One of the more common patterns seen in a strong market are longer term players buying stocks that have gapped lower after earnings. Sometimes this plays out on Day 1 with momentum buyers aggressively buying the stock leading to a gap fill. But many times a gap fill will play out in the days following the earnings release once the longer term players have sifted through the earnings report and feel comfortable that a positive fundamental thesis for a company is still intact.

It is important to pay close attention to price action and not be overly aggressive committing to a “gap fill” thesis until the larger players have tipped their hand. Let’s look at two companies that gapped lower recently for a discussion on how to trade this scenario in a low risk and low stress kind of way.

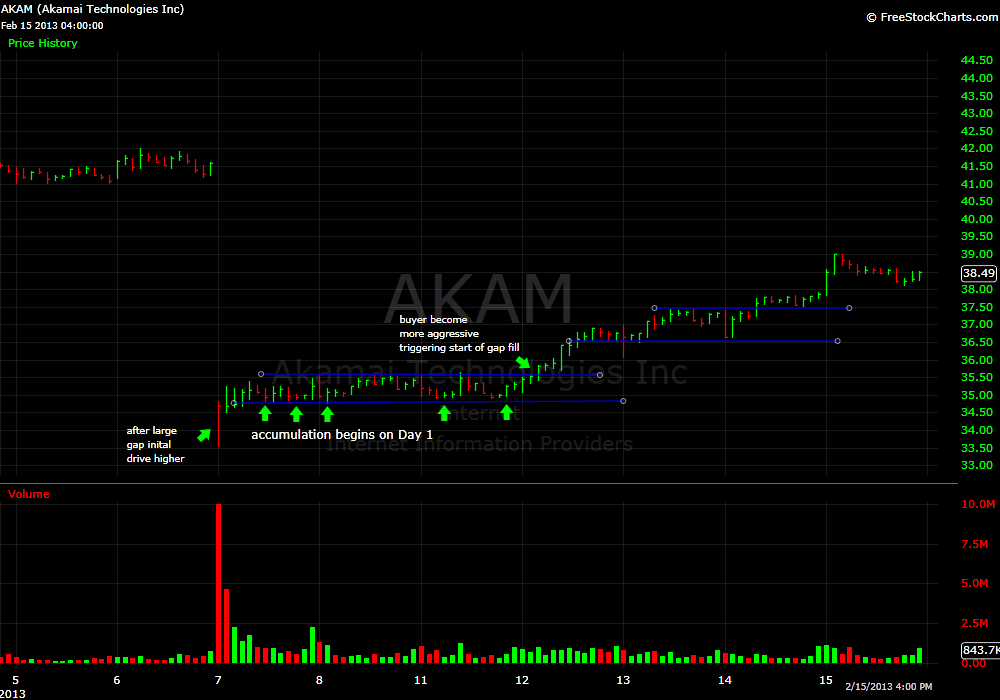

The first stock is AKAM that gapped lower two weeks ago. After the initial gap down it was bought on the Open driving higher and then moving sideways for the rest of the day. It consolidated for two more days (never trading lower than the Day 1 consolidation) before beginning an uptrend which is still intact. If you are looking to play a longer term bounce you should use the bottom of the consolidation range from Day 1 to start to build a position.

Once you have initiated a position at the bottom of consolidation your job is to wait. Wait for the buyers to defend the bottom of the consolidation again or to become more aggressive pushing the stock to higher prices. Either way those are the only two instances where you should be adding to your position.

Once the trade is #working, meaning it has begun a gap fill above the initial consolidation make sure you hold a core until the stock proves to you that the sellers have regained control. This is most easily recognized with two consecutive down moves on the higher time frame and a hold below the most recent breakout area.

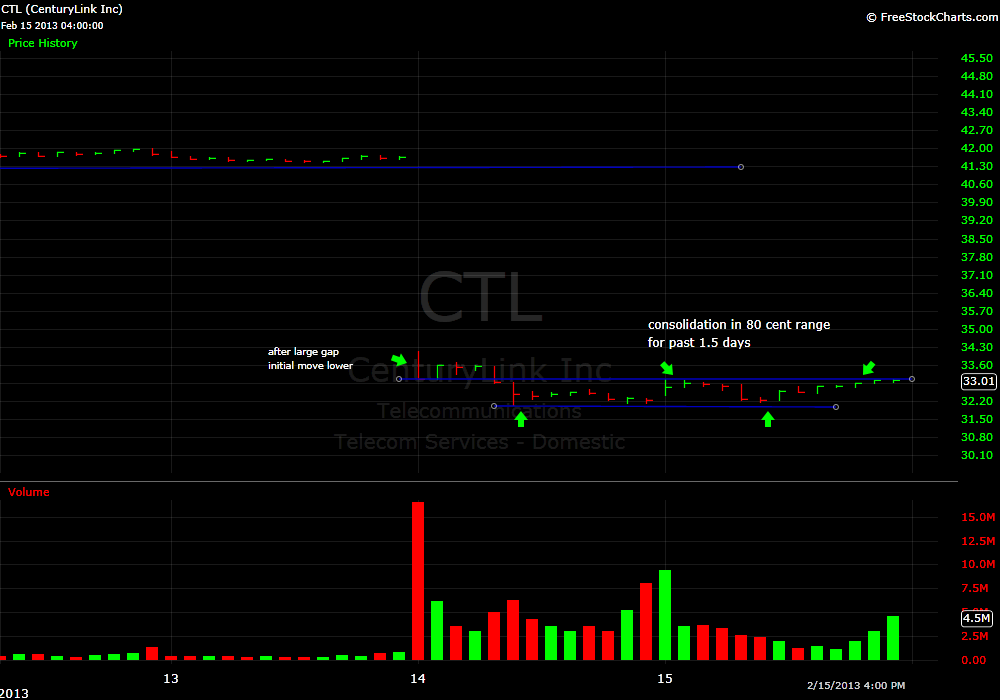

The next stock is CTL. It gapped down a few days ago and has a very similar price to AKAM having gapped down from around 41 to the low 30s. Unlike AKAM the first drive after the initial gap was lower. Since that initial drive lower CTL has been consolidating for 1.5 days spending most of its time between 32.40 and 33.

On Monday if it breaks above 33 I will look at a potential a gap fill. Some of the things I would want to see before committing more aggressively to a long idea would be a 30+ minute consolidation above 33, a move above 33.60 where it failed to breach on Day 1 after its initial Opening Drive. There is no rush to pile in as if it bounces 37 would be my initial target which is four points higher than where it closed Friday.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].

2 Comments on “Not So Fast”

Steve,

Great insight here.

Especially like the comment “your job here is to wait”.

From personally trading experience, *waiting* comes in two ways, waiting for trade strategies/entries to set up and then waiting for trades to pay off. For me the most difficult (by far) is waiting for trades to pay off. IMHO, to be successful a trader *must* learn how to be patient in both areas.

-B

Bruss,

So true. The waiting for a position to come to fruition is by far the most difficult leap to make as a trader. The fear of the “give back” is worse than fear of the initial loss for many.

Steve