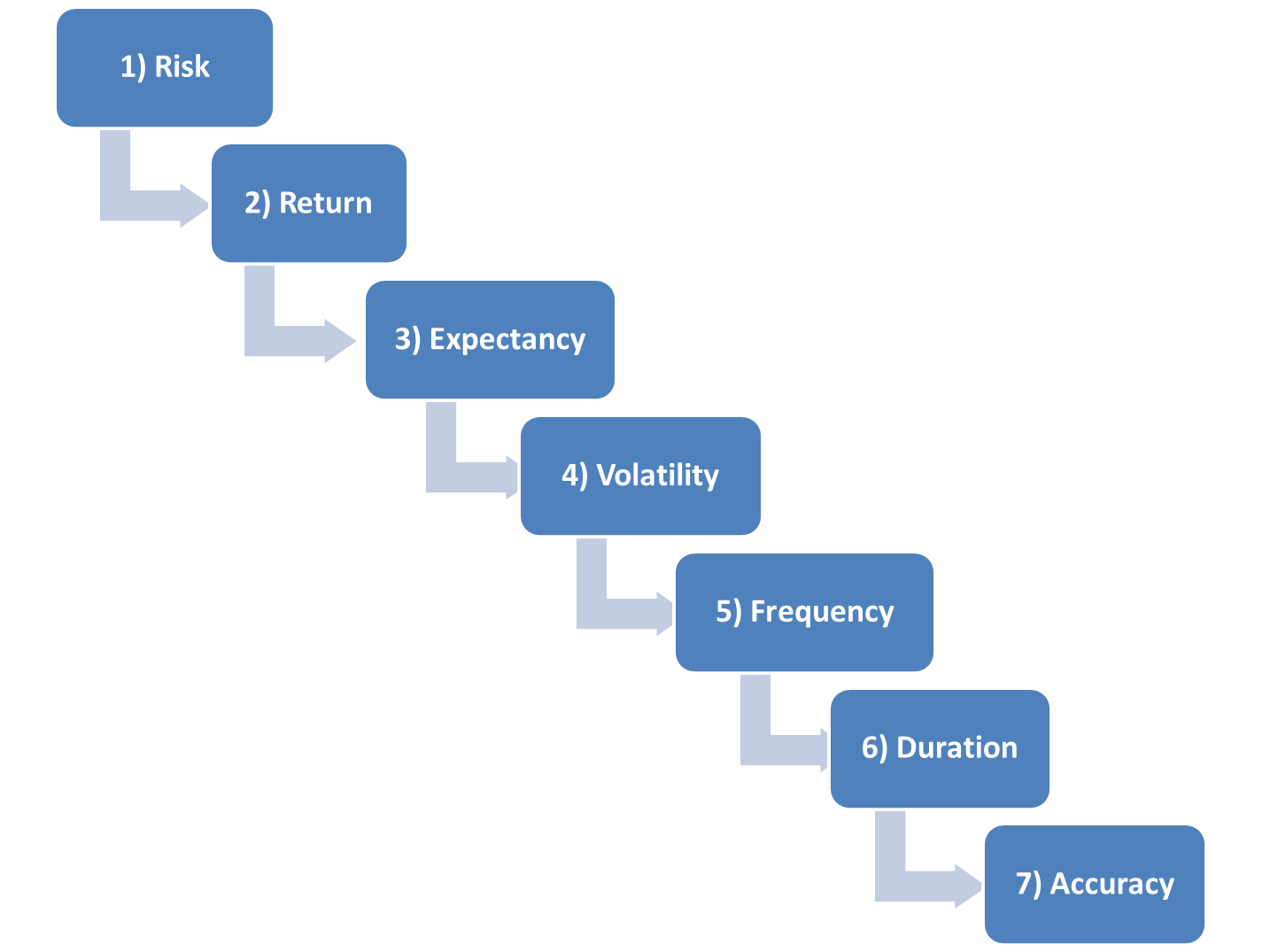

Previously, we covered Risk and Return as the first two things we look at when building a system. The third thing we want to review is called Expectancy.

The idea behind expectancy is to focus on the big picture and long-term results of your system — and not just the next trade. Insurance companies and casinos base their entire enterprise around this idea—and so can you.

The formula for expectancy is:

Expectancy = (Probability of Win x Average Win) – (Probability of Loss x Average Loss)

For example, if you had a system that averaged $500 winners and $100 losses and your win-loss ratio is 30:70 then your expectancy is:

(30% x $500 = $150) – (70% x -$100 = -$70) = $80 positive expectancy.

Expectancy is not what you should expect to make on the next trade. In fact, very few trades will actually fall right on the expectancy level. Rather, it is what you should expect to see on average over the course of hundreds, even thousands of trades.

If your historical expectancy is not lining up with your forward test or live average trade results, then you know your system is not performing in line with history. This could be a factor of changing market conditions or that your information was not statistically robust (we’ll talk about that in the future).

We like to know our expectancy ahead of time using back tests; then we monitor simulation accounts for a few weeks. Ultimately we want to see the same results in the real world. This careful monitoring helps us build confidence and add size to strategies that have proven to be statistically relevant.

Andrew Falde

No relevant positions