Dear Mike,

Thank you for your insights in your 2 books. Given me great insight into the mentalities of the top traders and that too, of the failing trader. I’ve started learning to trade in the last year and admit that I am failing. Had gone through my journal, done backtesting on “my edge” and meditating and deep breathing during trades. Yet, I still have a huge, huge difficulty : Psychology. On the advice of Steven, I humbly write this email to you for advice.About my trading journey:

I started my trading April 2015 following the trading system of a certain someone on internet. 1Min bar, candlesticks on BB and I’m good to go. Frankly, I did well then. 3-5 mins a day, I was up $300-$500. For 2 weeks. Then things started falling apart when I traded on news of $AAPL and bought on the dips intraday. No idea what I was doing, but I lost all my profits in a single day. I then stopped and started reading up and testing. For the next couple of months, I started testing my strategies on SIM, and when I’m on a roll, I’ll start doing something stupid again, totally deplete my account, and start doubting myself again. But I continued to read, learn, talk to people. But each time I had a run, I’ll go on to do something stupid like:– not following stop-loss rules, extending my losses

– placing a stop, and not adhering to it and closing out before I get hit (and the original stop was never hit)

– placing a stop so close it is IMPOSSIBLE NOT to be stopped out (like $0.02 from entry price)

– closing a trade at breakeven (within 5 mins of placing the trade) without any confirmation of direction

– questioning myself over and over about an entry and either miss the trade totally, or I’ve just simply increased my risk-reward from 1-2 to 1-1.

– placing a LONG when I told myself it was a short because the Dow Jones was UP (stocks)In short, I’ve done well DOUBTING EVERY TRADE I AM TO PLACE and MYSELF. I Aced it. I’ve gone back to simulation, and the same thing happens when I treat it like a real account. Yeah, I know, crap beginner.

I have FEAR. GREAT FEAR of making a wrong trade. GREAT FEAR that I will lose the profits I have. I had beaten myself up constantly during trade not because I took a trade and it didn’t go my way. In fact, when that happens, I accept I was wrong and was at peace and seek to improve my judgment. Rather, I beat myself up for the total doubt and fear in placing a trade when I think I see it or ruin the trade with so much fear that I close out with a small loss or at breakeven, even when the trade was in my favour. Things I have identified about myself:

1. Extreme Fear of placing a wrong trade

2. Extreme Fear of losing profits or the trade losing money

3. Fighting my judgment of a trade by creating a mental resistance to that judgment

4. FEARI’ve tried various ways to calm myself : Deep breathing, meditation before the trade, telling myself to trust my judgment, all to no avail. When I see an opportunity, ALL 4 of the above stands right in front of me again. Every night. I’ve come to a point where I show her what I think can happen, and she goes: “ So what? You still can’t trade!”

I’m sorry for the long email but hope that I can have some advice from you on overcoming them.

Try placing automated stops immediately after you enter your positions. Specifically try automated limit stops.

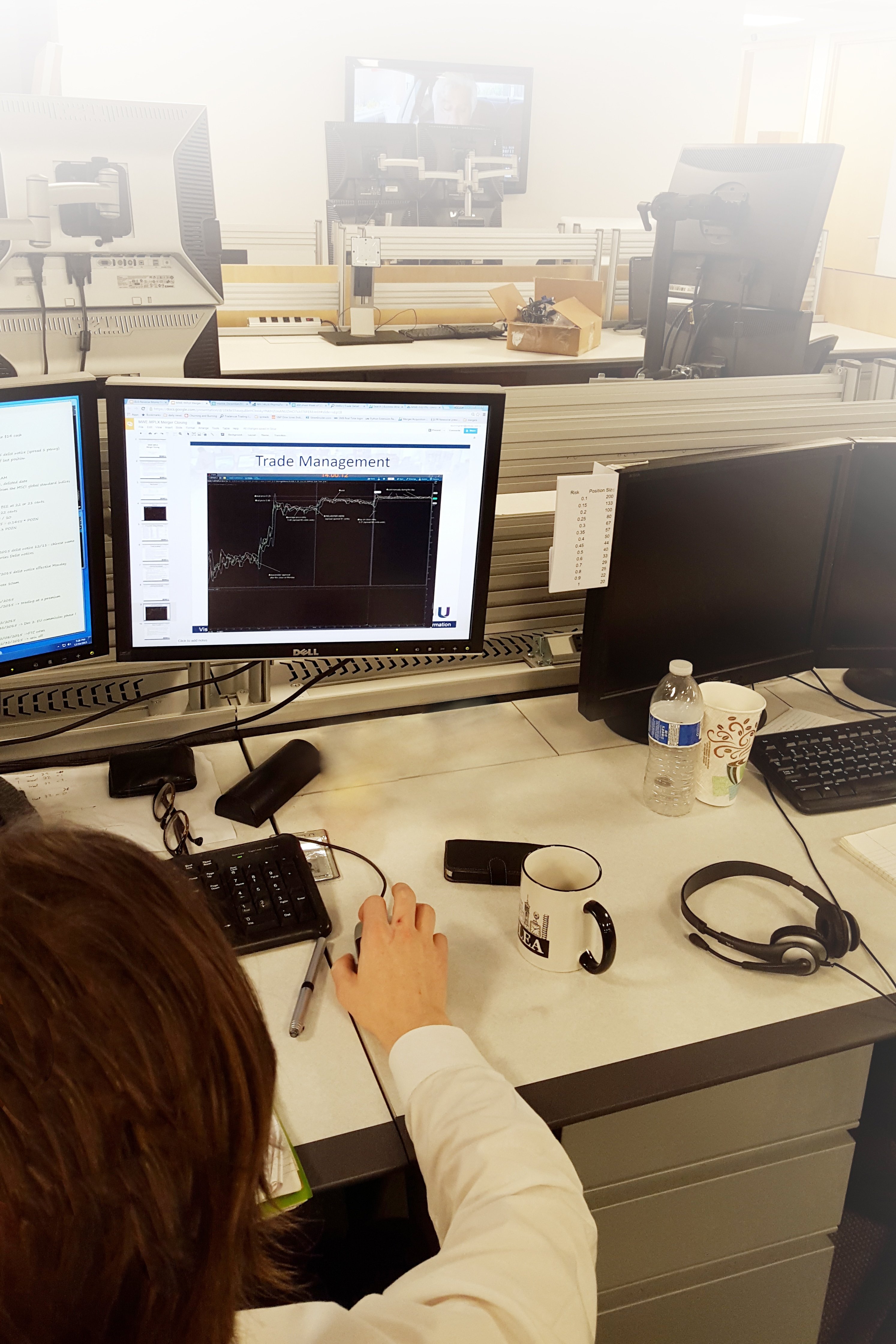

We had a similar issue with a trader at our firm. He started having trouble hitting out of positions past his stop loss. We suggested placing automated stops. In fact we placed him on a demo to practice and successfully place automated stops until he could trade firm capital again.

Automated stops take you out of the equation. When a price is hit you are automatically flattened. No thinking. No doubting. No reconsidering.

Start there and see if that helps.

*no relevant positions