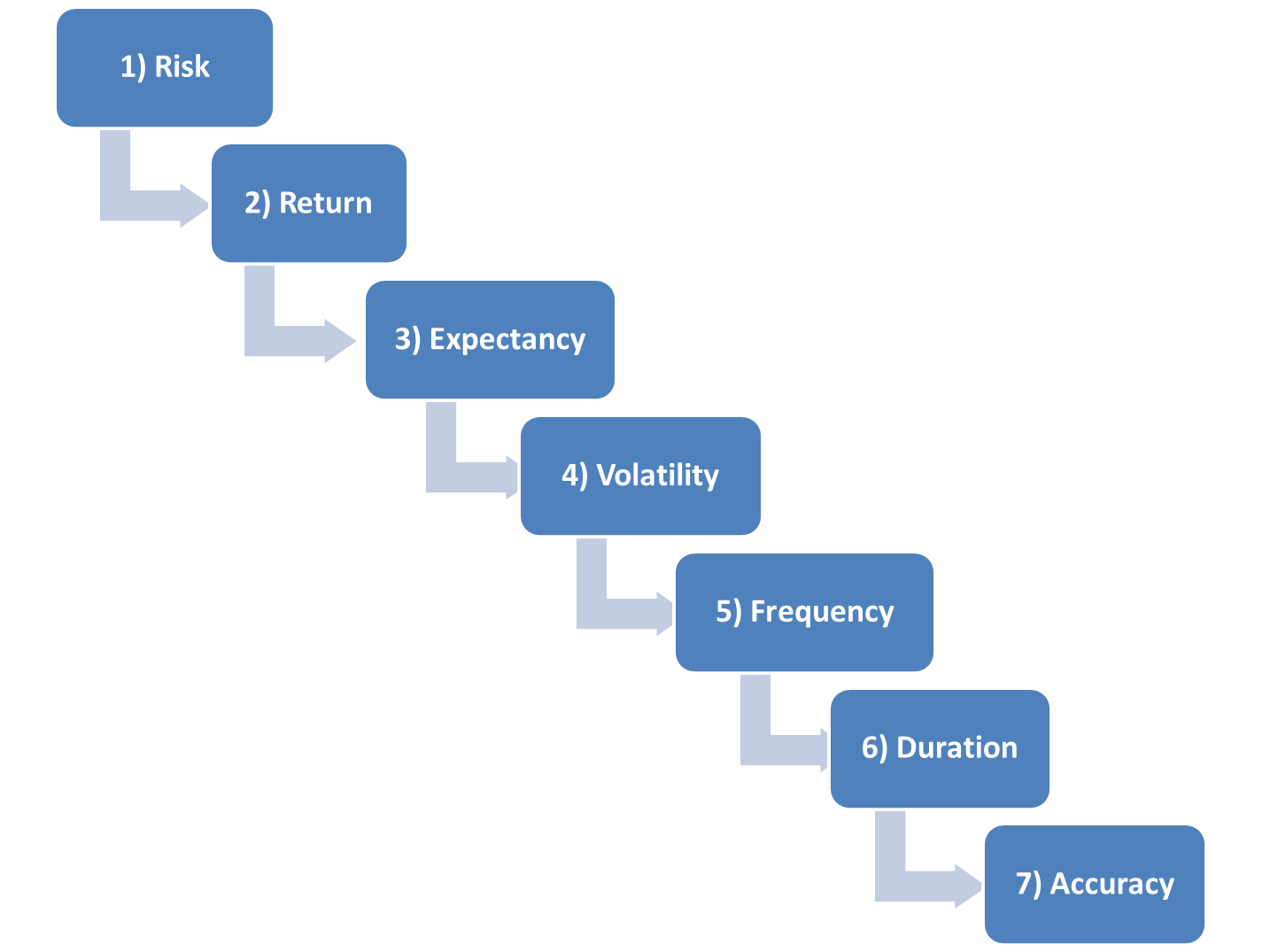

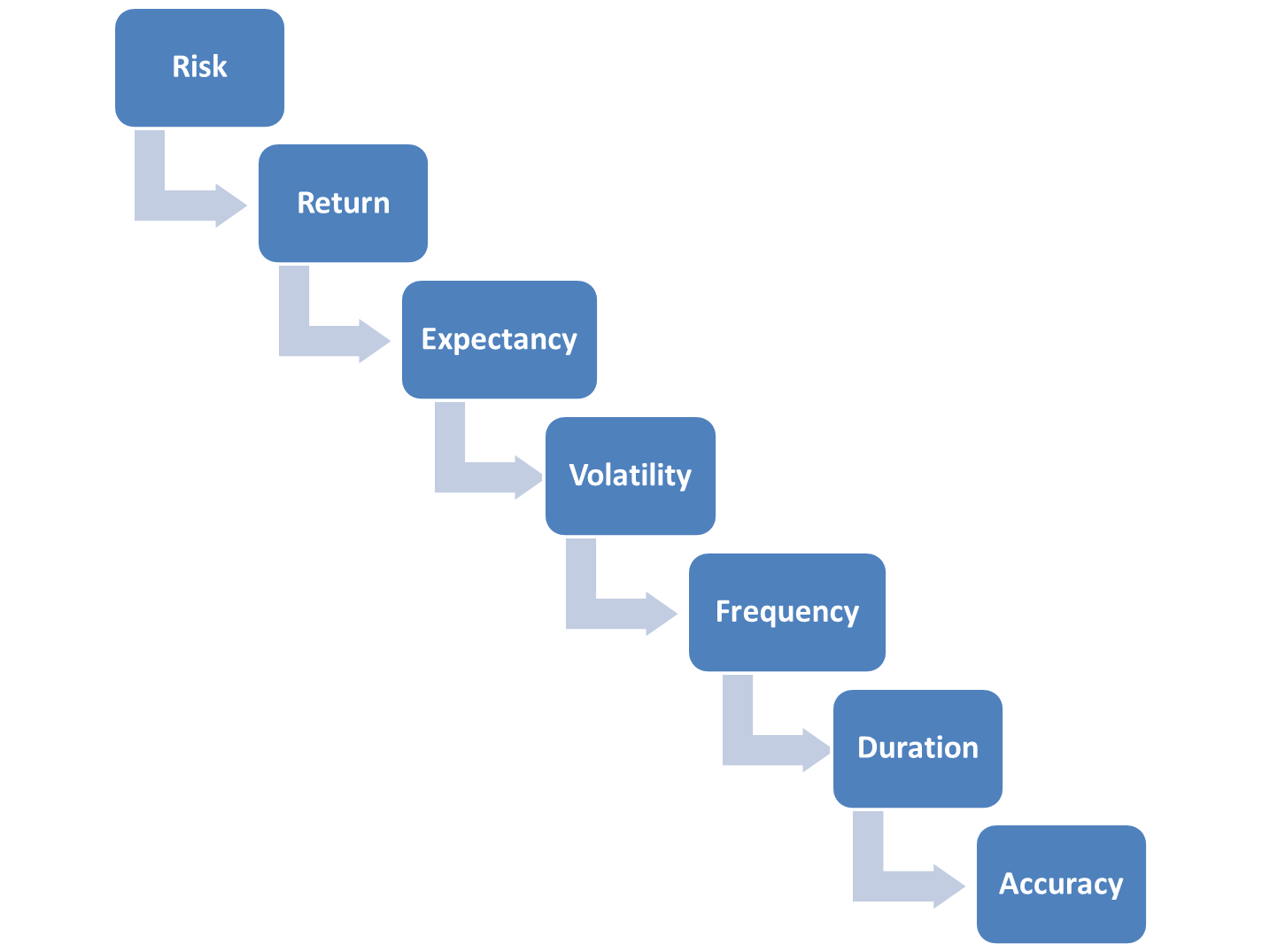

Seven Steps to Systems Success

Most platforms that run automated back testing and trading systems have extensive reporting capabilities to analyze performance. In these reports the software developers have included seemingly every possible statistical metric they could find. Reading these line by line quickly becomes information overload and can often leave the systems developer with more questions than answers. So we have narrowed down the … Read More