Traders, what an exhilarating week it was! I haven’t experienced such a thrill in trading since 2021. Despite the long hours from 4 am until 6-8 pm, the exhaustion is worth it! These hot cycles are rare gems in the trading world.

Now, as always, I’m excited to share my top swing ideas with you for the upcoming week. I’ll discuss my exact entry and exit targets for setups that could potentially have significant follow-through. This structured approach will help you better understand and apply these strategies in your own trading.

But right before we get into the ideas:

As I spoke at length to in my most recent SMB Inside Access meeting, there is a time to press and put the foot on the gas. That was last week. My previous week’s watchlist went out the window as we had a major sentiment shift in meme stocks, thanks to the post by Keith on Sunday. As a result, I shifted immediately to my theme mindset – scalp momentum in the leaders (GME and AMC) and looked for long swings in the sympathies (BB, FFIE, CRKN, GWAV). That mindset shift played out well; I had my best week in a long time.

Now, there were also insane moves in high-beta, market-leading names, from NVDA to BABA. However, I did not partake as I had my hands full with the meme mania.

PRO TIP: Always prioritize your focus, mental, and real capital to the opportunity with the highest edge and + expectancy. Do not spread yourself out too thin to the point where nothing counts.

Okay, after the selloff and crack in all of the names on Friday, I will be looking for dead-cat bounces to short. Due to the volatility, I will also be focused predominantly on day trades rather than swing trades.

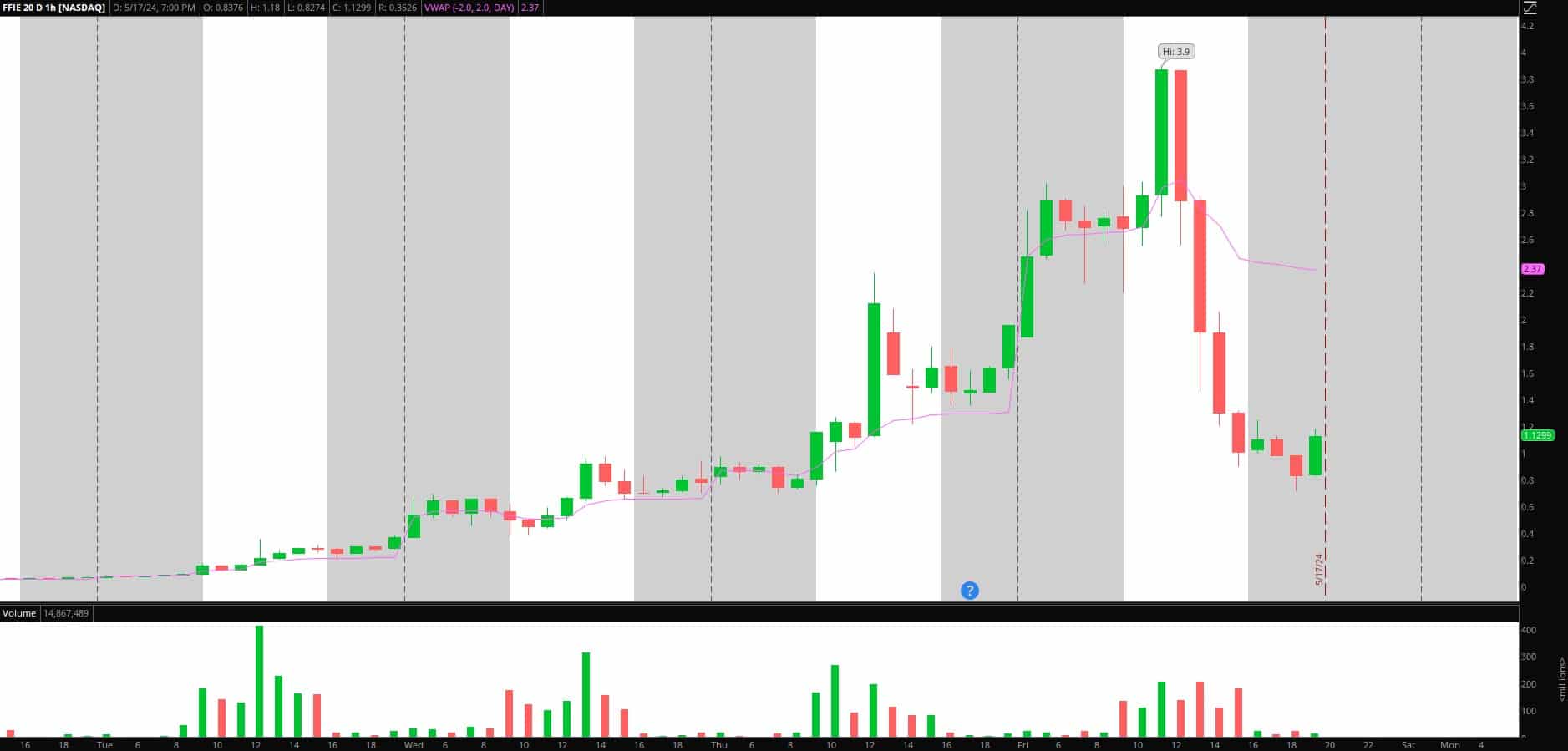

Pops to Short in FFIE

FFIE was just a monster trader last week. I caught a long swing from day one in it, with my initial entry with stock near $0.10, along with calls. However, as it approached $1 and then eventually blew off, my focus was solely on the short, and I took some cuts before it eventually cracked on Friday. Within that, there is a lesson: Know what you’re risking before hand, be ok with it, and don’t tire yourself out before the trade confirms. Personally, I like to take three attempts before shutting it out: three strikes, and I am out.

