This morning I got to the office a bit tired and not in the greatest of moods. I am not a big fan of bitter cold temperatures as my hands and feet tend to stay cold once they get that way! So the past couple of days let’s just say I haven’t been as quick on the key board as I normally am. I arrived at the office about 15 minutes late after dealing with some typical NYC subway delays. As I sat down at my trading station the first thing that was said to me was “TWTR got another downgrade”. I was long some overnight. Next thing I saw on my screen was “JC Penney sells off despite management confidence in holiday sales.” I was long some overnight. None of my other positions were up or down much overnight.

I began to prepare for the SMB AM Meeting which was set to begin in less than 30 minutes. There were actually quite a few stocks moving in the pre-market including MU which had reported excellent earnings. I forgot to mention that I had bought MU yesterday in the after hours as a swing position, but accidentally sold the entire position while I was on a conference call and not completely focused on my trading platform. The position would have negated about 50% of the negative PnL mark from JCP and TWTR, so that key stroke error didn’t do wonders for my mood either.

Any experienced trader will tell you that how you begin the day from a PnL standpoint can impact your decision making process. If you start down a significant amount of money you can be “gun shy” so as not to dig yourself into a deeper hole. If you start up money you may use that PnL to try to press your advantage in the market. I was faced with not an insignificant hole to dig out of and the question I would need to answer was how would I respond.

In the AM Meeting we discussed FRX, TSLA, TWTR, JCP as stocks with fresh news. Other stocks on my radar were FEYE, AAPL, APOL, ADBE, P, NFLX and BBRY.

As the market opened I was watching TWTR closely for a bounce from 59 as this is the level where it started its march back to 70 at the end of December. I didn’t have a good feeling about history possibly repeating itself. A price alert was triggered at 49.30 in TSLA and I punched it up. As it lifted 49.50 I paid the offer and was immediately rewarded with a 2 point pop.

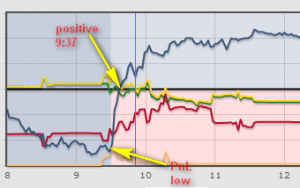

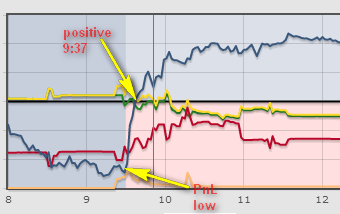

I opened short positions in FRX, BBRY, and APOL all of which immediately began to trade in my favor. By 9:37 I was positive and trending on a strong upward trajectory. I had been the opposite of gun shy, taking every trade setup that triggered, and was rewarded for my persistence. (I had no idea of my PnL at the time but I can look at our software later to see exactly where I stood at any point in time during the day).

By 9:37 I was positive and trending on a strong upward trajectory. I had been the opposite of gun shy, taking every trade setup that triggered, and was rewarded for my persistence. (I had no idea of my PnL at the time but I can look at our software later to see exactly where I stood at any point in time during the day).

In addition to all of the fresh positions I initiated there were several other overnights that began to move and needed to be managed. The first 15 minutes of trading today was action packed and probably bodes well for earnings season that is just around the corner.

By the time I was able to poke my head up for air I had liquidated most of the fresh positions outlined in the charts below and started to scan SMB Radar for other opportunities. The day overall turned out to be fairly slow including after the FED minutes were released. I joked on the desk that I was initiating a SPY position partly out of boredom. It turned out my initial long in SPY was stopped out but I did get back in at the LOD at 183 and am swinging some for a possible breakout tomorrow and the start of the first up leg of 2014.

Please feel free to ask questions in the comments section on any of the trades in this post as I will be creating several “2 Minute Trade Review” videos and am happy to cover the stocks you are most interested in.

Steven Spencer is currently long MU, ADBE, P, JCP, CROX, F, RH, AAPL, SPY and short BBRY

5 Comments on “Trading Education: Days Like These”

I really enjoy these “real life” posts that provide a kind of inside look at a particular trading day & the different details of trades (e.g. stop placement, trade management, etc.). My question is a little more specific yet broad; on days when you have so many names you’re watching along with their respective trading possibilities, do you find yourself pre-market or on the open just putting in bids and offers at certain prices that you’ve game planned as favorable (I assume that’s how you were able to get short MU & FRX practically @ the first ticks)? In doing so, how do you protect yourself if your bid/offer gets filled but the stock rips even further against your initial entry? How to you setup stops before your initial bid/offer is even filled? Or do you even do so?

I guess I’m just a little taken back by your ability to actively manage so many positions, but then again your experience does indeed eclipse mine 🙂

Thank you again for providing a consistent stream of some of the most helpful trading information around I’ve ever read. I’m an avid reader of the SMB blog & I don’t see that changing any time soon 🙂

Why’d you choose 26.10 on $GOGO for stop? Seems somewhat arbitrary. Yes, I see that it’s a dime above whole number. Yes. I agree that it seems sorta reasonable. Still lower than prev high, and candle high prior to prev high. Oops? maybe. Did you see something on tape? Or was it just force of habit?

Could you offer a few words on your interpretation of the first few transactions of an in-play stock upon market open? Jake, first poster, asks how you were able to get short on the first few ticks. I can understand $MU’s inability to hold the .50c mark. Your play on $FRX confounds me a bit. I see that it wasn’t able to regain pre-market highs. I can appreciate the pre-market patterns, and I would understand an explanation such as, “premarket couldn’t keep the price up.”

Hi and thanks, this was a great insight into thought and process. Showing the timeframe would be nice (although I can figure it out pretty easily) but the one thing that struck me is using both bar and candle charts. Is there a reason? Thanks, J.

Steve, thanks for your post. I have one question. What did you saw different? MU$ vs. TSLA$ It seems that both reach their premarket level. MU$ 24.5 and TSLA$149.50. And In MU$ you go short and TSLA$ you go Long.