A trader on the desk wrote this in his daily review:

Took the train home with (redacted, Senior Trader at firm) today, we had a really good chat. Seeing how far he has come and how he views trades. Does Not trade price action so much. He focuses more on his overall idea and trades it loosely. Shorting rallies covering dips, buying pullbacks and selling pops.

Makes me think about some of my main ideas and different ways I can trade them. Should I be smaller and let the stock really flex? Should I be bigger and risk X amount of my daily stop loss?

Something to think about moving forward. I get so caught up in price action, and not the overall idea and bigger picture sometimes it messes with me. Going to take some of the things he said and try them and see what works best for me.

@MikeBellafiore

This raises two important issues for traders: a) setting the real stop b) trading your PlayBook.

The real stop

When making a swing trade, there is a stop that many successful traders use: “when I know the trade is wrong”.

As short-term and intraday traders, we must be careful to set stops that do not afford realistic risk. We must also factor how much we are willing to lose with this real stop. If we need a larger stop, then we must trade with smaller size. Absent this then our trader losers can become outsized.

For example, I am in a swing short right now in UBNT. Where do I know I am wrong in this short? Above 52. Everything else is just noise. (I know I am right below 48ish.)

Having said that, I must acknowledge that my win rate will be lower with swing trades than with scalps or momentum trades. When I am right, I must make more. I must hold for the real move as well, when giving the trade the real stop.

Trading your PlayBook

I do see many developing traders grasp onto the trades of more successful traders, thinking this is their path forward. It is important to find a role model, from which to learn. It is important to be exposed to trades with edge. Starting with trades with edge taken by other traders is a good place to start your live trading. But, but, but to become your best trader you must develop your PlayBook.

This means making trades your own.

This means determining your own strategies for your trade theses.

This means building your PlayBook from your unique strengths.

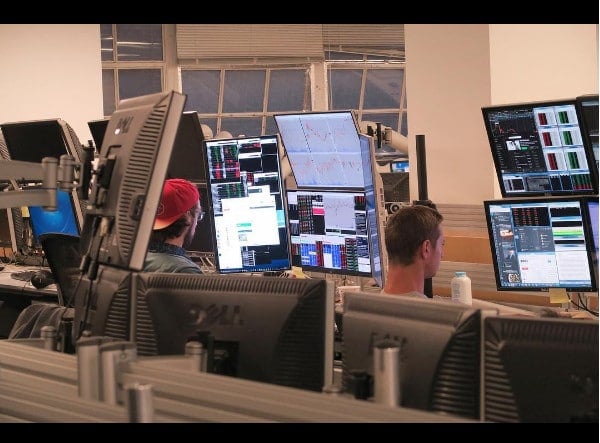

Let me offer an example. On our desk there is a team that focuses on a subset of stocks. The team leader is an exceptional trader. Many of the traders on his team are very strong traders. In fact, I cannot think of one that is not profitable.

They all attack trades uniquely.

They all get big in different ways.

They all trade their own PlayBook from the same trading opportunities.

It is terrific to co-opt trades of another. But in the end, you have to be your own trader. You want to develop a PlayBook based upon the trades that make the most sense to you. You want to develop a PlayBook that allows your talents to flourish.

That top trader is different than you. If you want to be as good as him, then you need to trade the setups that allow you to express your strengths in the markets.

As always, I welcome your comments/feedback- [email protected].

*no relevant positions