In our SMBU Daily Video, learn more about conditional orders.

In this video from Andrew Falde, you will learn:

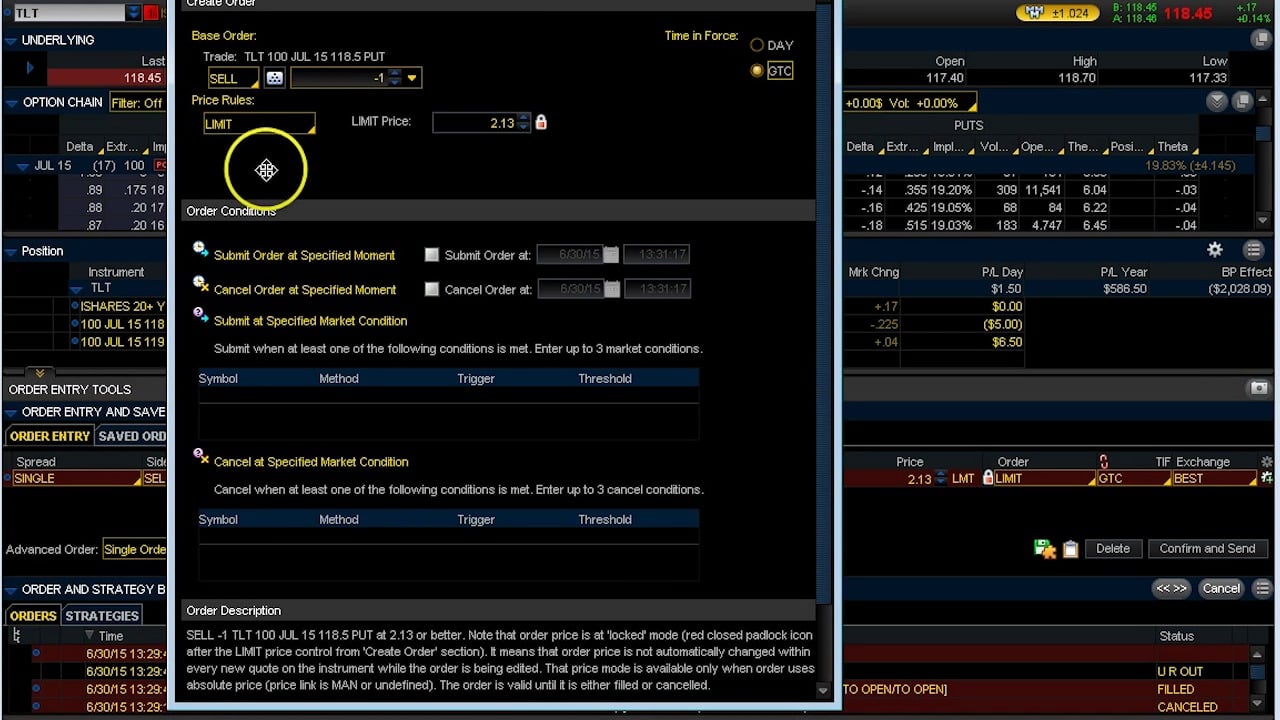

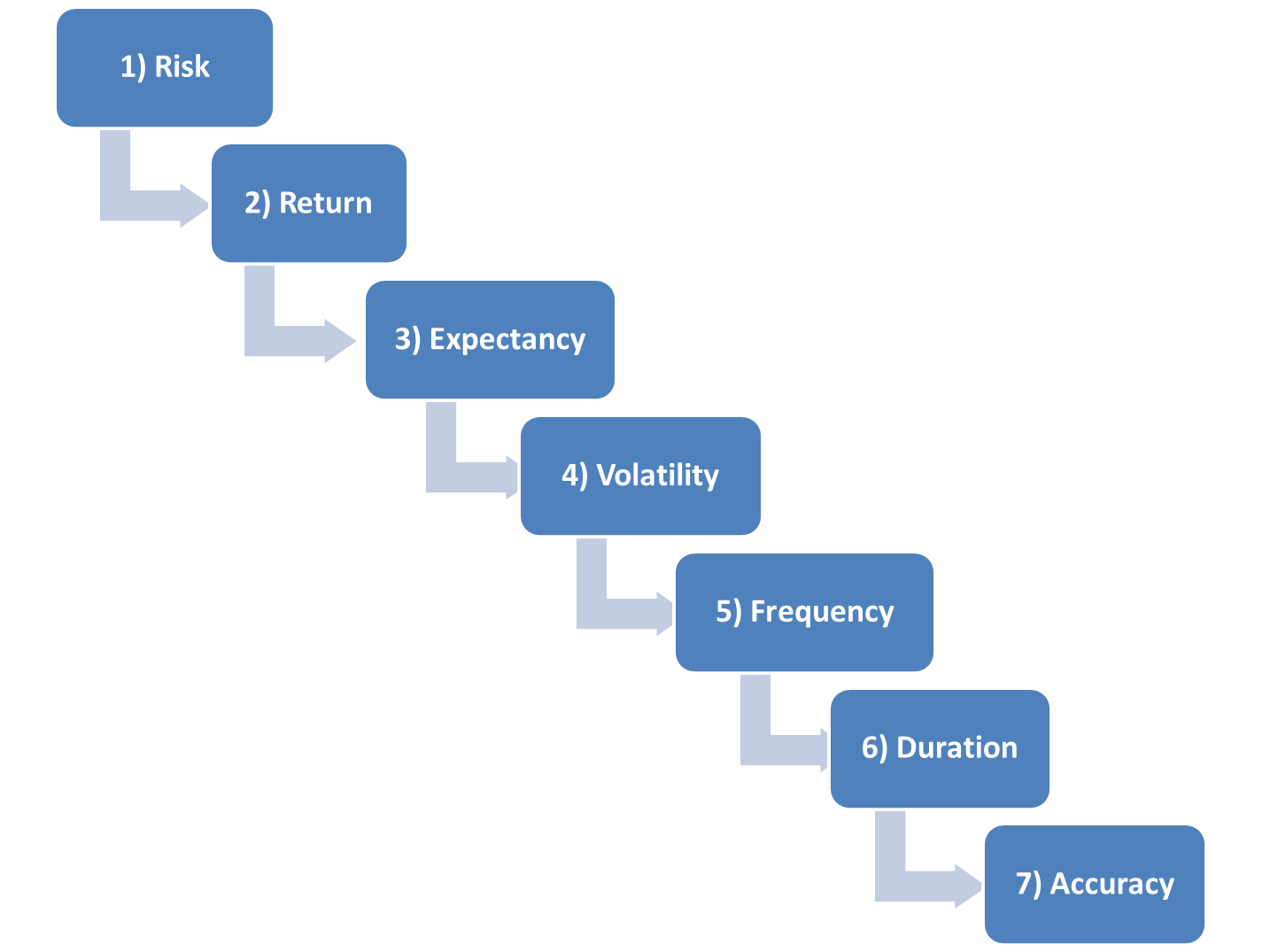

How to set up conditional orders to control your risk when you aren’t at your screen

