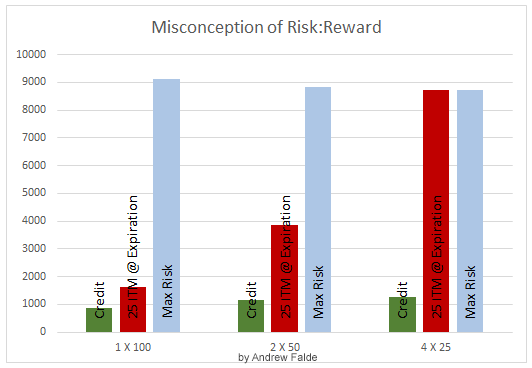

When analyzing a vertical based credit spread, including iron condors and butterflies, the first question that usually comes up is where to place the short strike. In a distant second usually comes the question of where to place the long strike, that is how wide the spread will be. This leaves some analysis to be done on using more contracts … Read More

Turn Your Ideas Into Statistics

The trading world is littered with anecdotal evidence of cause and effect from various technical indicators and signals. I cringe when I hear something like the following: “As you can see, last time the 19-week moving average crossed the 52-week moving average, this stock moved 18.5%.” This statement has absolutely nothing to do with anything. It’s an observation of a … Read More

Avoid This Back Testing Pitfall

This video takes a quick look at a strategy that appears to have a smooth performance in a back test but wouldn’t perform the same way in the real world. Rick and I will be filming a live course in February to introduce the tools that we use to find strategies that are working. If you would like to receive … Read More

Stop Predicting

New traders are trained by the financial media to believe that accurately predicting the market is the only way to gain an edge. Meanwhile professional traders and prop firms around the world successfully navigate the market without forward-looking analysis. Here are three over-simplified components to a portfolio strategy that do not require predictive trading: 1) Buy (long) instruments that are … Read More

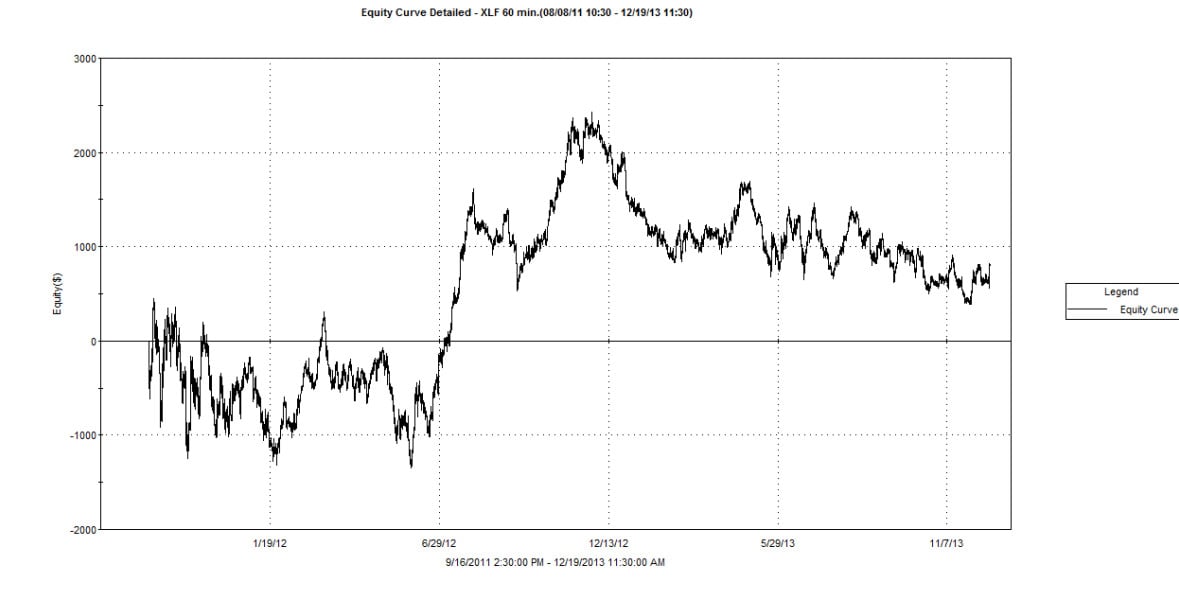

All Hedging is Not Created Equal

In this post I will show you a strategy that can be long and short financials at the same time and end profitably. The concept is based on pairing instruments that have different natures. The nature of leveraged instruments is to increase the impact of one-way movements. The nature of unlevered broad-based indexes/funds tends to have more reversion and overlapping … Read More

What is Your Idea of Back Testing? Part II

Yesterday we looked at some examples of how a trader could use a handful of recent examples to make trading decisions. The hypothetical scenario played out quite terribly. Although fictional, it’s a thought process that I see happen each day by traders around the world. Here is an alternative way to consider strategy and statistical trading when trading something like … Read More

What is Your Idea of Back Testing?

Trade decisions are often based on what a trader observes on the chart. The thought process often starts with something like this: “The last time this happened ABC moved 5%” “Last year at this time the market stayed in a 2% range” “If I had bought the last three breakouts, then I would be up $5k right now!” “The MACD … Read More

Using LRC to Create and Hedge Positions in Multiple Markets

The LRC Channel has a twofold purpose. First, you can use it to leg into index credit spreads with higher statistical probability of success. Second, you can use the direction of the LRC (linear regression curve) to trade the trends in individual stocks. Here is a recent example: The center line on $C (Citigroup Inc) indicated a long trend direction … Read More