So you’ve developed or learned about a great strategy. You back tested it, tweaked the rules, and re-tested. Maybe the results are looking great – now what? All the information that you have is history. Is it reliable and repeatable in the real world? Here are few things that I do before running a strategy live. 1) Make sure the strategy works in … Read More

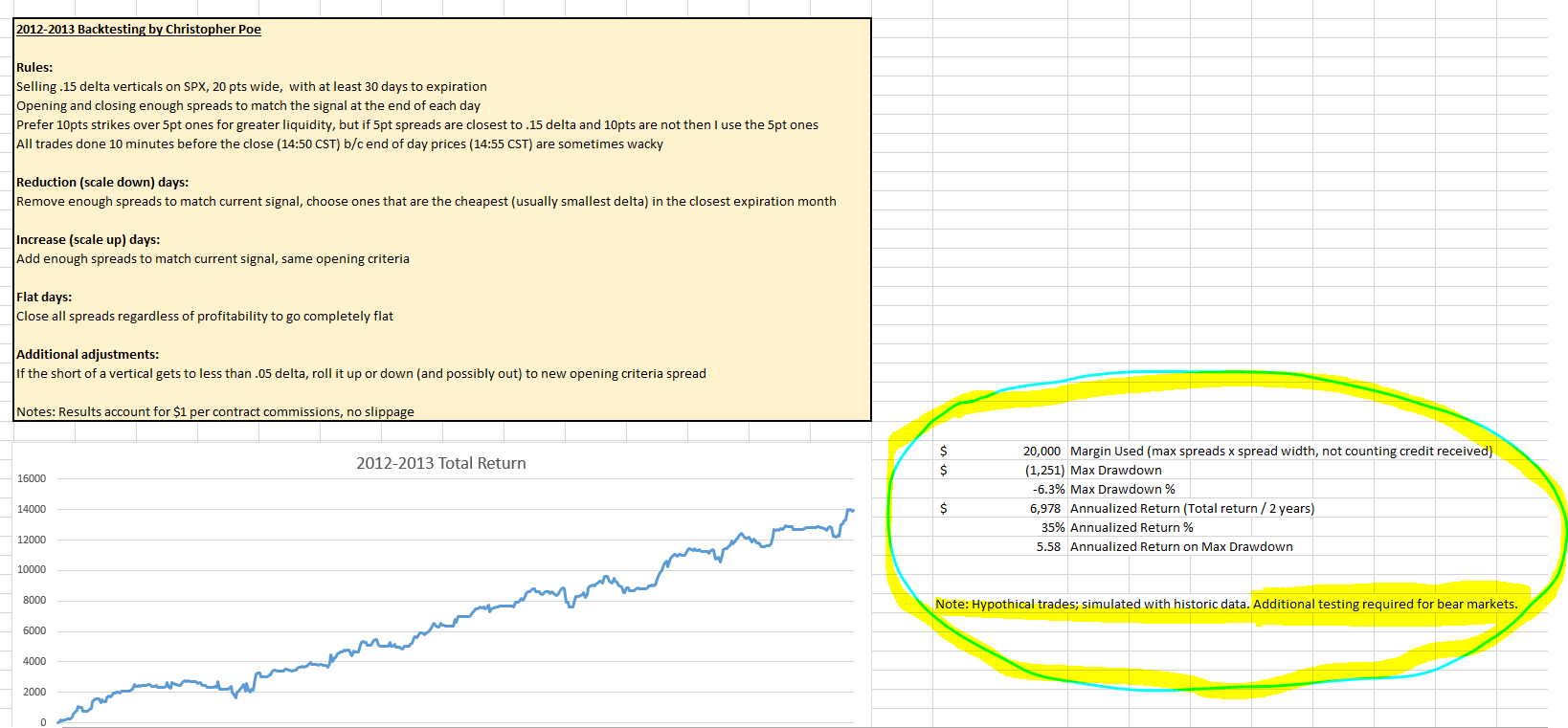

Back Testing an Options Strategy

Note: The following contains hypothetical results; simulated using historic data. As mentioned at a recent SMB Options Tribe meeting; a group of options traders are now working to back test a proprietary momentum signal using a variety of options trades. Several tests have come back with varying results… but we are seeing a common thread for options trades that show low … Read More

The Final Step for Systems Success: Accuracy

Accuracy is simply defined as the percentage of trades that end profitably. It is the final of our seven steps to systems success. To phrase it better, accuracy is the last thing we look at in building a system. Accuracy—almost without fail—is the first question asked about a system. However, it has the least impact on the success of a system. … Read More

