So you’ve developed or learned about a great strategy. You back tested it, tweaked the rules, and re-tested. Maybe the results are looking great – now what? All the information that you have is history. Is it reliable and repeatable in the real world? Here are few things that I do before running a strategy live. 1) Make sure the strategy works in … Read More

Finding Strong Trends

This video shows a way to look at the broad markets and sectors on multiple time frames; then drill down to individual stocks in strong trends. Andrew Falde [email protected] No relevant positions.

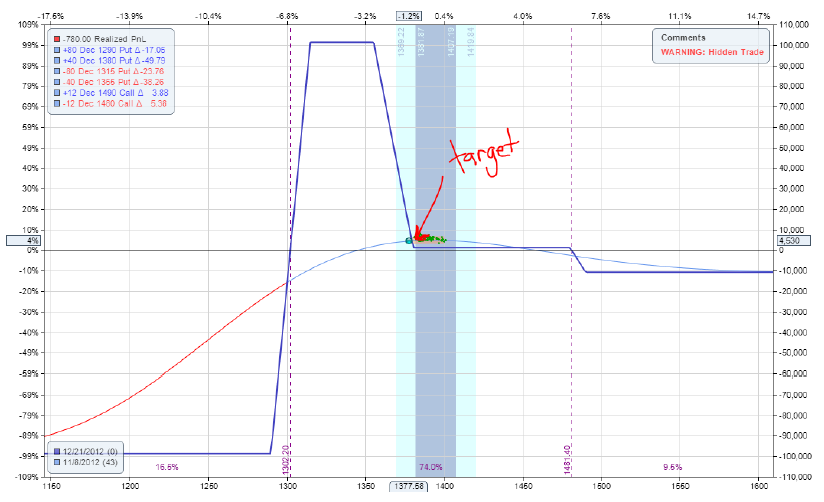

SPX Ratio Spread: 3 Year Back Test

I recently completed a third year of back testing the SPX Ratio Spread on the SPY Detector signals. Without any changes to the rules or the signals, 2012 had remarkably similar results to the previous two years which were much more volatile. Here is some documentation for this back test: PDF Overview: SPX Ratio Spread Back Testing Results – Part 2 … Read More

