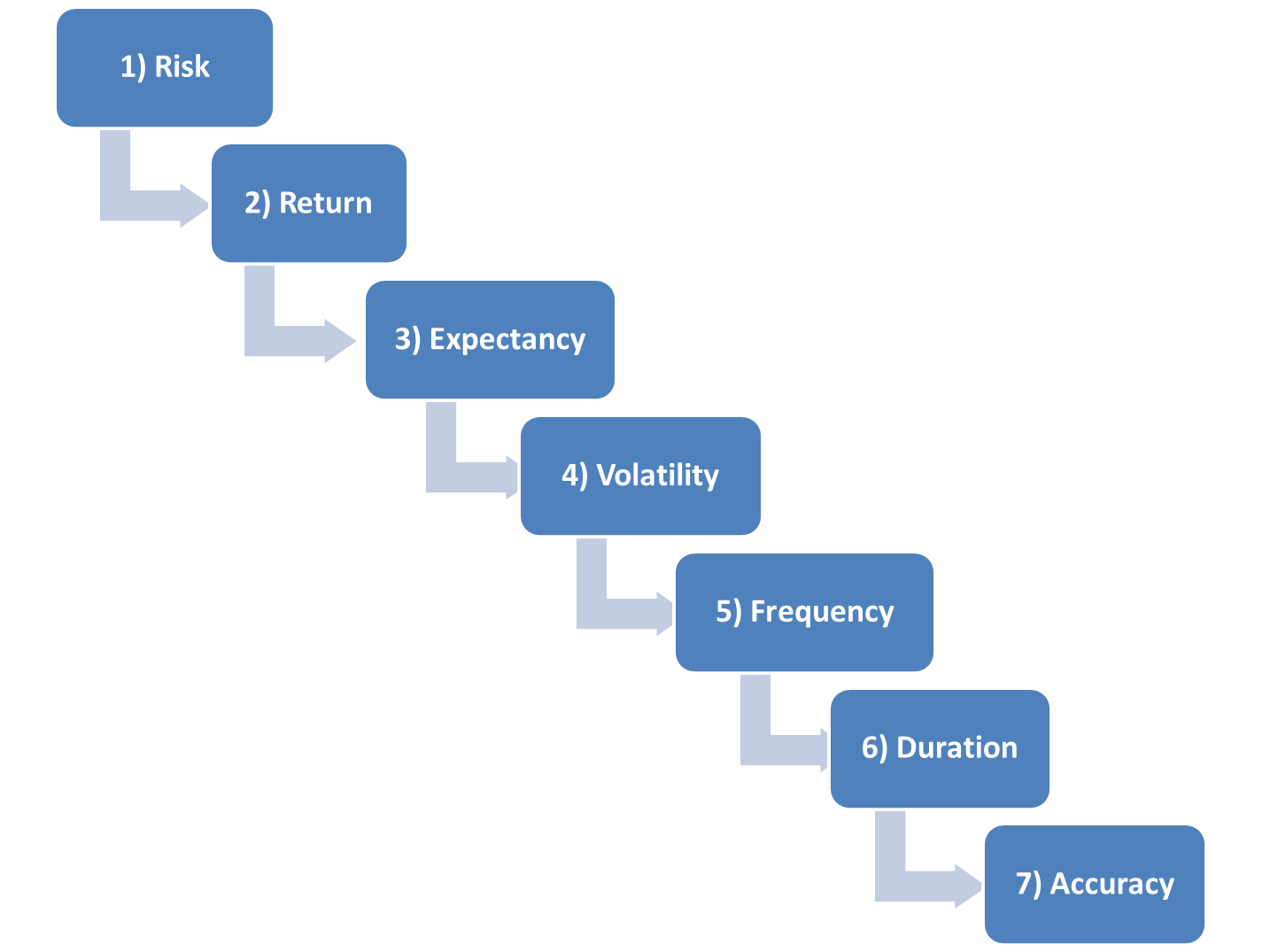

Our fifth of seven steps for building, testing, and following a system is to understand the frequency of the system. Higher frequency increases profit potential, but it also reduces reliability.

Our fifth of seven steps for building, testing, and following a system is to understand the frequency of the system. Higher frequency increases profit potential, but it also reduces reliability.

The two primary downsides of higher frequency are 1) transaction costs and 2) execution assumptions. In back testing you can assume buying every bid and selling every offer. But this just doesn’t happen in the real world. But to assume paying every spread may be too conservative. Experience and live forward testing are the only ways to know how well your assumptions match up with reality.

The two primary benefits of higher frequency are 1) profit potential and 2) day trading. Profit potential increases because you can accumulate your expectancy more often and reinvest the gains. If the frequency is high enough to generate several round turns per day, then you may have the ability to go flat at the end of each day. This allows you to eliminate gap risk which helps control draw downs in the strategy.

When using lower frequency (average holds of 5 to 20 days for example), then transaction costs and execution assumptions have little impact on the final results. Your potential profitability will decrease and you have overnight gap risk, but the reliability of future performance greatly increases.

Andrew Falde

No relevant positions.