Duration: The Sixth Step to Systems Success

Number six in our seven steps is Duration. Duration represents the expected length of time in winning trades, losing trades, and all trades. Almost without exception we find that trend- and momentum-oriented signals have a shorter duration for losing signals and a longer duration for winning signals. The reverse is true for mean-reversion trades. Knowing your expected duration is important … Read More

The Fifth Step to Systems Success: Frequency

Our fifth of seven steps for building, testing, and following a system is to understand the frequency of the system. Higher frequency increases profit potential, but it also reduces reliability. The two primary downsides of higher frequency are 1) transaction costs and 2) execution assumptions. In back testing you can assume buying every bid and selling every offer. But this … Read More

The Second Step to Systems Success

Last time we talked about Risk, which is the first and most important aspect of a trading system. We discussed how limiting risk can create higher absolute returns because of reinvestment, raising capital, and using leverage. Now we can talk about our second focus: Returns. There are three types of returns that we need to understand. First is the back tested returns. … Read More

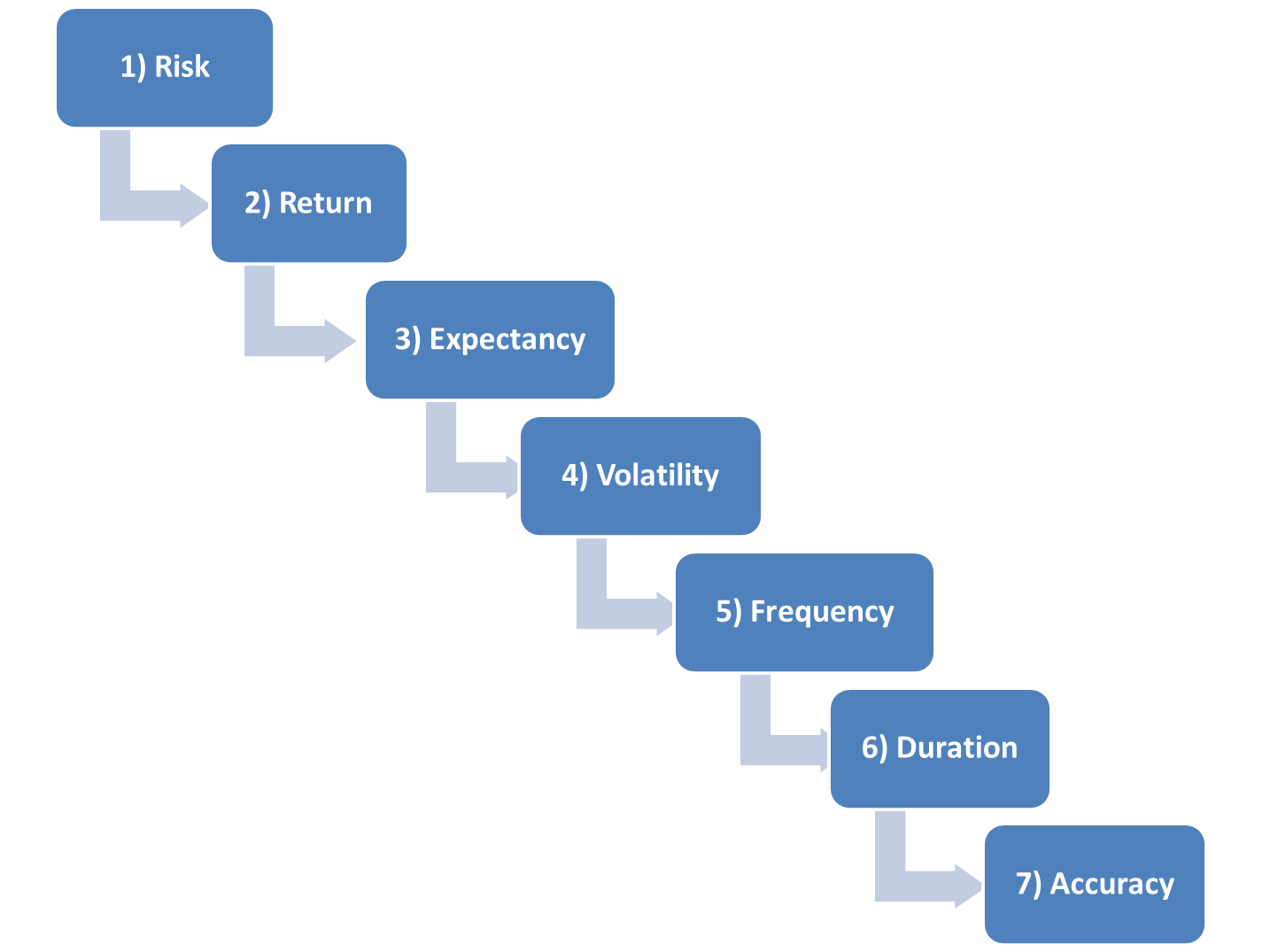

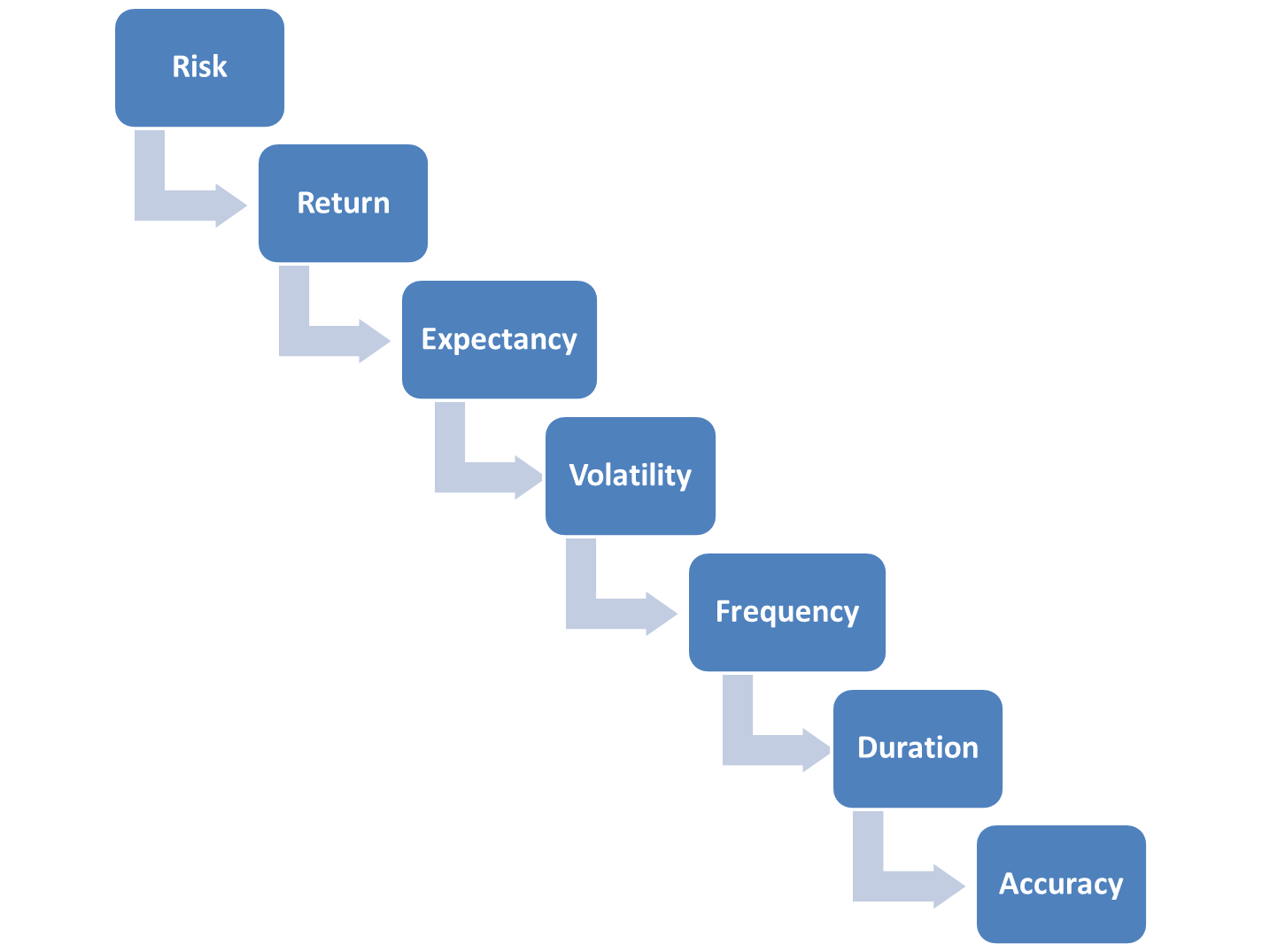

Seven Steps to Systems Success

Most platforms that run automated back testing and trading systems have extensive reporting capabilities to analyze performance. In these reports the software developers have included seemingly every possible statistical metric they could find. Reading these line by line quickly becomes information overload and can often leave the systems developer with more questions than answers. So we have narrowed down the … Read More

