We had an ice storm on the East Coast this week that knocked my Internet service off the grid and shut down electricity throughout the area, and so I wandered through the city whose infrastructure had failed me as snow and ice fell around me. From home to office to a soccer-mom-filled Starbucks, I finally made it to my daughter’s … Read More

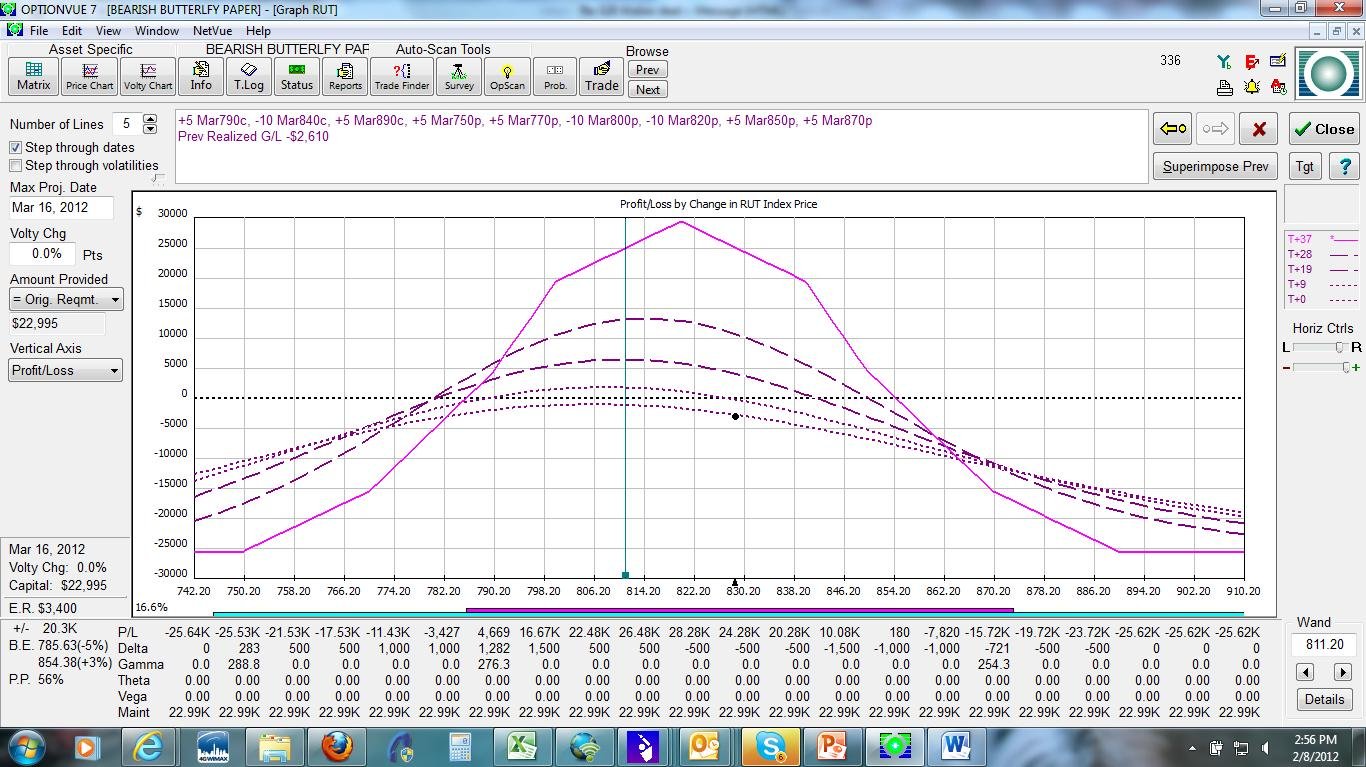

The March Bearish Butterfly–the wheels of the $RUT grinds slowly upwards

This post is the second in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. In the law there is an expression, “the wheels of justice grind slowly”. To bearish butterfly … Read More

O Options Trader, Know Thy Vehicle

In yesterday’s Options Tribe meeting, tribe member Craig Wassenberg made an excellent presentation of his expiration Friday “pinning” trades. (For those of you who aren’t familiar with the term, a pinning trade is a trade that takes advantage of the tendency of certain stocks that become anchored to a particular options strike price on options expiration day.) It was an outstanding … Read More

“Milking” an Options Trade

Every properly designed income options strategy should have both a target profit and a maximum loss. Both are extremely important in order to maintain a realistic annual return target for a particular strategy. The skilled income trader is both disciplined at exiting when a trade has hit the maximum loss threshold and skilled at what we alluded to in my last … Read More

Insights from Wharton School’s Investment Management Club

I gave a talk in Philadelphia on options strategies to the Wharton School Investment Management Club last Thursday. My daughter Halima, who is an undergraduate student at Bryn Mawr College in suburban Philadelphia, sat in on the the talk as well. In addition to wanting to be a supportive daughter, she was my intern four summers ago, backtesting options … Read More

Beware of the Fad: Five Reasons to Take it Easy with a New Options Strategy

In the options universe, there are plenty of traders who are happy to share a new strategy that has either worked well for them in the recent past, or has backtested splendidly over an extended period of time. Regardless of whether these strategies have been developed by competent veteran traders or newer traders who have not experienced every type of … Read More

Avoiding Pitfalls: Safeguard Your Options Trading Journey

In a speech delivered to the American Enterprise Institute in late 1996—in the middle of the formation of the dotcom bubble of the 1990s—then Federal Reserve Board Chairman Alan Greenspan coined the term “irrational exuberance” to describe an illogical optimism about the economy that was pumping up stock prices well beyond any reasonable level. History shows that he was correct, … Read More

“Going to School” on Experienced Options Traders

This blog entry is the introduction to a series of posts about common mistakes made by options traders and how to avoid them.