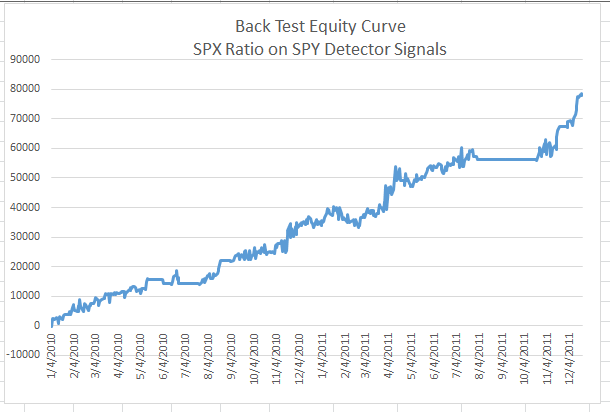

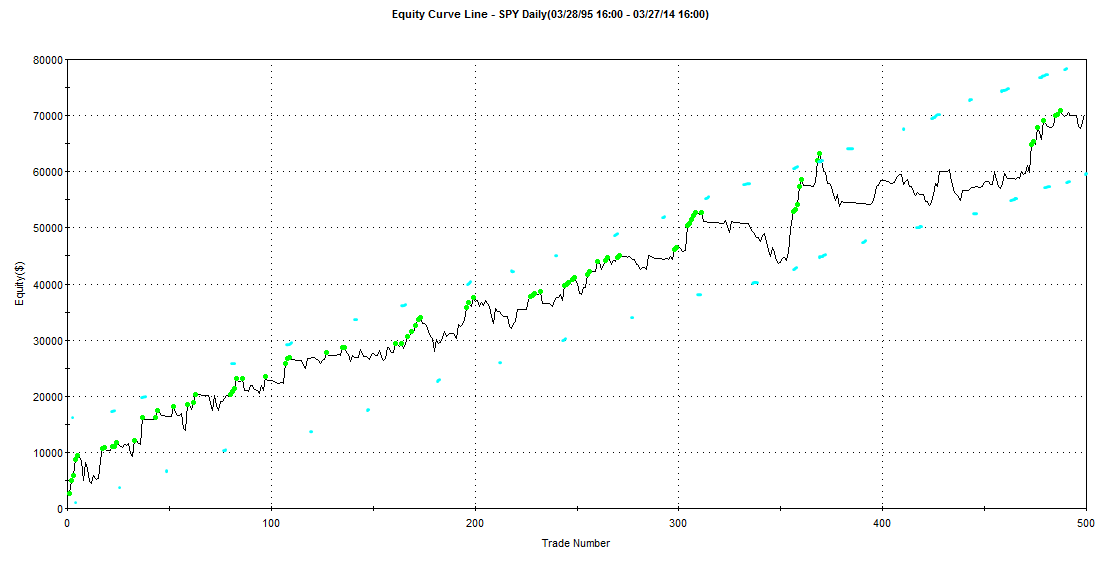

Options Back Testing Report

(Please note the following is based on hypothetical trades using historic data.) The SPY Detector signal has a 20 year history of successfully navigating the underlying price change of the S&P 500. The signal is made up of 5 sub-systems that follow trend and momentum using proprietary indicators. Each of the 5 underlying systems makes up 20% of the total … Read More

Transactions Costs and Slippage

When running algorithmic back tests, it’s important to always include reasonable transaction costs and slippage assumptions. Here’s a quick example of how a seemingly great strategy can fall apart quickly when you leave these two critical factors out of the study. This is a simple range bound strategy for SPY that is setup to trade during the typically quiet mid-day … Read More