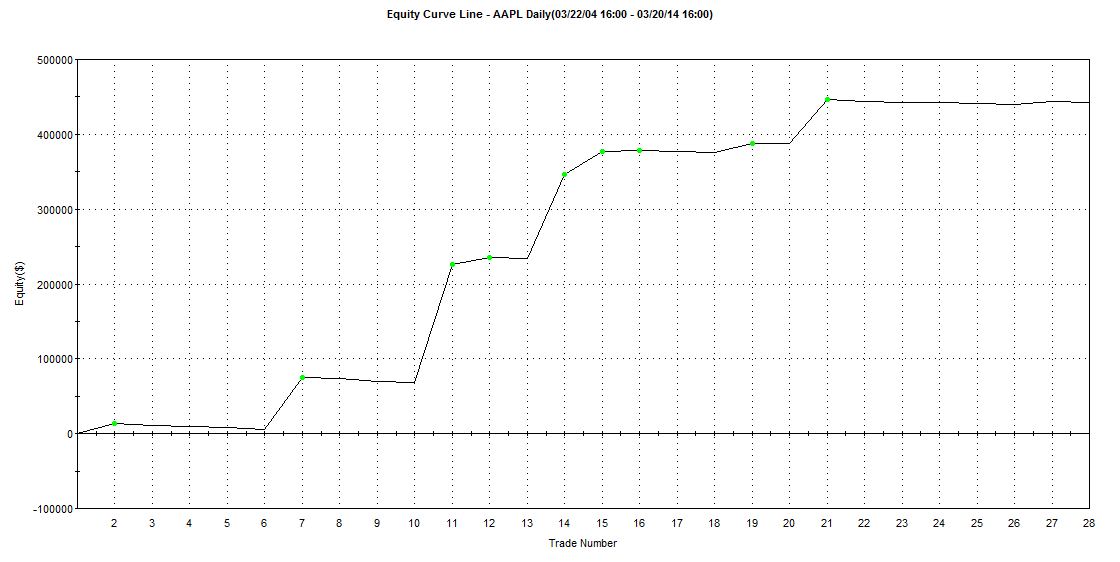

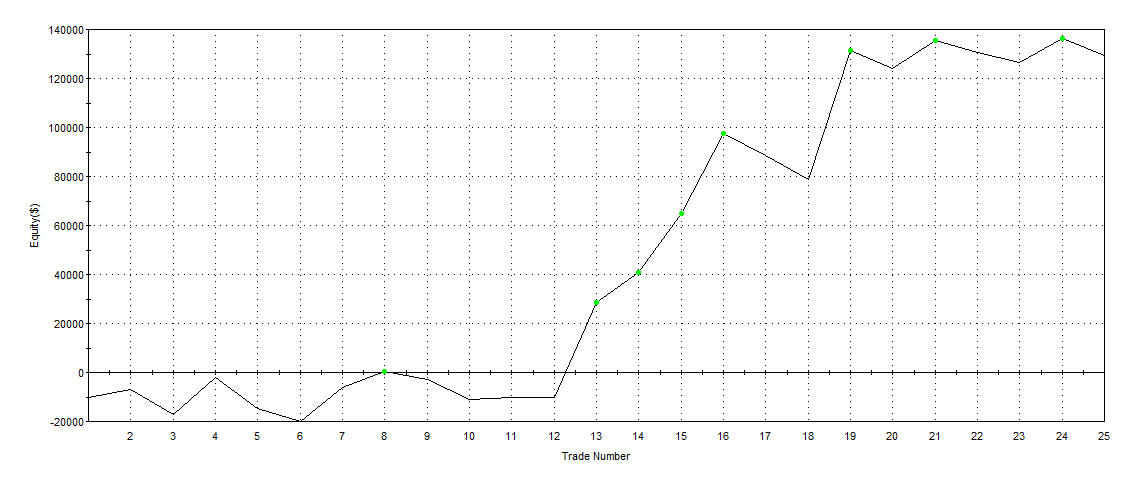

Turn Your Ideas Into Statistics

The trading world is littered with anecdotal evidence of cause and effect from various technical indicators and signals. I cringe when I hear something like the following: “As you can see, last time the 19-week moving average crossed the 52-week moving average, this stock moved 18.5%.” This statement has absolutely nothing to do with anything. It’s an observation of a … Read More

- Page 1 of 2

- 1

- 2