The decisions you make about your trading business matter. To this point, I received the note below from a 7-figure trader on our desk. He was a 7-figure trader by his second year of trading. Not easy to do. Not often you see that. This is a very talented trader and person. Even for him his decisions about his trading … Read More

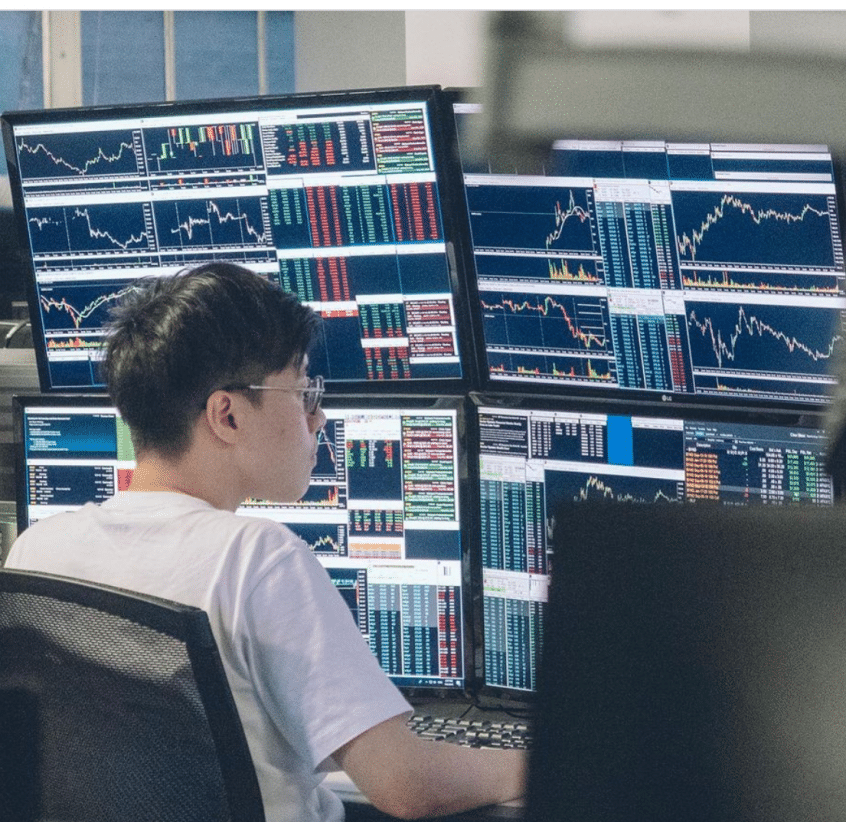

10 Key Takeaways from March Trading (from the Prop Desk)

1. Gchat an accountability partner to help you trade bigger. One junior trader had a breakout month in March. During his Team monthly review, this junior trader attributed the below as a big reason for this success: During the 5-6 biggest opportunities of the month, he sent a Gchat to an accountability partner, outlined why the opportunity was worthy of … Read More

6 critical trading lessons from crazy $CAR

These are crazy times to trade and $CAR was crazy for even this market. This is what traders on our desk are saying about this market and this most recent $CAR trading opportunity. One elite trader at our firm in an AAR (After Action Report) to other select elite traders described these trading times this way: What a crazy time … Read More

This is what unprofessional trading looks like

Good Morning Mr. Bellafiore, I’ve been reading your book One Good Trade where you talk about traders doing exercises on exiting losing trades. This seems to be my main problem. I’ve had weeks where I’m up close to five figures then on one day give it all back and then some. Mainly because I get this deer in headlights feeling … Read More

2 Paths to Making More as a Trader (not one!)

I want to share an important lesson I have learned observing many elite traders. It is a lesson that some have not yet learned as they seek to make more money. It troubles me that some think there is only one path to make more money, when that is just not true. Let me share a recent anecdote on our … Read More

Give me your honest opinion (on my trading)

Mr.Bellafiore, I have been trading for a year and a couple of months now. In April of last year I began trading with (redacted), I enjoy trading with them and have taken their …. course. as well as other courses within their offering. This has been valuable to my trading in Identifying the Fundamentals. Recently, I began using Tradervue after … Read More

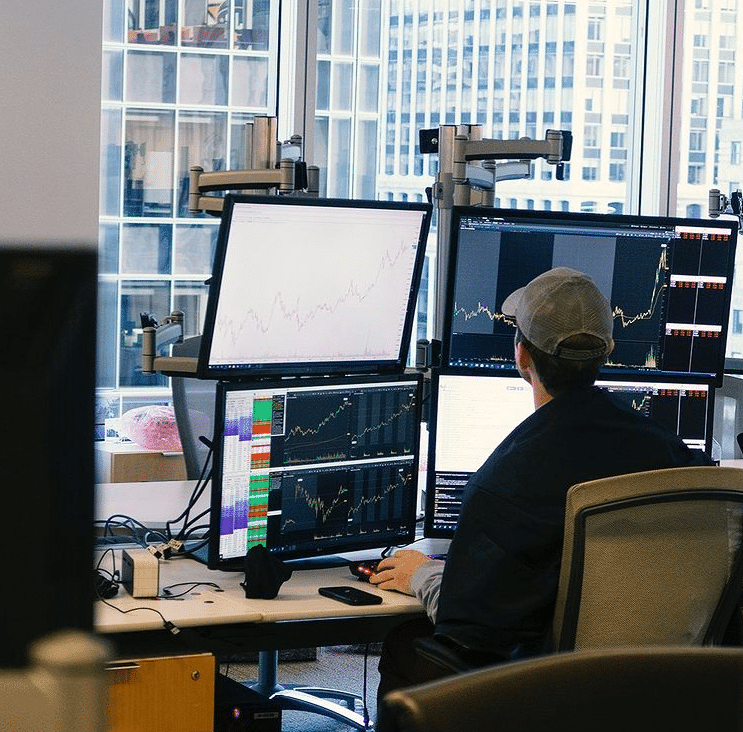

Trading does not have to be an individual sport

Trading does not have to be an individual sport. What if you looked at your trading career differently? What if you gave yourself as many chances to succeed as you could? What if instead of viewing your trading career as merely the result of your discretionary trading, there was much more opportunity? Wouldn’t that significantly increase your chances of success … Read More

You Are Trading Better Than You Think

I was reviewing the PlayBook trade of a junior trader, when an important trading principle needed to be shared. Better said, this might also be an important life principle. The trader was reviewing a Multi-Day Swing Trade in GameStop and reviewing his performance. From my seat, the trader had done so many things right. He chose the right stock. He … Read More