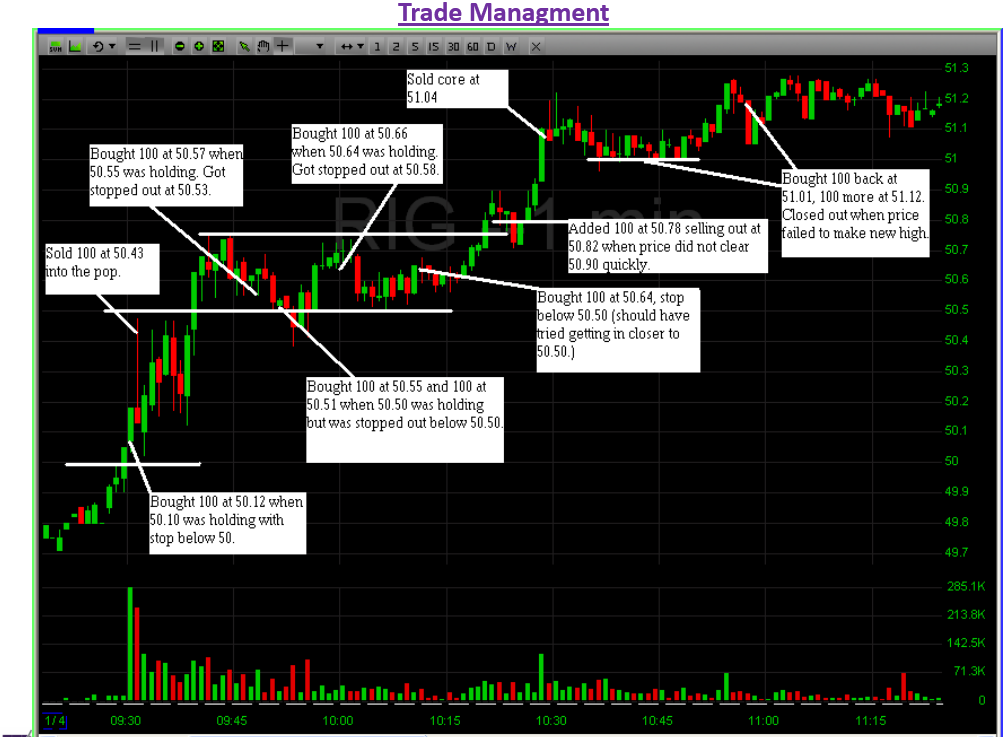

One of our new trainees from Thailand traded RIG yesterday and sent me a PlayBook on this trade. This was his Trade Management slide for the trade. There are some lessons here.

1) Great job being in the best stock yesterday for intraday traders, RIG. You are only as good as the stocks you trade. This was a stock with opportunity.

2) The Trend Trend Trade is a powerful trade for the new trader. This is one of the first patterns you should learn. First work on taking as much as you can from a basic set up like this before moving to more difficult set ups.

3) I would take issue with some of his stops, but this will come with time. This new trader needs to do some thinking this weekend on whether he placed the appropriate stops for each trade.

4) I love, just love, how he stayed with this trade. It failed a few times while he was controlling his risk with stops. But then he caught it.

5) When RIG started working he added to his position. This is terrific. Add to your winning trades. Be aggressive in Trend Trend Trades that are working for you. Do not suffer from what I call in my next book The PlayBook, “Trader Wuss Syndrome”. Good traders press the trades that are working for them.

6) Great job of reviewing your work. Be hard on yourself and review in depth the plays that make the most sense to you and the trades that offer the most opportunity. We build from our strengths.

For the new, developing and underperforming traders take note of the excellent work done here by this trader.

Mike Bellafiore

no relevant positions

One Comment on “A Trade to Master- $RIG”

Thanks for sharing this informational blog with us. Hope to read more from you in future.