On our prop desk I encourage our traders to look for stocks that are trending, enter a Trade2Hold, and stay in the position if it is working until there is a Reason2Sell. SMBU offered a free Webinar on Reasons2Sell here. I discuss them in great detail in my latest book, The PlayBook. Below is an example of a Reason2Sell, a Time Stop.

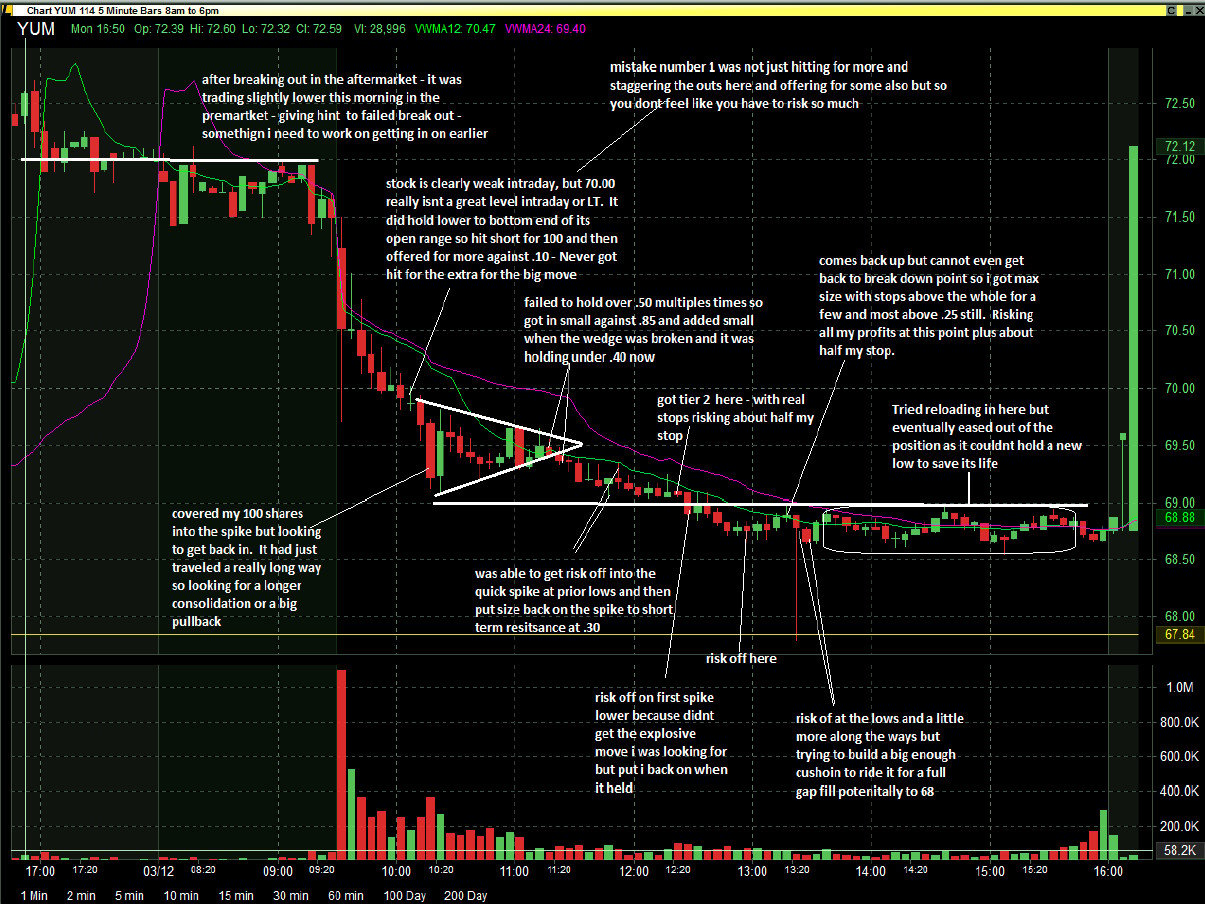

Figure 1.1

In this setup, trader Chapel Hill, gets very short as YUM forms a bearish flag pattern, after an opening drive to the downside, as you can see in the chart above (Figure 1.1) and after a longer term failed breakout in the after-hours (see Figure 1.2).