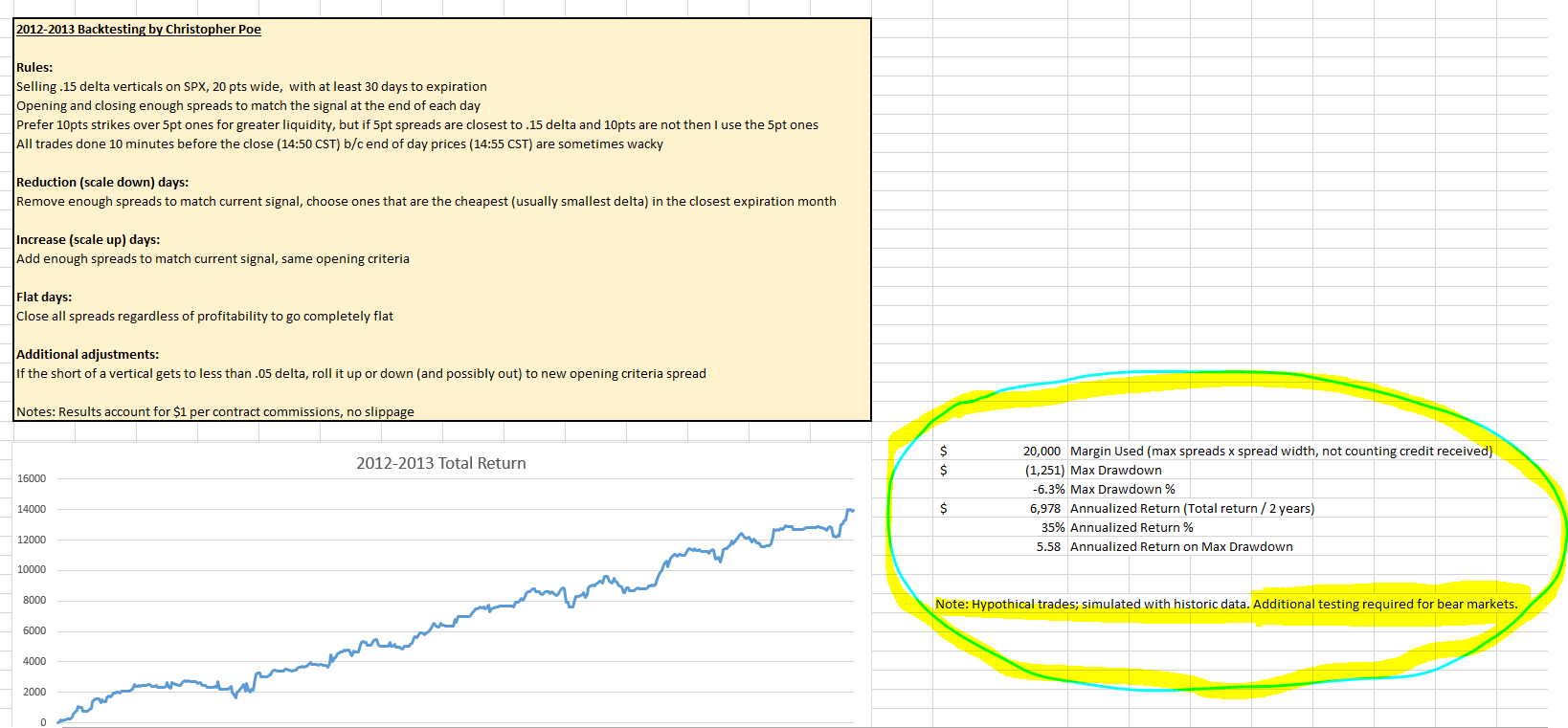

Back Testing an Options Strategy

Note: The following contains hypothetical results; simulated using historic data. As mentioned at a recent SMB Options Tribe meeting; a group of options traders are now working to back test a proprietary momentum signal using a variety of options trades. Several tests have come back with varying results… but we are seeing a common thread for options trades that show low … Read More

Free Signal for SPX

This coming Tuesday — April 8th — I’m going to speak to members of the SMB Options Tribe about the importance of having a pre-determined reason to reduce or remove risk from positive theta positions. In the heat of the moment, its hard to concentrate and make objective decisions. Having 50 years of market statistics behind your decision process makes … Read More

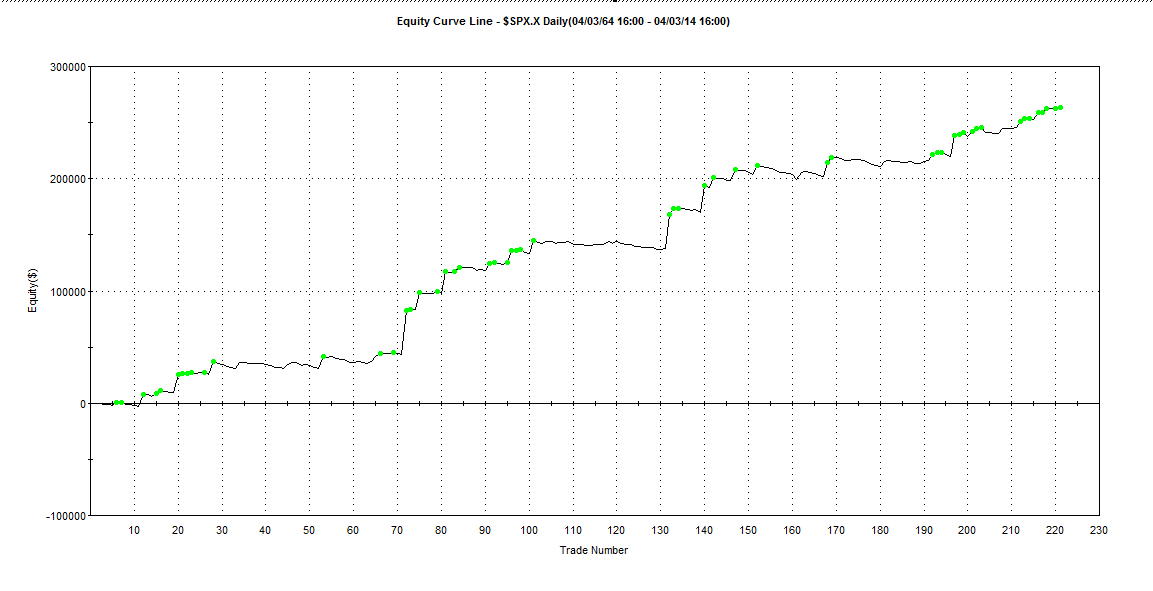

Volatility-Based Sizing

In running back tests, it’s important to understand the impact of volatility and position size. A consistent position size in number of shares or dollar amount can greatly skew historic results. If optimizing, this may lead to curve-fitting the system to periods of high volatility. Here are some examples of the impact of fixed-position sizing vs volatility-based sizing: The first … Read More