Watch SMB Trade of the Week, a Resistance Trade from Mike Bellafiore.

Hot Topics in Proprietary Trading

Steve Spencer discusses the hot topics facing proprietary trading in this Wall St. Cheat Sheet interview.

SMB Morning Rundown – June 18, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

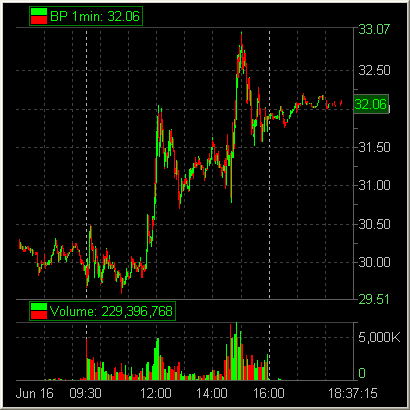

An Intraday Reversal (BP)

Tuesday night news hit that a government investigation determined that BP had been spilling closer to 60,000 barrels a day in the Gulf instead of the 35,000 previously thought. This same night President Obama delivered harsh words for BP during his presidential address. The news was very negative for BP heading into today’s session. I started a short position after … Read More

Steve Spencer Interview with TraderInterviews.com

An exclusive interview with Steve Spencer on TraderInterviews.com. Steve discusses the importance of tape reading combined with chart reading for money-making results. A must listen to interview!!!

SMB Morning Rundown – June 17, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

School of Algos 101: Intro Class

I received great feedback about this idea. And since I am asking for feedback and help of all you readers I think a great place to start is defining the algos I see all the time. Please leave comments if you see any subsets or any other algos you see often (let’s leave the creative name ones out for a … Read More

SMB Trade of the Week: Amazon

Watch SMB Trade of the Week, an Intraday Support Play in AMZN from Mike Bellafiore.