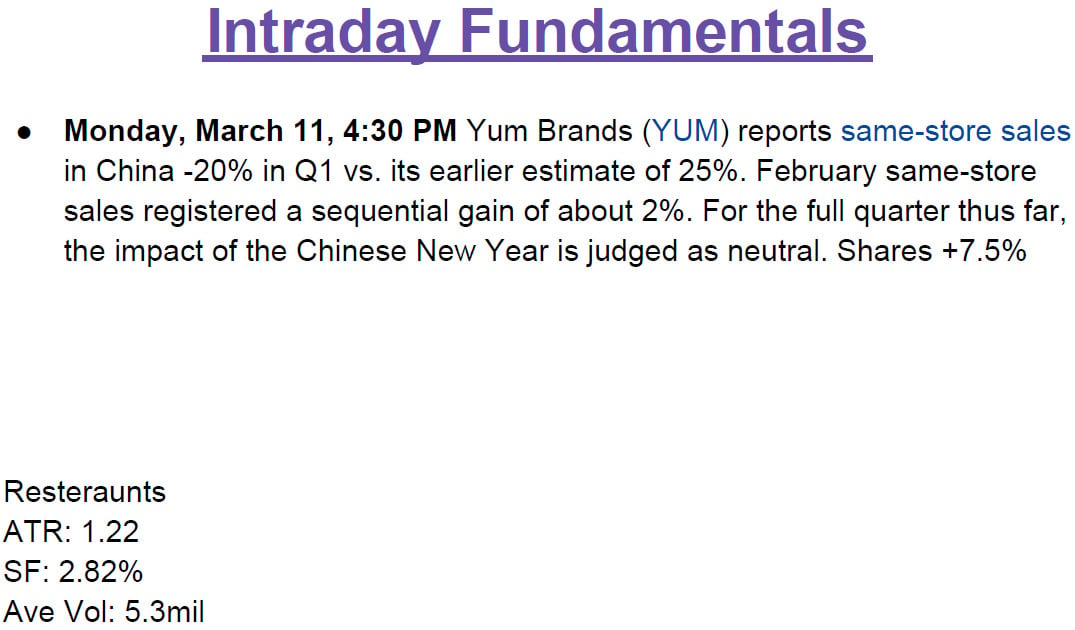

Figure 1.2

Chapel Hill gets very big against the 69 and 69.25 as you can see from the intraday chart, Figure 1.1. I love this position. He is trading from a position of strength, with the trend, with identifiable stops. And the stock was In Play (see Figure 1.3) so it was more likely to continue trending down intraday as opposed to a stock without a news catalyst.

Figure 1.3

But the stock just did not move. As traders it is a good habit to set a time clock in your head for when you expect a stock to move. If the stock does not move in the time you think it should then you can reduce your risk, lighten up in your position. Said another way, you can have a Time Stop for your position. In this case, YUM did not trade lower in the time we thought it should, which can be a Reason2Cover, so we lighten up.

I’m asked frequently about how to manage positions that are in your favor. Develop Reasons2Sell for your winning positions. And consider a Time Stop as a Reason2Sell.

Tomorrow we can be better than today!

Mike Bellafiore

no relevant positions

One Comment on “The Time Stop (an Example in $YUM)”

I’ve developed and used a lot of variations of time based stops. My feeling is that time stops work well when they are sufficiently long enough to allow for an idea to work out. At least in futures market, this is typically a minimum of 8 to 48 hours for most types of plays. If a trader suspects a position is going bad then being aware of time can be useful… From my extensive study, I can say fairly confidently the market primarily respects price and time is a weaker component.