Each morning ALJ comes into my office and requests I give him our “Best AM Idea” for the Open so he can blog about it. Bella is not a huge fan of putting out the specific trades we are considering making because he believes successful trading is about having trading skills and not about having some great trading idea. My own reservations about blogging one specific trading setup are related to the fact that many of my setups will not result in trades because my entry prices are chosen so that the risk to reward is often much great than 1:10.

So when ALJ asked me for my Best AM Idea today I looked at a few of my top setups and went with GS even though I thought it probably wouldn’t get to my entry price of 164 based on the weakness we were seeing in the pre-market. ALJ responded to me that GS was just crazy enough that it would pop up to my short price on the Open before collapsing. And he was right!

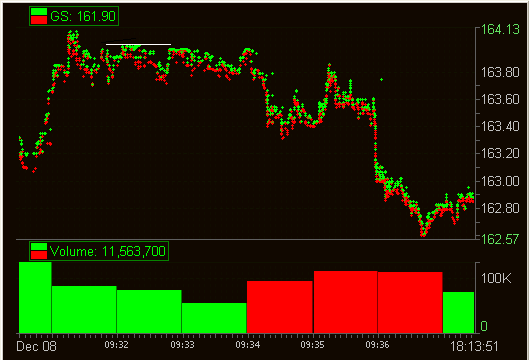

There are three setups that work well in GS. They are technical setups that can be spotted fairly easily on a thirty minute ten day chart. Today’s setup in GS was a gap below a recent support level. The level was 164 and GS closed below this level for the first time yesterday. Our plan was to short on the Open on a pop to 164. I told ALJ to blog to get short at 163.80 because I was somewhat skeptical of getting my dream entry of 164.

This is how I traded the play. I shorted 200 shares the moment GS opened at 163.80. I then waited to see what would happen at the 164 level. When there was identifiable selling at 164 I shorted an additional 400 shares. When GS had a quick 50 cent downmove I covered 200 shares thus covering my risk. When GS then traded down to 162.60 and started to bounce I covered an additional 100 shares. I covered my remaining shares as it tanked through the 162 level which was my initial target.

Upon reviewing my trade it was clear that there were two opportunities to add to my position that I failed to take advantage of. One was after the initial 50 cent down move GS spiked back up to 163.85 where there had been some selling right on the Open. I passed on shorting at that level as I was hoping to get some shares off in the 163.90’s. The second opportunity to add to the position was on a momentum short below 162.60. The reason I failed to make that trade was that GS was not my primary trading stock and I had already begun to actively trade something else.

GS is not a good intraday trading stock. If I were to attempt to trade it on a daily basis I would be lucky to make money 50% of the time. But it is a great stock to make very specific technical trades where the risk to reward is greater than 1:10. My profit in GS today was three times greater than the losses I suffered making two trades in it last week. Another example of why as an intraday trader you MUST make the trade every time your setup occurs. Otherwise, your PnL data will be meaningless.

Don’t forget to follow us on Twitter.

8 Comments on “Trading Our Best AM Idea – December 8, 2009”

Thanks for emphasizing to take the trade “everytime”, Steve. I understand the importance of it.

Thanks for emphasizing to take the trade “everytime”, Steve. I understand the importance of it.

I notice on that tick chart that there are some stray isolated dots. For example at around 9:36 at 163.80. Is that an algo that popped the price up to stop someone out?

I notice on that tick chart that there are some stray isolated dots. For example at around 9:36 at 163.80. Is that an algo that popped the price up to stop someone out?

tao,

that is just bad data.

thanks for reading,

steve

So you initially shorted at 163.80 and shorted more at 164. Is that not considered to be adding to a loser which I’ve been told never to do (by Bella).

So you initially shorted at 163.80 and shorted more at 164. Is that not considered to be adding to a loser which I’ve been told never to do (by Bella).

J,

you should never double down. the definition of doubling down is adding to a position that has gone past your stop price. adding to a position at multiple prices before your stop price is called “scaling in”. it is an advanced trading technique that all of our experienced traders are taught.

hope this helps

steve