I was answering some questions at a trading seminar a while back and a trader stood up and said, “It’s impossible to average more than 12% per year on a portfolio”. I said “OK” and went on to the next person. After all it wasn’t a question so what else was I to say. Apparently, I missed something because he … Read More

What statement are you making with your trading?

I talk to traders all over the world and it surprises me how many “high probability” or “market neutral” traders don’t realize that they are making a statement with their position. By making a statement I mean whenever you enter a position, you are defining the conditions under which you will win and which you will lose. For example, when … Read More

Sign Up for Our Free Trading Webinar: How to Achieve Your Trading Goals for 2014

“You can be better tomorrow than you are today!”– Mike Bellafiore, The PlayBook At SMBU we asked our trading community to share their trading goals for 2014 with us. If you have not shared your trading goals for 2014 with us, please consider sharing them here. I made a list of my goals in a recent post, Seven Goals for This Trader … Read More

Breaking Through as a Trader

Hi Mike, Firstly, I just want to say thank you for your Webinar yesterday for the Big Mike Forum. I’m sure you’re ridiculously busy, but if you have a moment to answer one question, I would greatly appreciate it. You mentioned an SMB trader that needed to take a break in the summer and was able to turn things … Read More

Trading Quote of the Day – November 13, 2013

The Trading Quote of the Day has to be from this pro trader who sent me an e-mail about a point I made during a Webinar we did last night with BigMikeTrading. He wrote: We’re just a flea on (the) back of (an) elephant going for the ride. You can see the entire e-mail and its context below. Hey Mike, … Read More

How Do We Improve This Trader’s Performance?

Hello Mike, I had a quick question for you: I’m currently experiencing a small draw down and was trying to formulate a plan on what are the steps I need to take going forward so that I can get back to being profitable. I came up with some questions I should ask myself and some actions I must take to … Read More

All Good Traders Must Have a Nickname

Mike Bellafiore, Hello. I want to say thank you for a wonderful book, One Good Trade! In Russia there is nothing like this book. I have not yet started trading, as do the study of the theory and the accumulation of money for shopping schea, but I’m sure that if I follow all the rules you set, it will reduce … Read More

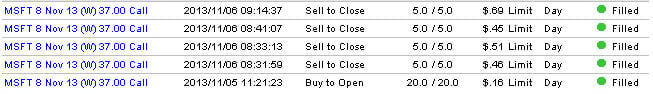

A Profitable Weekly Options Trade in $MSFT

Almost five years ago two of the better traders ever trained by SMB asked for risk with longer term positions. We loved these guys and had all the confidence in their trading ability. After a period of huge gains the firm had had a particularly bad month and these two traders were not trading their intraday accounts well. Bad timing … Read More