Hey Mr. Spencer. I was a participant in the SMB-U webinar on Tuesday morning and I have some clarifying questions I hope you could answer. 1. You discussed the importance of only trading securities with 1/5 risk reward. I understand the concept, but I’m not sure I understand how those levels are quantified. What I thought was being said was … Read More

Don’t Break The Chain

I’m sure it’s a difficult grind having a career in a creative field such as stand-up comedy or being a writer. No matter how creative the person is, they still have to sometimes force themselves to sit down and find a way to come up with new material. No easy task. Perhaps one of the most famous stand-up comics is … Read More

Immerse in a Culture of Success: Experience the Path to 7-Figure Traders

The best learning experience that you can have as a trader is to sit face-to-face and shoulder-to-shoulder with successful pro traders. Imagine listening to the words that traders use to describe the setups and live trades they are in. This is how you learn to speak the language of a profitable trader. Think about seeing the way traders follow … Read More

Fear This

I see a whole lot of traders afraid of a whole lot of things: Being wrong Losing money Open profits evaporating Not catching the next big move Failing in general Taking a loss, therefore letting it get worse Having objective trade processes, therefore being fully responsible for results and More Do you identify with any of these? Do you experience … Read More

Stop Deleting!

I often get requests from traders in our Futures Tryout asking us to delete their prior trade history from Tradervue. They haven’t performed well, and mentally want a “fresh start.” I promptly respond with, “No way Jose!” Why? I think this is a big issue that relates to a common hurdle to getting better as a trader… avoiding discomfort! There are … Read More

Perception and Trading

Laurel or Yanny? There are a few viral videos going around in which different people perceive different words despite listening to the same audio clip. This one is particularly impressive to me: You can hear EITHER one, simply by telling yourself that is what you’re about to hear. Kind of bizarre given the cadence and different syllables of the two … Read More

Drills For Skills

A few weeks ago I was working with a futures trading student that had been a bit beaten up as of late. We chose to take the path of stripping his trading plan down to its core. We chose to go back to basics. That’s not all though. We also came up with a plan to use market replay to … Read More

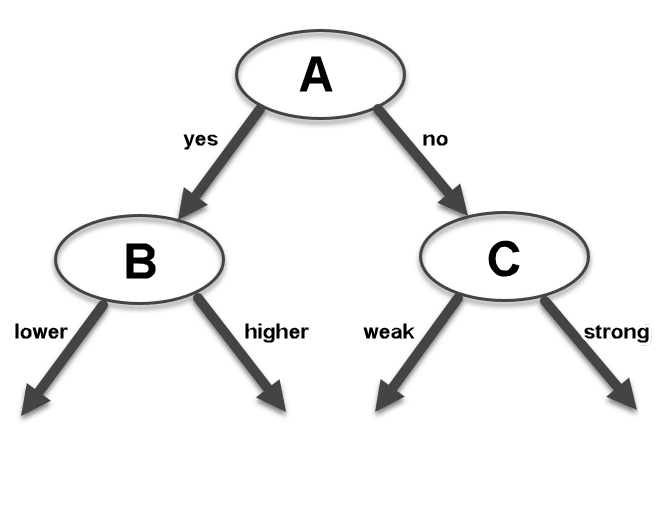

See the hypos!

I’m grinning from ear to ear today. One of my mentees was tasked yesterday to begin preparing premarket “hypos” each morning. It’s just what it sounds like – a few hypotheses for how the day might unfold, therefore providing a roadmap for the day with key inflection points and potential targets. Here’s a screenshot of his premarket journal post in … Read More