Traders, As always, I’m looking forward to sharing my top swing ideas with you for the upcoming week, along with my exact entry and exit targets for setups that might have significant follow-through.

Last week, my ideas were isolated to individual names and outlier scenarios, not correlated to the overall market. That’s because the overall market lacks a trend. I have discussed this in far more detail in my weekly meeting in the SMB Inside Access.

Sticking with that theme and doubling down on patience, allowing the market to show its hand better before I get more aggressive with swing ideas, here are my top ideas for the upcoming week.

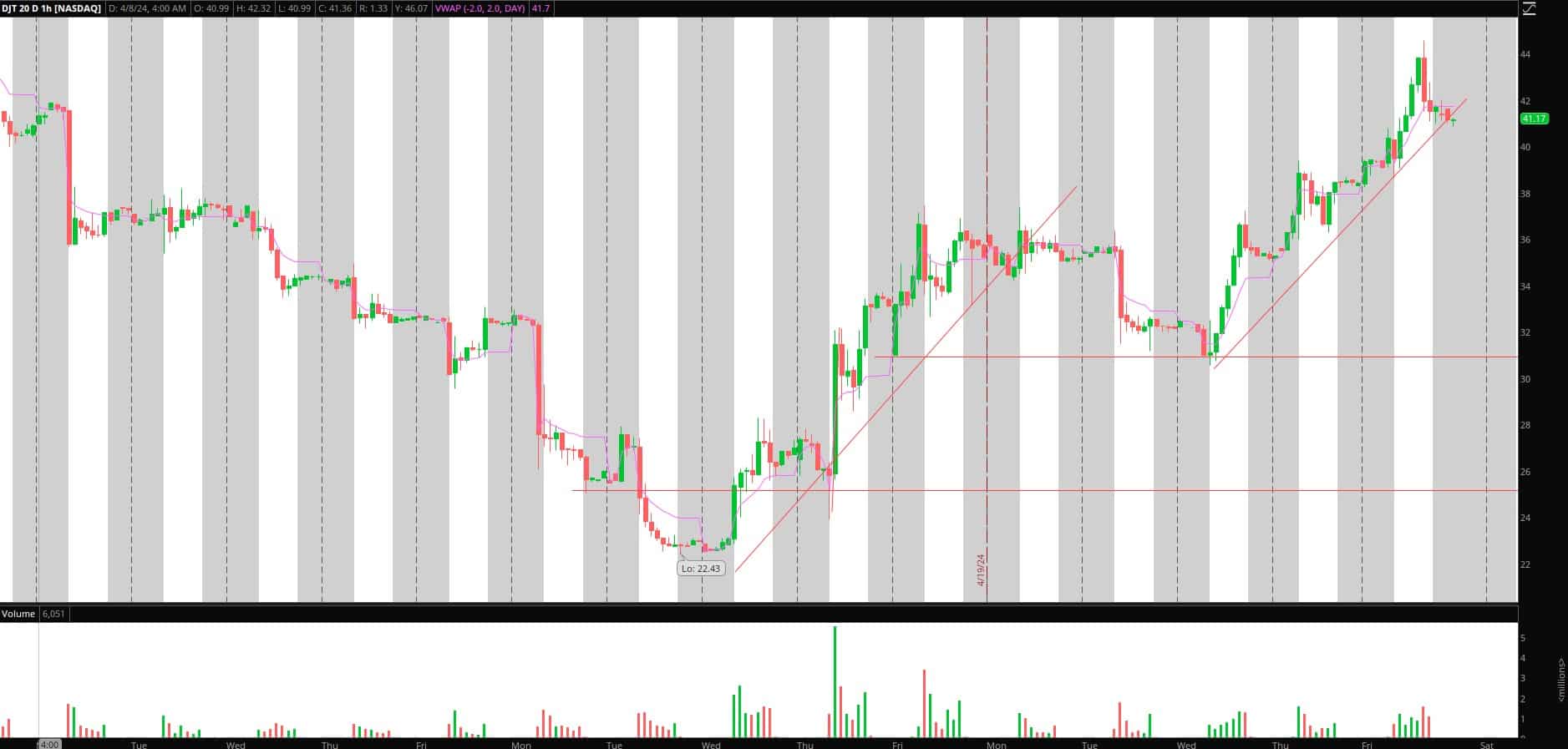

Short Swing in DJT

The only idea from last week that never materialized and triggered an entry was DJT. However, it continues to form a better setup as the bounce stretches. Therefore, as I mentioned last week, the higher this goes, the better, making for a juicier trade once confirmed.

Here’s my plan, similar to last week:

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Nice grind and squeeze higher last week, followed by a quick selloff into the close on Friday. Going forward, I am monitoring the price action if it pushes back into ~ $43 for a potential lower high short entry. If it holds up, I will continue stalking for a failure higher—no need to be early as there is plenty of meat on the bone. If a lower high is confirmed, I will look for a 3 – 5 day short position, trailing the stop against the prior day’s high, targeting a move toward the mid-to-low $30s, and scaling out along the way.

Pullback in SOXL

The swing-long bounce in SOXL played out beautifully last week after the higher low was confirmed on Monday. It was a brilliant setup to go back and playbook and study. However, after closing the week up almost 30%, I am now targeting a pullback opportunity over 1 – 2 days.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

I’d like to see a gap up / push toward its flattening 50-day and rejection near $42 or a significant lower high and fail to hold above the uptrend’s support near $39 for a short entry. After that, I would aggressively trail the stop using lower highs on the 5-minute timeframe and scale out of the position on significant lower lows and extensions from the VWAP, targeting a move toward $35 / the 5-day SMA.

Additional Ideas:

Secondary Liquidity Trap in AGBA: Solid idea from last week. Has since pulled in, and volume has died. If this reclaims $2.30s and churns higher, shorts might be trapped for a retest of $3+. On watch for the $2.30 reclaim and uptrend intraday to form for a 2-day long targeting $3+.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Penny Stock Breakout in JAGX: I like the setup from a technical point of view, but it’s also important to recognize that this is a serial diluter, and the company needs cash—know what you own. Six hundred million shares traded nine days ago. Since then, the volume has died down, with $0.20 acting as significant resistance. I’m looking for a breakout in price and volume over $0.20 for a one—to two-day move toward $0.40.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.