What financial websites do you use to prepare for trading? @MikeBellafiore I asked our newest training classes in Austin and NYC to share what websites they use and why to prepare for each trading session. Then I aggregated their answers, unedited, into this post. This gives you an excellent guide of websites to help you prepare for each trading session. … Read More

Top Voted – Top Three Trading Topics (Power Point Presentation)

SMBU asked our trading community to vote for the top three topics to teach during its next webinar. Our partners then taught these topics during a recent webinar. The top three topics were: Price Action Analysis- Specific trades were presented showing how price action was instrumental to construct winning trades The Best Setups for New Traders- Two setups are discussed … Read More

Top Ten Trading Books

I had a wonderful conversation with a retail trader who has read 194 trading books. Wow! This gentlemen has a passion for trading and reading about trading. I was actually speaking to him about our firm backing his trading. He has developed a track record while working full-time in the Heartland. For those of you trading retail who dream of … Read More

SMBU’s Top Ten Trading Blog Posts of 2013

SMBU’s Top Ten trading blog posts for 2013: The Failure Rate of a Proprietary Trader The Opportunity for a Prop Trader Lessons Learned From a Million Dollar Loser What I Learned From the Best Trader at Citibank Ten Takeaways From a Top Trading Coach Do You Have a System to Identify and Trade Breakouts? Ten Ideas for Creating a Good … Read More

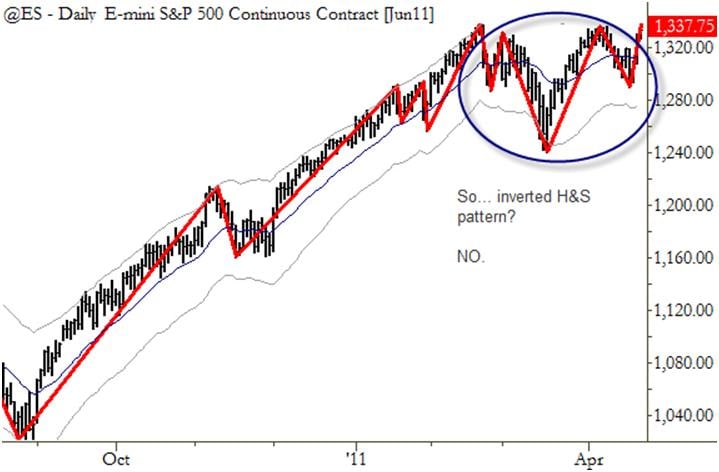

Is this an inverted Head and Shoulders pattern on the S&P?

Adam looks at Head and Shoulders patterns and points out an important nuance.

Top StockTwits Traders’ Strategy Talk

Mike Bellafiore, co-founder of SMB Capital, and Author of One Good Trade: Inside the Highly Competitive World of Proprietary Trading will be in Los Angeles for the International Traders Expo this week. The expo showcases some of the worlds’ most respected trading experts. Mike is scheduled to speak at the Expo with other StockTwits traders to share and compare their … Read More

GMan Makes Wall St. Cheat Sheet’s Top 3 Traders Under 30: Unveiling the Secrets

A special congratulations to Gman for making the Top 3 Traders Under 30 for the Wall St. Cheat Sheet.

Last Week’s Top Posts

Steve examines Google’s (GOOG) recent interaction with China and the consequences of those actions on the market, Steve Discusses Apple’s (AAPL) latest levels, Gman’s interview with Tim Bourquin, A discussion of Dov’s great SEED call out, and Steve was on Stocktwits.tv