This reminded me so much of CEI from the previous meme cycle. Yesterday’s crack and fade opp was A+, and I highly recommend studying that. What a move, and it was my single most significant trade of the week.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Now, just like CEI did after it cracked, I am hoping for a last-ditch, final attempt at an SSR squeeze in the coming days, ideally toward $2, for a swing short entry before this eventually finds its way back to where it came from. The fundamentals are not pretty. So if this has any secondary pushes, I will be shorting on failure, with a stop above the high of the day, and holding for several days up to a week, for a move back to $0.50 or lower.

Sympathies Attached to FFIE Include:

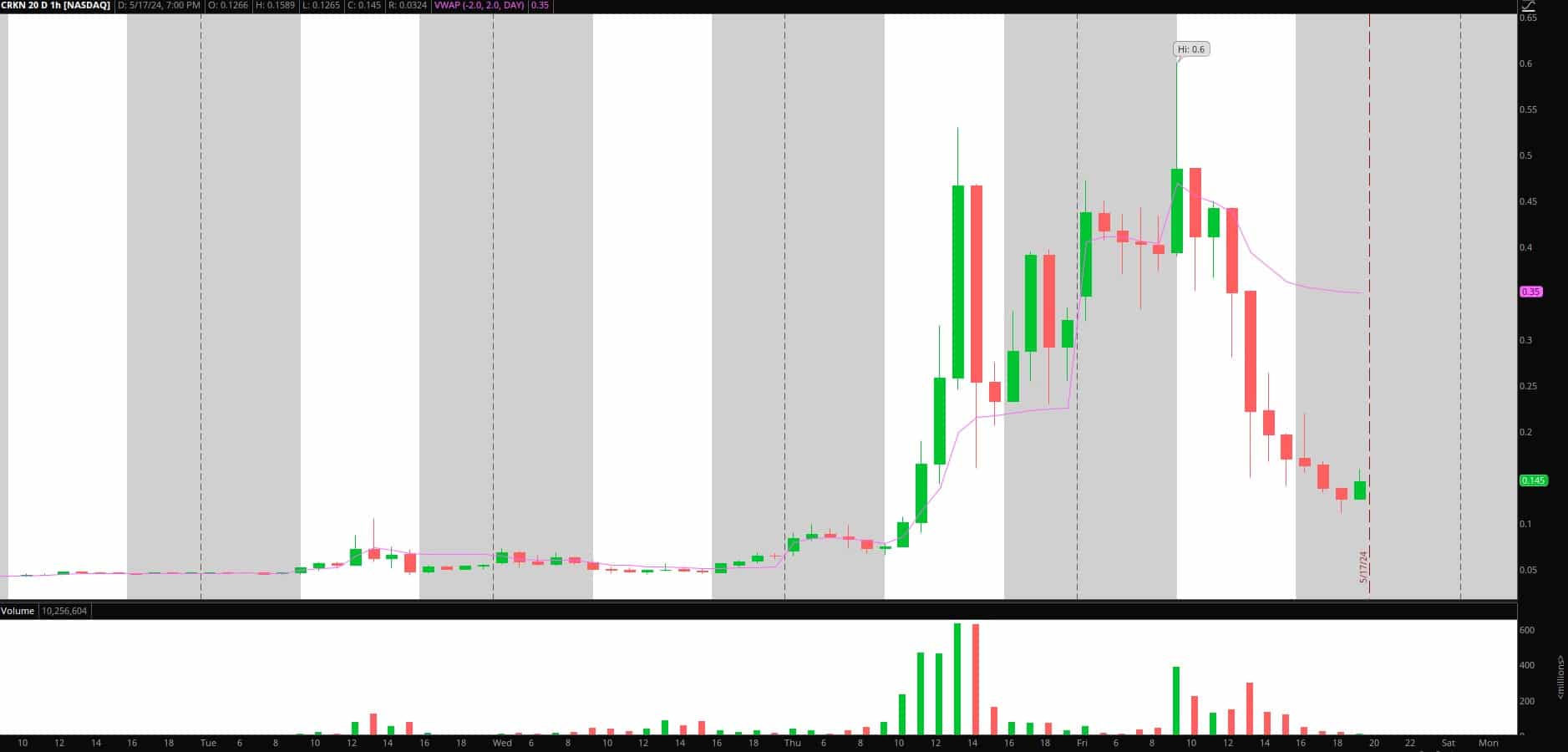

Along with pops in FFIE to short, I will monitor sympathies attached to the name, including CRKN and GWAV (along with a large list), for re-entries on the short side. Ideally, they can push back toward what will become the two—or three-day VWAP for a short swing entry on failure.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Ideas:

Pullback / Higher Low in BABA: I missed the pullback long in BABA I previously discussed as I was busy with meme mania. However, with the trend and momentum firmly to the upside and several industry titans adding and initiating large positions in BABA / Chinese names, I am stalking this going forward for a 2 – 3 day pullback/consolidation for an entry into a continuation move higher.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Bounce in GME / AMC: While they will go back to where they came from or lower, I am watching for a higher low versus Friday’s low for a potential intraday bounce trade. Alternatively, in both names, I am stalking for major capitulation to the downside and sharp reversal off the lows for a brief intraday relief rally. Closing strong might get me to hold a piece for a gap-up and sell on day 2.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.