Earlier this week Mike Bellafiore asked me to participate in a 30 Days/30 Habits webinar. The idea behind the webinar was to share the best practices that lead to habit formation for the top performers from our trading desk. In true Bella fashion he invited me to co-present with him a few hours before the webinar was scheduled to begin! The two habits I discussed were a pre-market AM Meeting and sharing with your own trading community. As part of the discussion of an AM Meeting I implored our attendees to identify each day if a particular setup stood out among the stocks they planned to trade. One of the hardest things to do as a trader is correctly allocate your finite mental capital.

Each day many traders identify 4-5 “good” potential setups and have a list of other stocks to “monitor”. But all trades are not created equal. Some setups offer clearer catalysts than others. And some stocks are setup technically such that risk is well defined and limited and upside is significant. I asked the traders in our webinar to rank each idea from their AM prep if it was their “best” idea. I also acknowledged some days nothing would stand out and that was fine as well. I follow this in my own process and it has been very helpful recently. The market Open is the busiest time of the trading day with tons of action and the chance to be easily distracted. If one of your morning ideas truly stands out then make sure your full attention is on it during the first 30 minutes (technology can be used to track and execute on other setups as well).

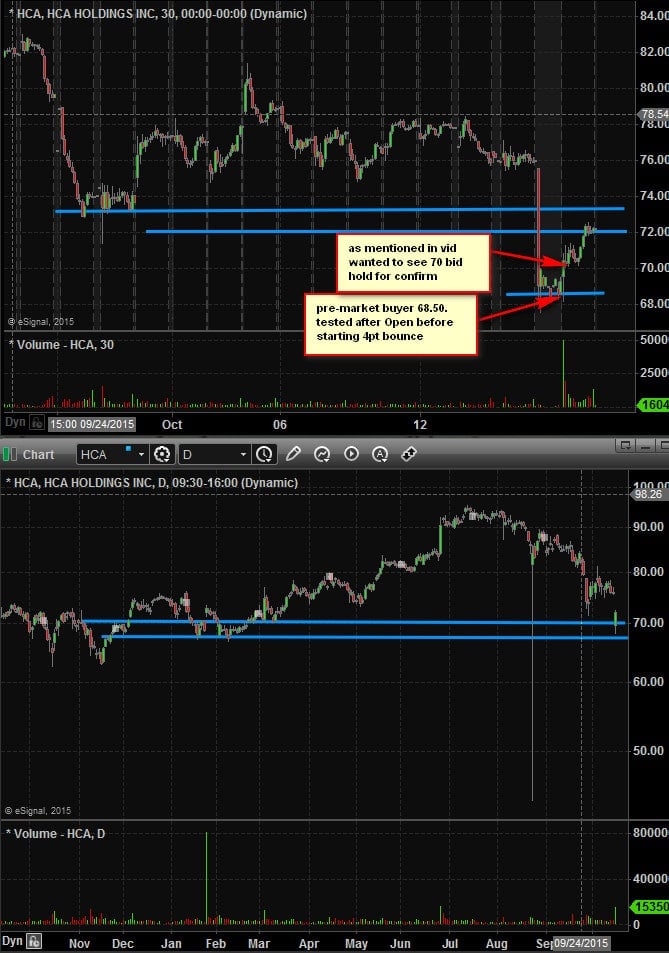

During our AM Meeting I usually lay out different long and short scenarios that could unfold based on how a stock behaves at key levels. This is the most common behavior of In Play stocks that provide both long and short setups . But occasionally the odds largely favor one directional bias over the other and in that case I will more strong advocate focusing on that direction as I did in HCA today. Here is how things played out.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, and options. He has traded professionally for 19 years. His email address is: [email protected].

Steven Spencer is currently long HCA