Current conditions and the overall complexion of the market is always subject to change, but it’s still always worth taking note of. The market seems to be continually morphing into another phase, whether it’s range-bound, trending, highly volatile, or really tame. Right now, we’re in short-term pullback mode after seeing some upside continuation. The past couple of sessions have been … Read More

Making Decisions How to Enter on MOS

A guest post from an SMB trainee, TO: Bella has the entire floor working on their Playbooks on a daily basis, in order to take internalize our best plays. Here is one of my plays on MOS last week. 1. Big Picture: The SPY’s were in an intraday downtrend in the 116’s and next support was 115. 2. Intraday Fundamentals: … Read More

Looking for a Bounce

When a momentum stock makes a misstep the market is very unforgiving. A few weeks ago we saw NFLX get hammered dropping around 80 points in a four-day period. This caught the attention of many short term traders. When a stock moves that far that quickly there is a lot of money to be made on the short side but … Read More

A Scalp Trade on JBL

This is a post from our traders TO about a scalp trade he made on JBL from yesterday: My trading desk neighbor SW and I were both trading JBL today, with 19 as the key level of interest. Without knowing it, I took the opposite direction of his trade at the Open for a quick momentum scalp. SW got long … Read More

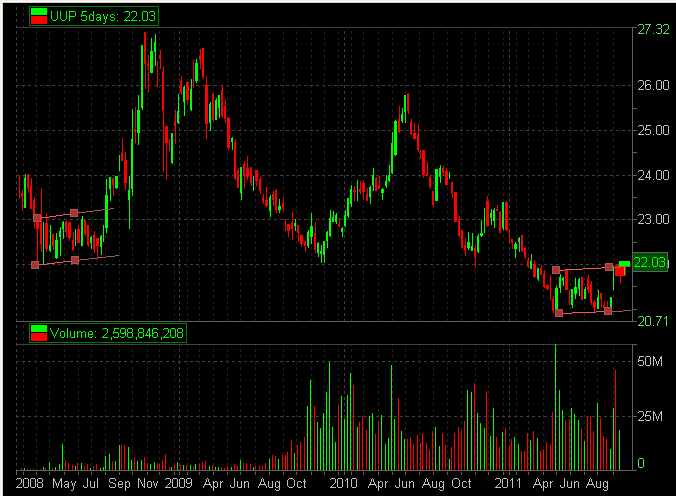

The Pre-market Tell

I am really starting to sound a lot like Bella these days. When he lectures our trainees he tends to repeat himself over and over and over again. My style tends to be more like “this is the concept–good luck” (maybe not that bad:) I didn’t fill out a lot of “blue books” in college and law school. I like … Read More

Bears Don’t Exist, Think Like a Bull

This is a guest post from Fred Barnes aka @DCDaytrader: I recently had a conversation with a few somewhat novice traders. For us traders who don’t have the 2007-2008 market experience on our resumes, we’re looking at the recent market activity in awe. Watching the quote screen (of the $ES_F) in August (2011) required the skills of a speed reader. … Read More

What is working now?

I ask myself this question constantly. It isn’t enough to come in each trading day armed with a series of ideas. You must evaluate the price action in the market and for each stock that you are watching. And you MUST be prepared to move your attention to the stocks or ideas that are offering the most opportunity. This is … Read More

Reviewing the SMB Archives

In August and early September, the market seemed to rotate around two distinct type of trading days: 1. The momentum panic day, driven by major news, with lots of volume in the SPY 2. An uptrending grind or ‘melt-up’, characterized by a wide ranges, low volume and steep pullbacks that would shake a lot of traders out but seldom break … Read More