How to improve your trading entries A Senior Trader reveals two quick and profitable scalp trades in hot stocks (Tape Reading) How to use options to chase the market until it finally gives up The journey from new trader to senior prop trader (from South Africa to New York City) 5 trading lessons from Facebook *no relevant positions Important disclosures

Improve your trading this weekend with these education videos – recap of the week of August 8, 2020

How to use technical analysis signals that can lead to large stock trading gains Why this surprisingly easy options strategy works The Monster Trade Review When technical analysis trades are more likely to work How to become a pro trader with a full-time job *no relevant positions Important disclosures

Improve your trading this weekend with these education videos – recap of the week of July 12, 2020

Trading 101: Know the Trade You Are Actually Taking Huge Profits Are Available On Slow Days How to Use Robinhood Users data to Make a Quality Trade How new traders can improve their odds of success- DRAMATICALLY 17 Questions for Proprietary Trading Firm C0-Founder – Brutally Honest Answers Important disclosures

Improve your trading this weekend with these educational videos – recap of the week of May 2, 2020

How to identify a large market move before it happens Ideas to spark real trading progress from the prop desk (an evening with Dr. Brett and Bella) The 4 keys to a junior prop firm trader profiting better than he ever has How to make larger profits from options hedges How to become a consistently profitable trader (like you deserve … Read More

Improve your trading this weekend with these educational videos – recap of the week of February 29, 2020

Trader Education: A top trade for day traders to learn {especially when you begin} Options Trading Blunders: Why should I waste my money buying long options to protect my short options Two things traders should be doing today Why you need a trading network {ways you can build yours} What moves momentum stocks {where to buy Tesla} *no relevant positions … Read More

Snapchat- When to add size

Traders often want to trade bigger. Today SNAP offered an example to me of when and how. I was short Shapchat ($SNAP) intraday and scrolling through the SNAP positions of our other traders on the desk. I felt like I was not big enough in my short. I started to think where I could add to my winning position. First, … Read More

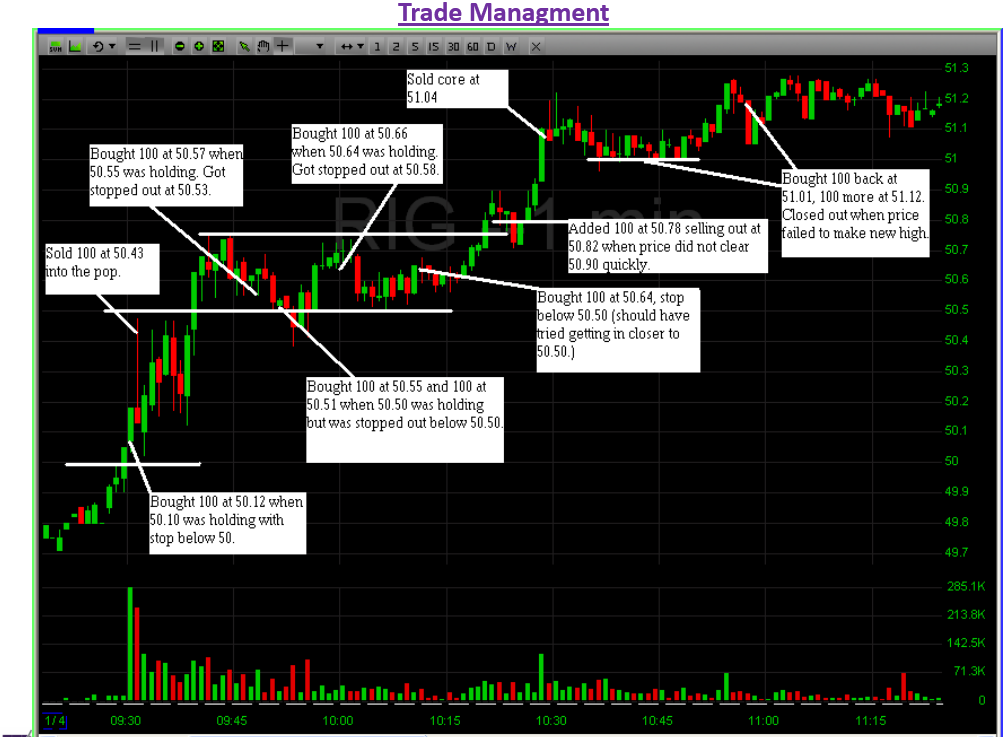

A Trade to Master- $RIG

One of our new trainees from Thailand traded RIG yesterday and sent me a PlayBook on this trade. This was his Trade Management slide for the trade. There are some lessons here. 1) Great job being in the best stock yesterday for intraday traders, RIG. You are only as good as the stocks you trade. This was a stock with … Read More

The happier Toronto trader

I am an hour away from my presentation at Quant Invest Canada and instead of preparing I thought I would share some thoughts from a few meetings with Canadian traders with whom I met. I take the Coach K approach to presentations. If you cannot get up there and speak on a subject without notes then they probably should not … Read More