At around 3:00pm EST Dov Bar called out that SEED had just made a new high for the day. Dov Bar is our designated SEED watcher. You may have seen his recent blog post “SEED Money for the New Year”. I typed in SEED on my platform for a quick look to see what was going on. The first thing I noticed was the huge spike in volume that had accompanied the move from 12.20 to 12.75. That was a check for a possible continued up move. As I started watching the tape I noticed that although SEED was not trading above 12.75 it also was not dropping the 12.70 bid. Another check for the long as it was consolidating very close to its intraday high after just having traded up more than half a point. As SEED moved higher towards 13 I noticed whenever it ticked down despite some aggressive bid hitting it would not have a second consecutive down move. Another check for the long.

At this point I had enough checks in my favor and got long at 12.93. The volume continued to pour in so I figured there was a pretty good chance it would trade up to 14.50, which was the high back on December 1st. I was fairly vocal about my price target and suggested that the younger traders on the desk who were not versed in trading high volume momentum-type stocks should start watching SEED. As SEED continued to trade higher towards 13.50 I noticed one of the less experienced traders getting short. Part of my job as a partner at the firm is to monitor what other traders on the desk are doing. Rather than calling this particular trader out for his silly trade in front of others I simply exclaimed “if anyone is shorting SEED you should start looking for a new job”. Shorting stocks that have explosive up moves on huge volume is a recipe for disaster. By day three of our training program our trainees have been told at least once that they are not allowed to “fade” stocks against the trend. I would surmise that by day 25 of their training that they feel as though they have been bludgeoned by this particular point.

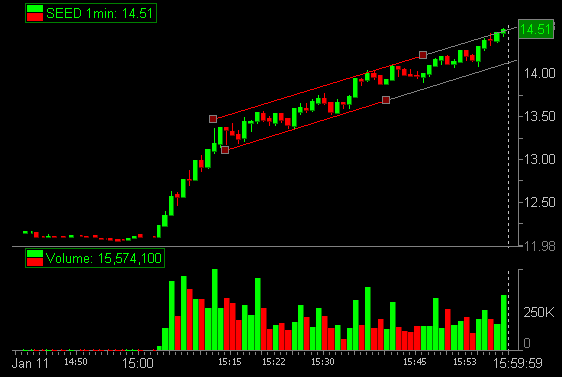

I refocused and started trading SEED again. I bought a few hundred shares as it traded down to 13.40. I noticed a few other traders on the desk were getting involved and bought into this shallow pullback as well. Good trading! As SEED ticked higher one of our traders paid the new high for his max allowable position size. Another silly trade. Not as silly as getting short into the up move but silly nevertheless. The trader who bought his max number of shares was attempting to catch a move to the 14.50 target I had mentioned a few minutes earlier. The problem with his trade was that buy paying 13.60 he was in a position of weakness based on SEED’s trading pattern. As you can tell from the chart below SEED was moving higher very methodically within an uptrend channel with small pullbacks. This pattern required that you establish a position into the small down moves. By paying momentum for his max size the trader was forced to hit out of his long on two occasions so as to not violate his rules on risk.

At 14 another trader decided to get short. I cut him some slack as he was up a bunch of money in the stock already so I didn’t call him out for his silly trade. This trader is very fast and could cover his short and get long within a few pennies without much difficulty. Of course that is in theory. It is not so easy to go from long, to short, and back to long again. This requires a lot of mental gymnastics. Trust me I’ve probably done it several thousand times in my trading career. During the trading insanity that was 2008 it worked quite well as stocks gyrated up and down throughout the day. It doesn’t work so well under the current strong market conditions. Strong stocks tend to go up and weak stocks tend to go down. By focusing on being long strong stocks and being short weak stocks you are more easily able to fully capitalize on the multiple opportunities each type of stock offers during the day.

Fast Forward to the close and SEED was at 14.50 per share. Just as promised to the traders on our desk 🙂

Look for it to continue its march higher in the coming days and weeks. Don’t forget to follow us on Twitter.

5 Comments on “There Are So Many Ways To Be Silly”

“if anyone is shorting SEED you should start looking for a new job” is a classic! Hilarious.

“if anyone is shorting SEED you should start looking for a new job” is a classic! Hilarious.

I welcome this kind of articles in which you discuss about the mistakes that the unexperienced traders are making.

I welcome this kind of articles in which you discuss about the mistakes that the unexperienced traders are making.