Level 2 Strategies Every Day Trader MUST Know (Taught by a Prop Trader) You Can Supercharge Your Options Trades With THIS Technique A New Trading Strategy from Future Star Trader How to Trade a SPAC with Tape Reading (3 Prop Traders Reveal) How to Trade a Market Sell Off * no relevant positions Important disclosures

Improve your trading this weekend with these educational videos – recap of the week of September 12, 2020

How to Trade a Market Sell Off You are in the Driver’s Seat with this Options Strategy Tips for Successful Trading (Trading Psychology Every Trader Needs) Teaching a Prop Trader Secrets on Technical Analysis (that you will not find anywhere else) *no relevant positions Important disclosures

Improve your trading this weekend with these educational videos – Recap of the week of September 5, 2020

Tips for Successful Trading (Trading Psychology Every Trader Needs) You Can Substantially Increase Your Win Rate With This Simple Options Strategy Teaching a prop trader secrets on technical analysis (that you will not find anywhere else) How to use Tape Reading to enter a profitable swing trade 3 prop traders present their most profitable Breakout Trade *no relevant positions Important … Read More

Improve your trading this weekend with these educational videos – recap of the week of August 29, 2020

How to effectively combine Tape Reading AND technical analysis to make a quality trade You can win so many different ways with this weekly options strategy How to use Tape Reading to make a quality trade in Target How to make a quality Breakout Trade in the hottest stock (Tesla) A Senior Trader reveals two quick and profitable scalp trades … Read More

Improve your trading this weekend with these educational videos – recap of the week of June 27, 2020

Trading lessons for you from a remarkable trader who just broke 10 million in trading profits One simple, effective trade traders are not making enough (surprisingly) You Can React to the Market Instead of Predicting it with this 1 Day Options Strategy How Two Traders Worked Together to Build a Clear, Repeatable and Highly Profitable Stock Trade A simple, profitable, … Read More

Would You Make This Fade Trade? $APOL

I received this trader question via email on fade trading. Here goes: After the (well-known trader coach visit) meeting, I’ve come to realize I don’t ask enough questions from the people who are more experienced than I am. Today was a dull day, lost about $150, I don’t have a lot of talk about except this APOL trade. I’d like … Read More

Should This Trader Make a Comeback?

Below is an interesting trading anecdote I received via LinkedIn. I asked the writer if I could share his trading experience with our community. He agreed. The names and places have been changed for compliance reasons and we have no interest in saying anything negative about anyone or any firm on this blog. What I find interesting about his note … Read More

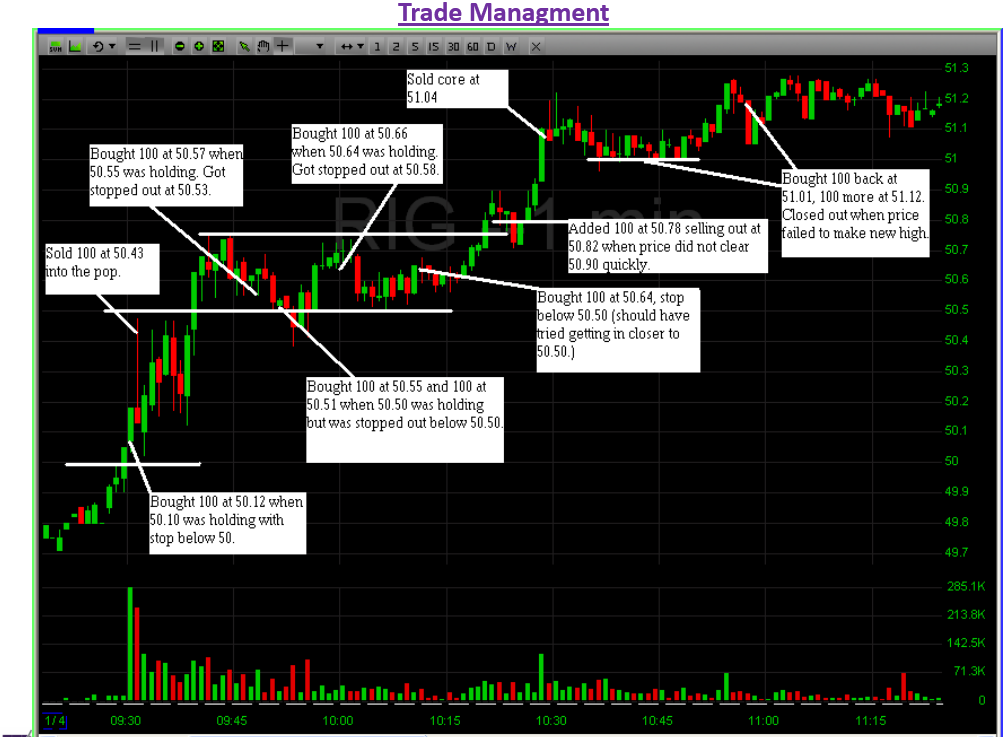

A Trade to Master- $RIG

One of our new trainees from Thailand traded RIG yesterday and sent me a PlayBook on this trade. This was his Trade Management slide for the trade. There are some lessons here. 1) Great job being in the best stock yesterday for intraday traders, RIG. You are only as good as the stocks you trade. This was a stock with … Read More