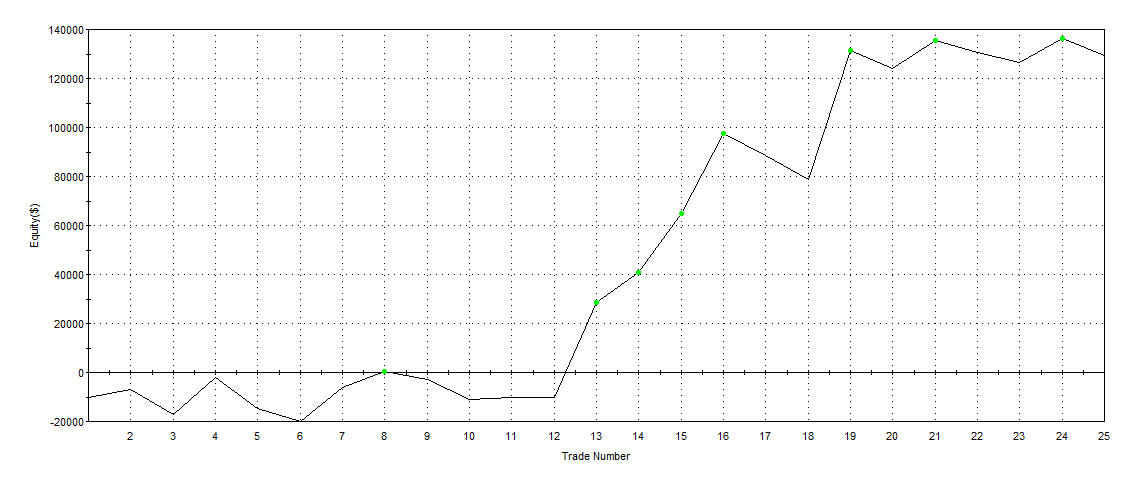

How to plan your trades for different scenarios and automate for each

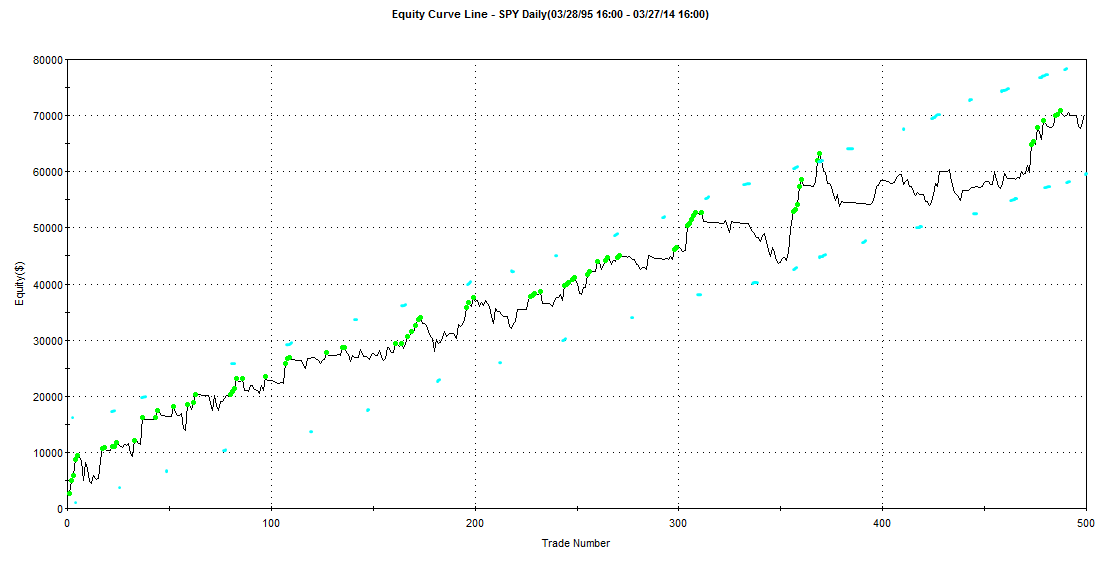

Learn what qualities to look for in a stock, ETF, or Index that make sense for conditional order placement

We hope this video improves your trading.

SMBU Team