Hi Steve,

I am interested in learning your thought process behind trading LVS on 12/02. Do you mind writing a post on it?

Thanks,

AZ

Here you go:

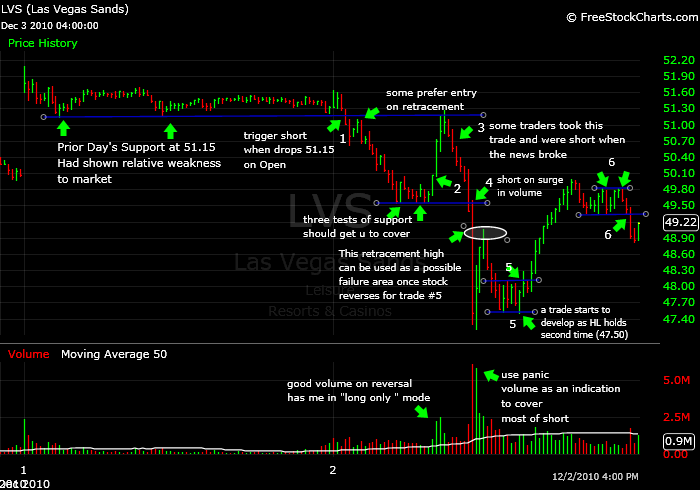

Before I break down the various trades that I thought offered good risk/reward on December 2nd for LVS I would like to discuss December 1st. LVS gapped higher on 12/1 with the large gap up in the market. It sold off in the morning and found support at the 51.15 level. The level was tested a second time around 12:30pm right as I began to broadcast on Stocktwits.tv. LVS was showing relative weakness to the market and so when we received a question about buying it if it touched support again I recommended not getting long. I also made a mental note to look at it the next day as a potential short if it traded below the 51.15 level.

On 12/2 as the market opened LVS was directionless for the first 15 minutes. Then at 9:46 there was an increase in selling pressure which caused my price alert to trigger at 51.15. This was the beginning of the fun!

- The first trade opportunity was a short sale based on a breach of the prior day’s support area. My trading style dictates to initiate a small position as soon as the prior day’s support is breached. If the stock continues to hold below the prior day’s support then I will add to the position. In this instance LVS did traders the favor of showing them a 70 cent down move on heavy volume so they could have confidence in shorting the retracement to prior support. If you zoom in on the 2 minute chart you can clearly see a large seller with an intermediate sell algorithm dumping LVS all the way down to 49.54. It is clear when the sell program tapers off at 11:30AM as it is forming a triple bottom.

- The second trade which was a long triggered at 11:38AM on a large increase in volume as LVS was clearly breaking out of its downtrend. My trigger buy price was above 49.90 which was the price it failed at after the second test of support. Confirmation of the trade came quickly as there was surge in volume and it traded above 50.05 which had been the retracement high off the initial low of 49.54. The large surge in volume in conjunction with the disappearance of the methodical seller led me to believe shorting opportunities were probably done for the day. Little did I know that the initial seller in the morning was someone exiting due to advance knowledge of the news from Macau.

- This trade is not one I was interested in making. Yes LVS did fail to hold above the 51.15 resistance but the volume on the reversal from 49.50 was so huge that I thought it was more likely to find support on a pullback from 51.25 and then continue higher. But it is clear from viewing the two minute chart that after LVS pulled back to 50.78 that the next significant move was lower and represented a shift in momentum to the downside. Anyone who took this short was in a great position to capitalize on the panic downmove that began when the Macau news hit the wires.

- At 12:26PM when the volume exploded on the Macau release LVS was a momentum short below 49.50. Once the momentum slowed and began to reverse in the 48.60s it was time to cover half the position. My preference would be to add back the shares covered plus some extra on the drop of the prior intraday low of 48.62. Once the measured move was completed around 47.30 I would take off the majority of the position. Also, there was a crescendo of volume that further confirmed it was a good time to cover the position.

- As LVS began to tighten up after 1:00PM a 60 cent range was established between 47.50 and 48.10. After six bars of consolidation on the 5-minute chart LVS breached the 48.10 signalling another change in momentum and offering a trade on the long side. You can see that this entry initially failed dropping LVS all the way to 47.90 prior to beginning its next uptrend. I think of all the trades offered so far this is the one where some traders would have been stopped out depending on where they were to place their stops. I think in this instance an appropriate stop was 47.89 or 47.79. My target for this trade would have been 49.60 based on the morning low. I also would have taken some off at 49.07 as this was the retracement high of the panic low.

- The final trade opportunity was when LVS began trading sideways in the final hour. This is another trade that I wasn’t interested in making but could see why others might. After failing at 50 some would argue that LVS made a lower high at 49.83 and could possibly reverse again. My feeling was that it rallied almost three points from the low at this point and there clearly was a buyer at 49.35 so I thought it was more likely to touch 50 again. But when the buyer dropped at 3:45PM there was a legitimate momentum short opportunity, which ended up offering about 50 cents of profit potential.

10 Comments on “Traders Ask: What Was Your Thought Process In LVS?”

It was a great trade from you again, Thank you for your thought

Rex

Great insight into so many opportunities on one stock. Thank you!

thx for the share

“…you can clearly see a large seller with an intermediate sell algorithm…”

Can you please define or expand on ‘intermediate sell algorithm’? Does ‘intermediate’ here imply the sell program’s aggressiveness?

guest,

that is exactly right. “intermediate” is the level of aggressiveness of the algo. in this instance the intermediate aggressiveness worked beautifully allowing someone to dump a large amount of shares without causing a freefall in the stock.

steve

Steven usually one should be trading with the trend, on this trade you talked about shorting the stock when the longer trend is to the upside (based on 60 min chart). What time frame do you use to identify the trend? or was this an exception and why?

brunito,

please be more specific.

steve

Wow, that is some really excellent insight and justifications for actions and decision points on this page. Thank you, I’ll be printing this one out, taking pencil to mark up and studying for a while.

Good Stuff!

Brandon

many thanks for posting this, I found it very educational.

Thank you for sharing