We shared that we have been hawking a potential Bounce Trade in Tesla. I spelled out Four Keys for a Tesla Bounce Trade. Some on the desk pounced on a Bounce Trade in Tesla after SEEING it. They took rips as the trade failed. Let’s discuss an important reality to being a professional trader.

Taking losses is part of the business. Taking rips will happen. Trading is a game of probabilities. Some (many?) trades will not work and are still be worth taking. Even the best traders experience large rips in our game.

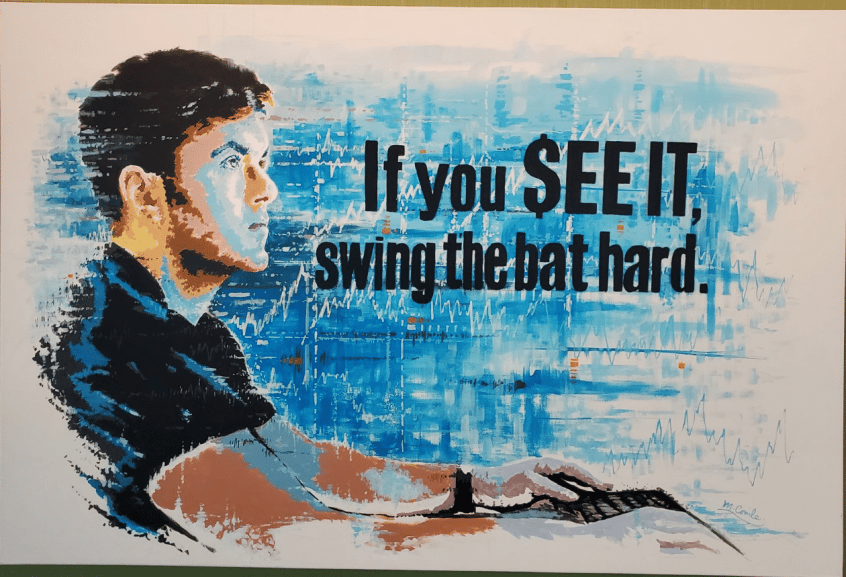

One star trader, and I mean star trader, sent me a Gchat after taking a rip. He wrote that two other star traders and he bought Tesla with size after SEEING the trade and took a rip. I responded positively:

One of my partners called after the firm took heavy losses in the Tesla trade. All he wanted to know was whether traders stayed inside of their guardrails and whether the trade was worth the risk. I replied it was and everyone stayed withing their risk limits. My partner replied positively, “Okay as long as they are taking a good trade. Losses happen.”

(How to Develop Winning Trading Strategies (with real-world edge))

Another trader at the firm, who also took a big rip in the Tesla bounce sent over a recording of a key moment in the tape. Man I love that! This trader used his Tape Reading skills to spot price action that was now most likely bullish. This trader and his team bought. This trader and his team held. And the trade didn’t pan out. In this trader’s words:

I wanted to share a very special moment I saw in TSLA yesterday. A lot of nuances added up together to make this a great trade. The trade didn’t end up panning out how I wanted it to, but I know for a fact that the spot I saw on the tape can be a huge trade the day it works.

My response to this trade was… *very positive*. He did his job. He was again doing his job by reviewing. This is what professional traders do. He took a good trade. The trade didn’t work out. He reviewed his work. He is better for the experience. In my words, I responded positively to this trader:

thxs for sharingI love this best practice of recording and replaying these special momentsthis will make you a much better tape readerand help you enter at much better prices and improve your win rate and thus allow you to trade bigger whichleads to making more

(For more on Tape Reading see: Two Variables that lead to an A+ trade)

Now none of this feels good on this Saturday AM after the rip for these traders and the firm. Not for the traders. Not for me. Not for the firm. And we all have to consider our Bounce Trade strategies, particularly taking profits in a bear market. But I am not even sure that was warranted given the immense sell off in Tesla. We could very much conclude that all the losses were acceptable. We could conclude we would do it all over again and in the same way. But maybe not. We will do the review work to scrub our Bounce Trade.

But I do hope the lesson from this experience for the reader is…professional traders take losses. This is part of the game. This is the game we signed up for. They will never go away. They don’t for star traders. They don’t for a professional trading firm. They won’t for you. They won’t for me.

Hey next trade. Next One Good Trade.

Bella

Mike Bellafiore is the Co-Founder of SMB Capital, a proprietary trading desk, and SMB Training, which provides trading education in stocks, options, and futures. Bella is the author of One Good Trade and The PlayBook. He welcomes your trading questions at [email protected].