The TEA has fired off a big warning on SPY – The first since May 8th. The current bullish move was confirmed about a month ago and held nicely with only moderate warnings on down days. In the context of slowing momentum and an extended move; yesterday’s bearish move is a more relevant warning. Applications I’ll be quick to … Read More

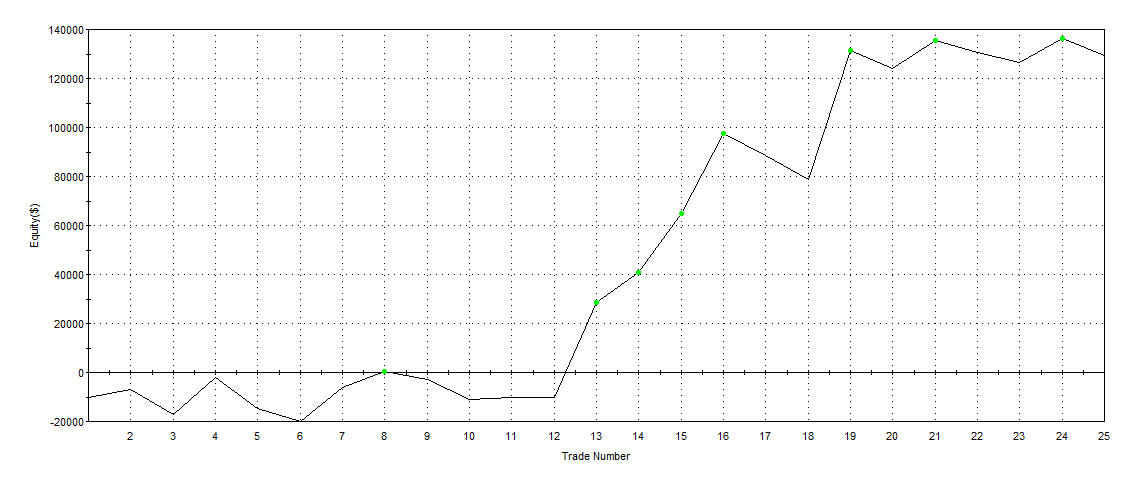

Duration: The Sixth Step to Systems Success

Number six in our seven steps is Duration. Duration represents the expected length of time in winning trades, losing trades, and all trades. Almost without exception we find that trend- and momentum-oriented signals have a shorter duration for losing signals and a longer duration for winning signals. The reverse is true for mean-reversion trades. Knowing your expected duration is important … Read More

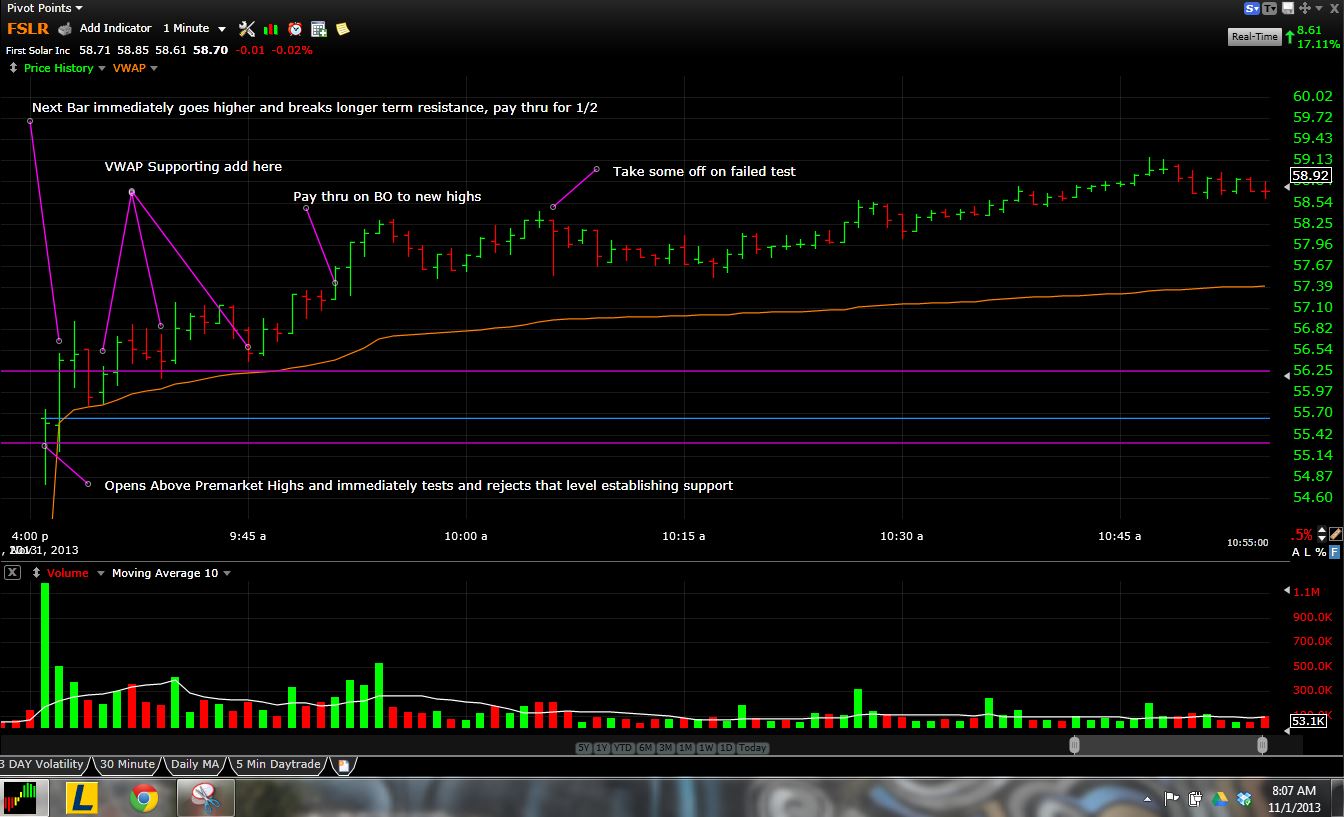

A Fireman’s 2nd Day Trend Trend Trade (FSLR)

We received this e-mail from an SMBU Blog reader. We hope you enjoy. So I had my first PlayBook trade today (that is, an A+ setup that I had previously seen and wrote a detailed Playbook entry for and now I actually traded it …) The trade was a Second Day Play with Trend Trend characteristics that breaks out over pre-market … Read More

Forex Trading: When Should You Go Against The Trend?

What makes prices in a financial market system fluctuate the way they do is traders entering and exiting the market for an infinite number of reasons. Some may be getting stopped out while others may be adding to a position. We can never know for sure the reasons why they may be acting a particular way at a specific period … Read More

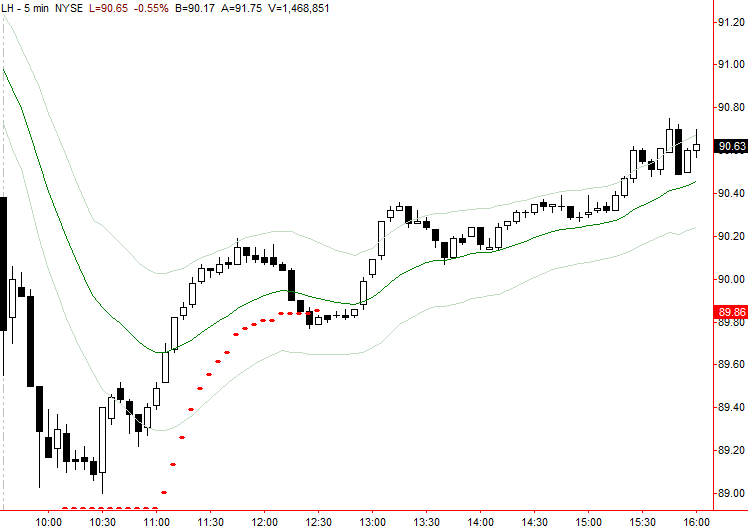

Sometimes Being Contrarian Means Betting on the Trend

A dip against the long-term trend offers a high probability setup for the contrarian trader to adjust options positions that haven’t been working and to put on positions that will take advantage of a possible trend resumption. In this most recent example, we can see that the price traded down to the lower band of the LRC Channel. Regardless of … Read More

The Trend: Is it Your Friend or Just an Acquaintance?

We’ve heard it a billion times: The most effective way to trade the forex market is to trade with the trend. Like 80 years ago some fast talking high pants guy probably at the New York Stock Exchange said, “The trend is your friend, seee?” So now what do we do? Find a chart that looks bullish and press the … Read More

Traders Ask: What’s the Best Setup for Newer Traders?

Adam answers a reader’s question about the best trade setups for new traders to start with.

AAPL: A Case for Mechanical Trailing Stops

A look at how a mechanical trailing stop can help with exits from trending plays.

- Page 1 of 2

- 1

- 2